Crude oil prices were hovering near two-week highs on Monday, a possible effect of Saudi Arabia’s statement on plans to continue cutting output levels and as last week’s upbeat U.S. supply data also continued to support.

The U.S. West Texas Intermediate crude April contract was steady at $63.52 a barrel by 07:40 GMT, just off Friday’s two-and-a-half week high of $63.73.

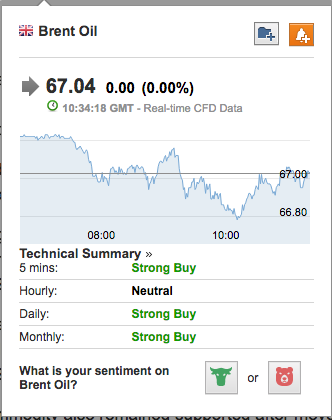

Elsewhere, Brent oil for April delivery on the ICE Futures Exchange in London was down 7 cents or about 0.10% at $66.97 a barrel, after hitting a more than two-week peak of $67.37 on Friday.

Oil prices strengthened after Saudi oil minister Khalid al-Falih said over the weekend that the country’s oil production in January-March would be well below output caps, with exports averaging below 7 million barrels per day (bpd).

Falih added that he hopes global oil producers will be able to create a permanent framework to stabilize oil markets after the current supply cut deal ends this year.

The Organization of the Petroleum Exporting Countries (OPEC), along with some non-OPEC members led by Russia, agreed in December to extend oil output cuts until the end of 2018.

The deal to cut oil output by 1.8 million barrels a day (bpd) was adopted last winter by OPEC, Russia and nine other global producers. The agreement was due to end in March 2018, having already been extended once.

The commodity also remained supported after moved higher after the U.S. Energy Information Administration reported last week that crude oil inventories fell by 1.6 million barrels, compared to expectations for a gain of around 1.8 million barrels.

Traders shrugged off Baker Hughes energy services firm’s latest report on Friday showing that U.S. energy companies added one oil rig last week, bringing the total count up to 799, the highest level since April 2015.

Elsewhere, gasoline futures were almost unchanged at $1.989 a gallon, while natural gas futures gained 1.47% to $2.696 per million British thermal units.