By Moses Obajemu

Nigeria’s hope of raking in a $2.8 billion largesse from its sale of crude oil following last week’s Organisation of Petroleum Exporting Countries (OPEC+) meeting may have just hit a roadblock in Mexico.

By production arrangement reached during the meeting, Nigeria was in line to earn the hefty sum from its sale of crude oil in the coming months if the weakened prices of the commodity gain an additional $15 per barrel after member-countries of the Organisation of Petroleum Exporting Countries (OPEC) and its allies agreed on fresh production cut to stabilise the oil market.

OPEC and its allies, led by the Russian Federation, agreed in a meeting on Thursday to cut output by 10 million barrels a day between May and June 2020, 8mbd between July and December 2020 and 6mbd from January 2021 to April 2022, respectively.

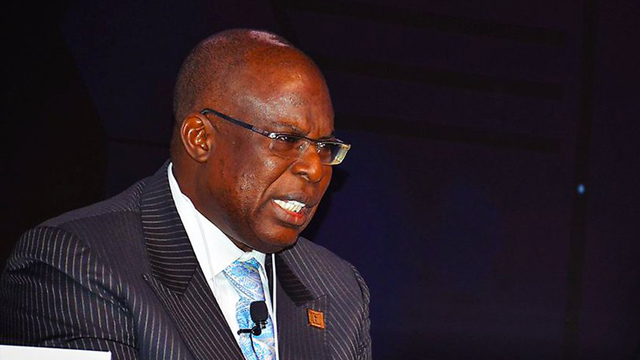

In line with the agreement, Timipre Sylva, minister of state for petroleum resources, who spoke on the expected $2.8 billion gain, said in a statement that the country agreed to limit its daily oil production to 1.412mbd, 1.495mbd and 1.579mbd within the period in compliance with the measures to rebalance and stabilise the oil market.

The refusal by Mexico’s Energy Secretary Rocio Nahle Garcia to accept the proposed cuts reflects her country’s determination to keep as close as possible to the production and spending plans it’s been pursuing despite the crash. In a Twitter post shortly after leaving the meeting, she said the nation is ready to reduce output by 100,000 barrels a day, far less than the 400,000 barrels a day proposed by the group, and from a higher baseline.

Sylva stated that the decision by OPEC and its partners was historic, but added that OPEC’s curtailment measures would not include Nigeria’s condensate production which is between 360,000 and 460,000 barrels a day.

He said: “It is expected that this historic intervention, when concluded, will see crude oil prices rebound by at least $15 per barrel in the short term, thereby enhancing the prospect of exceeding Nigeria’s adjusted budget estimate that is currently rebased at $30 per barrel and crude oil production of 1.7 million barrels per day. The price rebound may translate to additional revenues of not less than $2.8 billion dollars for the federation.”

The minister equally claimed that despite the production curtailments, it was pleasing for him that, “all planned industry development projects will progress, as they will be delivered after the termination of the 9th OPEC/Non-OPEC Ministerial Meeting Agreement on adjustments in April 2020.”

Nigeria’s 2020 budget, which is expected to bear the brunt of the oil price slash, was passed in December 2019 with assumed oil production mark of 2.18mbd and $57 per barrel. Sylva, however, disclosed that these assumptions have been reviewed downwards with the expectation that the new OPEC measures will be beneficial to the country.

If president Trump fails to convince Mexico to sign the agreement reached at the meeting of OPEC and OPEC+ countries, this will further cause oil prices to fall and make Nigeria’s plan of earning extra revenue for its funding needs difficult.