| What shaped the past week?

Global: Global markets traded mixed this week, as investors remained unnerved by the prospect of a global recession in 2023. In the Asian-pacific region, trading was bearish w/w, amid surprise from investors over the decision of the Bank of Japan to roll out a new bond-buying operation. The yen rose 4% against the dollar on Wednesday following the announcement.

The Japan Nikkei-225 lost 4.69% w/w, while the Shanghai Composite and Australian ASX fell by 3.85% and 0.57% w/w respectively. Meanwhile in Europe, where investor focus was on the latest economic data from the region, an improvement in consumer confidence in Germany fueled pockets of buy-side activity in the market. Amid this, the German DAX rose 0.70% w/w, while the French CAC and London FTSE rose by 1.11% and 1.52% w/w respectively. Finally, investor sentiment in the U.S. market was largely bearish, as investors’ reacted to the latest economic data, which suggested an increase in unemployment and a decline in consumer demand in November. The Nasdaq and S&P 500 ended the week 2.56% and 1.08% lower respectively, whereas the DJIA was up 0.03% w/w as at time of writing.

Domestic Economy: The Naira has remained relatively stable in the parallel market (N745/$) despite sliding to N452/$ in the official market. Our prognosis going into 2023 suggests that currency performance hangs largely on higher oil production receipts and improved intervention in the foreign exchange market. Thus, should our baseline scenario of stronger oil production and a reduced subsidy bill play out, we expect increased foreign exchange inflows and a narrower FX gap. We note that the Naira is undervalued in the parallel market, though slightly overvalued in the official market. Thus, while we see the Naira slipping to

₦480/$ in the official window, our base estimate for the parallel market is hinged on an appreciation to ₦665/$ in 2023. Risks to our outlook includes subsidy retention, excessive demand volatility, unrest in the Niger Delta, political upheavals, and a sustained hardliner posture from the apex bank towards retail FX outlets.

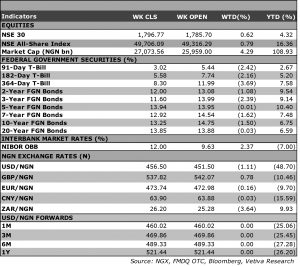

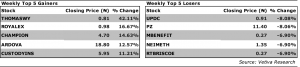

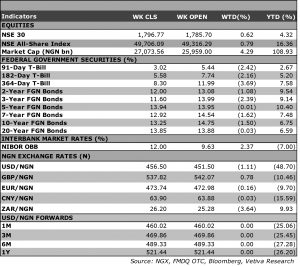

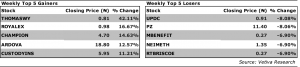

Equities: With fund managers rebalancing their portfolios as we approach the end of the year, broad-based interest across the NGX saw the index rise 0.79% w/w, to settle at 49,706pts. For a third consecutive week, the Banking sector was the best performer, rising 1.97% w/w; ZENITHBANK rose 1.87% w/w to settle at 24.55/share, while UBA and ACCESSCORP rose 2.74% and 2.37% respectively w/w. Likewise, in the Consumer Goods space, interest in low-mid cap names saw the sector rise 0.98% w/w. Moving to the Industrial Goods space, renewed interest in JBERGER (+9.91% w/w), drove the sector 0.04% higher w/w. Finally, interest in players across the oil marketing space saw the sector rise 0.91% w/w, with ARDOVA rising 12.57% w/w, driving the sector’s performance.

Fixed Income: Fixed income investors were buy-side driven w/w, as the rebalancing period for fund managers saw them pursue a wide-range of tenors across the Bonds, OMO, and NTB segments of the market. In the Bonds space, yields on benchmark bonds eased 32bps w/w on average fueled broad-based interest across the bond curve; notably, the yield on the 12.1493% FGN-JUL-2034 bond eased 85bps w/w to 13.20%. Meanwhile, in the OMO space, yields sank 541bps w/w, due to widespread interest across the OMO curve. Likewise, in the NTB space, we observed significant buy-side action over the week, as yields eased 289bps w/w.

Currency: The Naira depreciated ₦1.11 w/w at the I&E FX Window to ₦456.50.

| What will shape markets in the coming week?

Equity market: It was another positive week in the market, as all sectoral indices closed in the green. While we still anticipate some profit taking next week, we expect the market to sustain its bullish momentum.

Fixed Income: We expect the market to open next week on a bullish note, as portfolio rebalancing continues ahead of the new year. That said, we do not rule out the possibility of some profit-taking activity, given the recent market gains.

2023 Macroeconomic Outlook – Riding the seesaw

Elections and Enumerations

With the incumbent President Muhammadu Buhari signing out in 2023, the upcoming elections could shape the Nigerian economy for the next four (to eight years). Developments leading up to the election reveal one clear fact – the election is too close to call and makes policy outlook hazy. According to the Independent National Electoral Commission, 14 candidates are contesting the presidential elections. Following the conduct of its opinion polls via multilingual nationwide telephone calls, NOI Polls streamlined the number of popular candidates to four – Peter Obi of the Labour Party (LP), Asiwaju Bola Ahmed Tinubu of the All Progressives Congress (APC), Atiku Abubakar of the People’s Democratic Party (PDP), and Rabiu Kwankwaso of the New Nigeria People Party (NNPP). The poll was, however, unable to predict a clear frontrunner as the undecided respondents and those who preferred not to reveal their candidate summed up to 47% of respondents (2019 polls: 38%). With most of the leading candidates in favour of pro-market policies, this could induce the implementation of the needed reforms to steer the economy in the right direction.

2023 Census

Shortly after the elections, Nigeria will conduct her first census in 16 years. Slated for April 2023, the enumeration exercise would be the first digital census in the nation. According to the National Population Commission, the Population and Housing census would provide reliable data on the size, structure, distribution, socioeconomic and demographic characteristics of a country’s population, which is required for policy intervention and monitoring of development goals. In addition to the questionnaire used in earlier editions, more questions will be introduced to provide data on literacy, dual-nationality status, employment capacity, and internet access.

Real Sector outlook: Still on the verge of growth

Within the first nine months of 2022 (9M’22), the Nigerian economy expanded by 2.9% y/y

(9M’21: 3.2% y/y). Growth was largely anchored on expansion in two broad sectors; the services (9M’22: +7.1% y/y) and the agricultural (9M’22: +1.8% y/y) sectors amid the sustained slump in the industrial sector (9M’22: -5.8% y/y).

The expansion in the services sector was driven by the Trade and Information & Communication (ICT) sectors, which jointly contribute c60% to services GDP. The expansion in the Trade sector (9M’22: +5.4% y/y) comes on the back of the reopening of additional land borders and sustained post-COVID recovery in supply chains. We expect sustained growth in the trade sector as more ports are built and borders are reopened to support wholesale trade. The ICT sector (9M’22: +9.5% y/y) expanded on the back of growth in SIM registrations,

especially as the NIN-SIM related restrictions have been lifted. Thus, sustained growth in the ICT sector is anticipated, amid the rollout of 5G network and increased mobile penetration. Other key sectors such as the Real Estate and Financial Services sector rode on the back of increased economic activities. Despite the +500bps increase in the benchmark interest rate in 9M’22, the Financial services sector expanded by 18.3% y/y, its fastest expansion since 2013. In a similar manner, the Real estate sector recorded its largest expansion (9M’22: 4.5% y/y) since 2015.

The expansion in agriculture has remained steady due to sustained intervention of the CBN in the sector, with the Anchor Borrowers’ Programme (ABP) being a key source of funding for agricultural activities.

The industrial sector remained in a 3-year long recession due to the sustained

slump in the mining sector, which has masked the expansion in other subsectors (Manufacturing, Construction, Power, and Utilities). The slump in the mining sector is driven by a decline in crude production. For context, Nigeria’s crude production has been marred by pipeline disruptions and massive crude thefts. This situation has led to force-majeures, especially on the Forcados Oil Terminal. Mid-October 2022, repairs on the terminal were completed setting the pace for increased oil production. As a result, crude production recovered by 8% m/m in October. Our outlook for the oil sector remains broadly positive in 2023, with the adoption of local intelligence in pipeline surveillance yielding positive results – discovery of illegal pipelines and clampdown on oil thieves. |

|

The case for government’s engagement in business