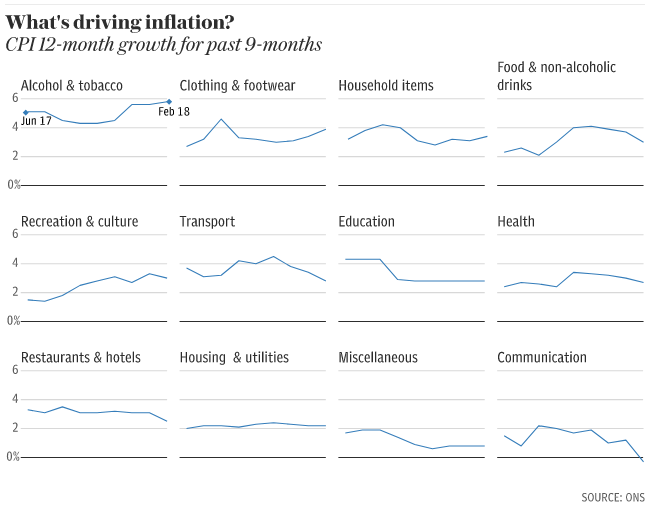

The squeeze on household finances eased slightly in February, as consumer price inflation (CPI) – the measure of how prices change for shoppers – grew by 2.7pc, according to official statistics.

The drop means that inflation reached its lowest level since July 2017 last month. This marks a 0.3 percentage point fall from January this year.

The general expectation from economists was for 2.8pc growth and this data also undershot expectations from the UK’s central bank for 2.9pc. This will raise questions as to whether or not it is right for the Bank of England to hike interest rates from 0.5pc to 0.75pc this May, as many economists have suggested it will.

The Bank of England’s Monetary Policy Committee (MPC), which determines interest rates in the UK, will meet on Thursday this week. Few expect any decision to raise interest rates this soon.

Car fuels are partly to thank for the drop in inflationary pressures. Petrol prices fell by 0.3 pence per litre between January and February. This is in contrast with a 1.6 pence rise between the same two months last year.

Food prices also grew at a less fierce rate, climbing by just 0.1pc in February compared to a rise of 0.8pc for the same period last year. The biggest driver of this was cheaper vegetables.

Last year, reports of poor growing weather in Southern Europe led to fears of shortages in certain types of salad and greens. Supermarkets even started rationing lettuce, with Tesco and Morrisons insisting that customers could only purchase three Spanish-grown Iceberg lettuces each.

Prices also dropped in areas such as a hotel bookings and meals out. According to the Office for National Statistics, these prices are often volatile, but the sharper price rise seen in the same period last year might have been driven by Valentine’s day.

Paul Hollingsworth of Capital Economics does not believe that this lower than expected figure will put the MPC off an interest rate hike this May. He argued that the committee increasingly looks to wage growth which is expected to have picked up, rather than just headline inflation, to inform its decision making.

Tej Parikh, a senior economist at the Institute of Directors, said: “Businesses and households will be relieved that the peak impact of sterling’s depreciation on inflation now appears to have largely washed through.”

Parikh added that this month’s drop in inflation “combined with tepid business activity and the inclement weather this quarter” added clout to calls for holding fire on an interest rate rise later this week. Day.