…what fiscal authorities must get right for growth trajectory

Adesola Afolabi

That the Central Bank of Nigeria (CBN) has been in full and positive engagement with its monetary duties over the last 12 months is a fact many Nigerians and experts will readily agree to. Truthfully, the apex monetary authority can be commended for outdoing itself on certain aspects. From cutting the monetary policy rate (MPR) to 12.5 percent, to the regular mopping up of excess liquidity and the recent upward review of the cash reserve requirement to 27.5 percent, it can be said that the apex bank has been alive to its responsibilities, especially in ensuring price stability and containing inflation. Also worthy of commendation is the policy on loan to deposit ratio which mandates banks to lend 65 percent of their deposits to the real sector to reignite the economy.

Experts’ views

In comparing the effectiveness of finance authorities in Nigeria over the past year, experts interviewed by business a.m were of the consensus that the policies introduced by the CBN have proven to be effective in tackling the economic challenges being faced in the country, however there is loads of work to be done.

“The monetary authority has well-stated policy focus and strategy to achieve it,” said Damilare Asimiyu, economic and investment research analyst at GTI capital.

The focus of the CBN is however faced with lots of bottlenecks. said Asimiyu, who noted that the fiscal authority in the last five years have exhibited policy inconsistency than any other time since returning to a democratic dispensation in 1999.

The bottle necks, he explained come in form of conflict with policy direction. “For instance, the CBN is currently trying to grow the economy through expansionary policy targeted at increasing capital flows (or credit) to the real sector of the economy, but the fiscal authorities, on the other hand, are raising taxes on many items that affect the activities of the real sector players that the CBN is trying to expand their operation.”

This position is complicated by the absence of complementary policy action said Asimiyu, who also stated that as the CBN encourages local production of many imported commodities by restricting FX sales to importers of about 42 items, the fiscal authorities are not complementing by providing good security, good road network, and stable power supply.

The CBN had at its last MPC meeting called the attention of fiscal authorities to solving what they termed “legacy structural impediments.” The CBN said these impediments which constrain domestic production and contribute to rising inflation, are in form of infrastructural deficit and long standing clashes between herdsmen and farmers.

While agreeing that growth stimulating policies are being favoured by the CBN, Janet Odukoya research analyst with Asset and Resource Management Holding Company (ARM) makes a case for fiscal authorities. According to her both the fiscal and monetary authorities are subtly trying to drive growth, however the CBN’s drive for growth is more obvious given the aggressiveness to grow loans.

“The fiscal authority is trying its part to ensure proper fiscal structure is in place, the increase in Value Added Tax (VAT) is probably the most obvious, but other measures like increasing the tax net and so on as contained in the new finance bill tries to put proper structure in place” Odukoya said. She however pointed out that a 2.5 percent hike in VAT isn’t quite the wildcard needed to grow revenues.

Speaking to the finance act, a policy document championed by the ministry of finance- Nigeria’s apex fiscal body, Odukoya noted that, business supportive policies, like 0% tax for small businesses, and exempting small businesses from VAT are commendable policies aimed at economic expansion. “They are speaking similar languages, but in addition to been expansionary, fiscal seeks structure and revenues.”

On the effectiveness of policies by both authorities on the investment community, Odukoya said, she thinks the CBN had more impact on investment decisions. “On a shorter term basis, you can say the CBN has more impact on hot money investors, like the Foreign Portfolio Investors (FPIs) concerned about OMO rates and FX stability on the short term. For longer term investors, along the lines of FDIs, I think they would want more domestic developments like infrastructural provisions, etc. expected from the fiscal leg.”

Speaking on the opportunity to plug infrastructure deficit, industry sources explained that not much could be achieved last year due to it being an election year.

“There were no fiscal policies or action till the tail end of Q4,”said one analyst who prefers to remain anonymous. The analyst however raised certain issues around the CBN’s synergy with fiscal authorities. “We must raise questions around how efficient the CBN’s role in ensuring fiscal responsibility is. The monetary authorities have a duty to keep the fiscal authorities responsible on how they handle government revenues.”

The analyst hinted that the second tenure of the CBN governor shows a collusion with fiscal authorities that may look positive, but is unhealthy for the economy. For instance, the parameters used to plan the budget i.e. the MTEF should be more realistic. An exchange rate at N305 to $1 is not healthy for the economy, when the purchasing power parity shows the dollar should be trading closer to N400, the analyst explained.

The problems and the two pronged solutions

- Slow economic growth: MPR reduction by CBN to 13.5% in March vs minimum wage increment.

GDP growth had begun to slow from the fourth quarter of 2018. Real GDP growth rate declined by 0.38 percentage points to 2.1 percent from 2.38 percent. To address this, Monetary Policy Rates (MPR), more simply known as interest rates were reduced for the first time in two years in March 2019. It showed the CBN’s agreement on the need to grow the economy as more urgent. Especially when comparing with the apex bank’s need to keep inflation in check and preserve the country’s external reserves. The stance on tempering inflation was to curb electioneering spending and was however quite understandable, giving the country’s preparation and conduction of elections at the time.

On the other hand, in cushioning the effect of rising inflation and diminishing purchasing power, the government succumbed to labour unions demand to increase wages. The move by both parties results in excess liquidity in the economic system prompting the CBN to hike CRR rates.

As the CBN made credit accessibility easier with a reduced MPR and the decision to increase minimum wage begun implementation, inflation started to rise and has not stopped since September last year. Latest figures by the National Bureau of Statistics shows inflation rate is at 11.98 percent. A high inflation rate means the value of money is being eroded. The higher the rate, the faster the erosion and the chances to gain real returns on money saved, is less.

To reduce the monetary induced inflation, the CBN increased the Cash Reserve Requirement (CRR) by banks to 27.5 percent from 22.5 percent. This move, received the commendation of Oluwole Adeyeye, research analyst at PAC Holdings.

According to Adeyeye, the increased CRR will mop up excess liquidity in the system. He however noted that “we may see a marginal increase in the lending rates as banks have less money to lend out. In addition, we do not believe that the decision of the MPC to increase CRR will fully address the rising inflation rate as other fiscal policies, such as increase in VAT to 7.5 percent, closure of land borders and the implementation of the new minimum wage, will contribute significantly to upward trend of inflation rate in the months ahead.

Other monetary policies:

By fostering a lower interest rate regime, the CBN followed swiftly with a raise in Loans to Deposit Ratio (LDR) to 65 percent, an OMO participation ban, among other economy stimulating policies.

Loans to Deposit Ratio:

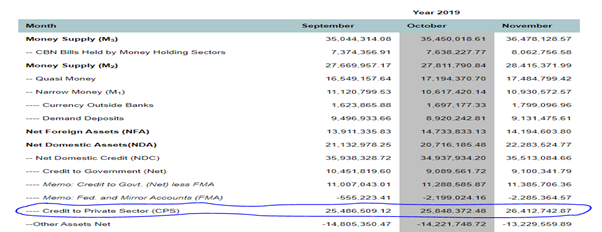

Data from CBN’s official website showed credit to private sector improved by N1 trillion between Sep and Nov last year. Emefiele Godwin had at the last MPC meeting mentioned that N2 trillion had been pumped into the strategic sectors of the economy, thanks to the strict implementation of the LDR.

The reason behind the increased LDR is not far-fetched. According to Adeyeye, the increased LDR will enable banks to focus on their two core functions – accepting deposit and giving out loans to the public.

What to expect from this directive issued late last year, is an improvement in the loans to the real sector of the economy, Adeyeye said. “This will promote inclusive growth,” he added.

Adeyeye however expressed that we may start seeing high non-performing loans in the banks as they (his research team) expect some borrowers to default in repayment of loans and interest.

Elaborating on the LDR directive, a business a.m’s source explained that although the CBN has a long term focus to help economic growth, dynamics for the LDR to be effective is not in the hands of the CBN. “You cannot tell banks to lend when the operating environment they are doing business in, has weak fundamentals.”

Across 190 economies in the world, Nigeria currently ranks 131 in doing business according to the World Bank Group.

Our source pointed out that the cost of doing business in Nigeria is one of the highest globally. “Forcing banks to lend to businesses that grapple with inadequate power supply and other forms of infrastructural needs will make the effectiveness of these policies very difficult. The way to go is to plug infrastructure deficit, like power and transportation. This will mean a reduction in the cost of production and increment in output, which can in turn facilitate faster economic growth.”

Open Market Operation (OMO):

In October 2019, the CBN excluded domestic investors (individuals and institutions) from participating in the OMO market. Meanwhile, CBN allow domestic banks and foreign investors to participate in the OMO market. Adeyeye explained that this has led to significant fall of interest rates in the fixed income market as many domestic investors who can no longer play in the OMO market dominate fixed income market.

Bringing more insight on the OMO directive, an industry source disclosed the underlining reason for the OMO was to help cushion the negative effect of government’s borrowing pattern over the years.

According to Patience Oniha, director general of the Debt Management Office, Nigeria’s public debt as at September 2019 was N26.2 trillion from N17.5 trillion in 2016.

Because revenue is threatened, the creation of a market where foreign investors can get high rate at OMOs and at the same time buffer up the country’s reserve above $30bn is a win win situation.

“We expect this movement by the CBN to benefit the government and other borrowers as it will enable them to borrow at lower rates in the market,” said Adeyeye. In addition, the excess liquidity from the OMO market may find its way back to equity market.

Fiscal Policies

Value Added Tax (VAT)

There are mixed reactions towards the efficacy of the VAT hike. The VAT increment from 5 percent to 7.5 percent is contained in the Finance Act which was made a law in January 13 2020. According to an industry analyst, this is one of the things the fiscal authority has done right. “18 items on the Act is very supportive of business growth,” he said.

The manufacturing association of Nigeria (MAN) had however stated that the increased VAT would constrain consumption and eventually, impact production negatively. “It will constitute a drag on the performance of the manufacturing sector and add to a possible decline in the growth of economy,” they had said in a statement made available to business a.m

MAN explained that VAT is paid on inputs, such as packaging materials, electricity, raw materials and so on. This means that the final cost of the product has suffered VAT and so not charging VAT on the final product doesn’t not mean that the consumer has not “paid” VAT on that product.

But, this analyst explained that VAT as an item is charged on 7.5 percent on the amount of goods. “Going by the factors of production, VAT is not a cost that should be included in the cost of production,” the analyst explained, urging producers to be more sincere.

The expert however urged the government to show better fiscal responsibilities and called on the people to demand better accountability as only 15 percent of revenue generated from VAT goes to the federal government while the remaining 85 percent is disbursed at the state and local level.

Adeyeye and his team at PAC expects that the implementation of the VAT will generate more revenue for government, however the increase will reduce purchasing power of the common man in the economy as they expect producers/manufacturers to pass the cost from VAT to consumers.

Company Income Tax rate (CIT)

With the recently passed Finance Bill, a small company with turnover of up to N25 million will have a 0 percent tax rate while a medium company with turnover that is greater than N25 million (but less than N100 million) will have a tax rate of 20 percent. However, a large company with turnover that is greater N100 million will be paying a tax rate of 30 percent. According to the research analyst at PAC, this is a good development for small businesses with a turnover that is not more than N25 million as this decision will have significant impact on their bottom-lines, a position held by Asimiyu, Odukoya and other sources.

More reactions from the investment community

There were mixed reactions towards the policies of monetary authority as restriction of domestic investors from participating in OMO market has led to reduction of interest rates in the fixed income market. This is not good for investors who invest in Treasury Bills, FGN Bonds and Commercial Papers as they will have to invest in these securities at lower rates in the market. However, businesses will benefit from this policy as they can now borrow at reduced rates. In addition, investment community see benefits in higher LDR as they can now have higher access to loans from banks.

Most recent fiscal policies create opportunities for investment community as border closure and new CIT structure encourage more participation of local businesses. However, investment community see the new VAT of 7.5 percent as a threat to the cost of production and consumer purchasing power.

The outlook is not bad

Overall both the monetary authority and fiscal authority have directed their policies towards achieving economic growth. The impact of monetary policies may be felt immediately while it may take time to see the positive impact of fiscal policies in the economy, says Adeyeye.

The impacts of monetary policies on businesses are clear, as they have access to loans from the banks at a lower lending rate. On the other hand, most of the fiscal policies such as border closure and increase in VAT currently have adverse effects on inflation rate. However, Adeyeye says he expects recent fiscal policies to improve productivity in the economy, reduce unemployment rate and generate more revenue for government in the long run.

Oil windfall expectations from the Middle East crisis