Now that OPEC and non-OPEC members have agreed to extend oil production cuts through the end of 2018, the priorities for markets will be global demand and shale oil production. The demand side looks strong for the year ahead, and shale investments will be held back by three factors: a backwardated forward curve (or when near-term futures are costlier than later contracts), a desire by drillers to not get burned like in early 2016 after prices collapsed, and a dwindling number of ideal distressed assets for investors to buy.

Demand was a hot topic at the OPEC meetings in Vienna, referenced repeatedly by OPEC President and Saudi Oil Minister Khalid Al-Falih. Like all commodities, oil is bought and not sold. This means oil demand is the most important driver of prices in the short term. And OPEC’s forecasts for oil demand growth in the year ahead are strong.

What underpins this expectation of oil demand growth? A strong macroeconomic outlook, where major economies are likely to show solid levels of growth and monetary policy is likely to remain relatively loose globally. While progression through the credit cycle presents some risks, those are likely to be a greater concern in 2019, but not 2018.

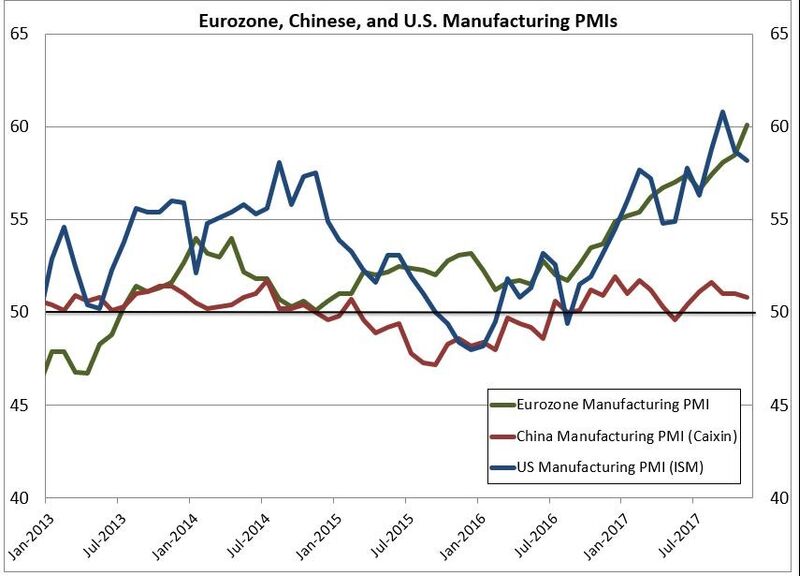

Strong leading indicators for near-term economic growth and oil prices are global manufacturing purchasing manufacturing indices (PMIs). These have been expanding, which is a positive sign for oil demand and prices. November releases showed expansions in the Chinese Caixin, the U.S. ISM, and the eurozone manufacturing PMI. The eurozone was particularly strong, posting the highest level since April 2000 and the second-highest reading in history.

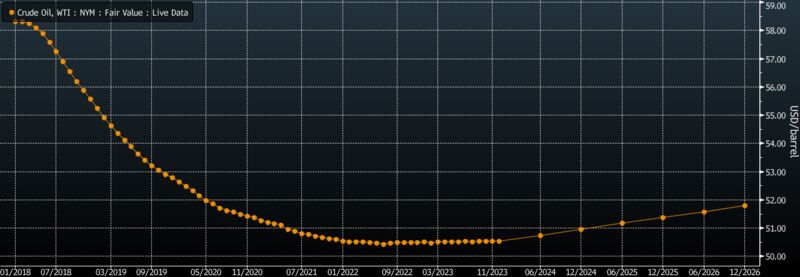

Oil supply is also a concern, but not OPEC’s supply. The biggest concern is a resurgence in shale oil drilling. But these concerns may be a bit overblown. One critical factor holding back U.S. shale oil drilling is the backwardated forward curve. This shows that the price of oil is likely to be cheaper in the future than in the present. And it reflects high levels of hedging in the market. Some argue that large amounts of hedging activity indicate that the shale boom is on solid footing. But there may be another implication: No one wants to get burned. The period from the end of 2014 through the middle of 2016 was a painful time for many oil and gas companies, as prices plunged and they had trouble meeting debt payments. Many drillers are still fearful — or at best, they are cautious.

This means that while shale oil drilling will continue, the hedging of prices is likely to be active. In order to incentivize high levels of drilling, the entire forward curve would need to be much higher than it currently is in order to protect drillers. Put another way, much higher oil prices across the curve would likely be necessary to reverse the trend in rising crude oil prices since April 2016. Oil prices that are marginally higher would likely result in only marginal increases in oil production rather than a big increase in barrels of additional shale.

Investors have tried to avoid getting burned again by limiting their investments to high-value distressed shale assets. But while investment in shale funds has risen, it is becoming more challenging to find these kinds of assets. Oil prices around current levels mean that high-quality distressed assets are becoming scarcer. I personally know of a number of funds that are struggling to deploy their capital, because they have very specific requirements for sweetheart oil deals. Such deals will be even tougher to find in 2018. Much like the backwardation in the forward curve, this risk aversion that has been codified into oil and gas investment mandates is also likely to limit shale oil supply.

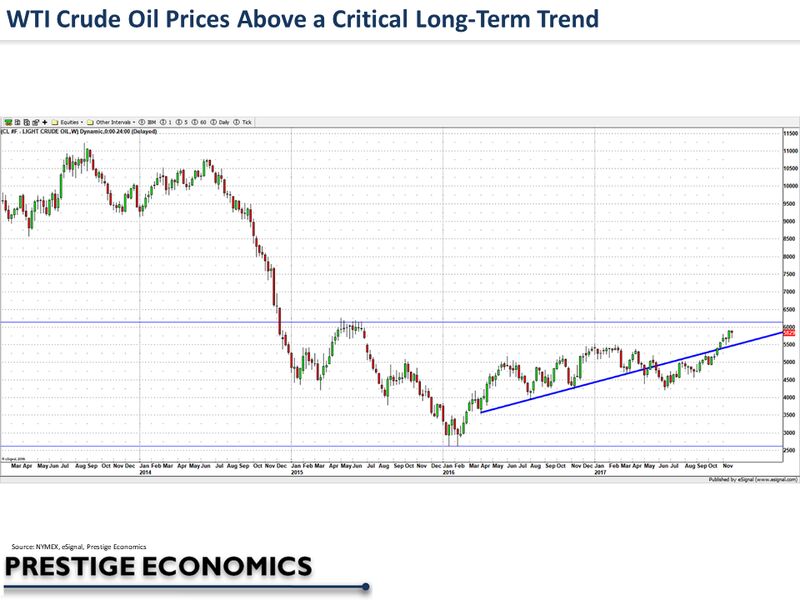

As the so-called Central Bank of Oil, OPEC doesn’t set targets for oil prices, but it is targeting the five-year average for global oil inventories. The policy of OPEC and the non-OPEC member has been explicitly designed — and extended — to drive OECD oil inventory levels lower to the five-year average. But technical trading factors may prove to be more important for the price of crude in the immediate term. West Texas Intermediate prices are above the critical 30- and 100-day moving averages, and they remain above a long-term trend that has been in place since April 2016 (blue line in graph).

If that trend remains supported, oil prices could continue to rise, and drilling will increase. However, without a more significant rise in oil prices, shale drilling is unlikely to raise enough to stop the decline in oil inventories to the five-year average level. And with strong growth as the backdrop, we likely end up with both lower oil inventories and higher average oil prices in 2018.

Courtesy Bloomberg