AfDB crisis: Surprises ahead in boardroom voting power

Phillip Isakpa is Businessamlive Executive Editor.

You can contact him on phillipi@businessamlive.com with stories and commentary.

May 31, 20204K views0 comments

- Africa shoots self in the foot

- Only thing worse than being ignored by the US is being noticed by the US

A fresh angle emerged over the weekend about a possible loophole that exists in the voting power arrangement at the African Development Bank (AfDB) that could easily play regional shareholders into the hands of non-regional members should the current United States push actually means Washington wants the bank President, Akinwumi Adesina, out of office.

Many in diplomatic circles, who told Business A.M. they were following developments, think this may be the ultimate goal. But how the United States succeeds in achieving this goal can be seen in how, over the time, the voting power between regional and non-regional shareholders has closed up.

Read Also:

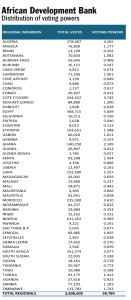

As at December 31, 2019, the distribution of voting power among the regional and non-regional executive directors of the bank was in the ratio of 3 to 2. Regional executive directors had 3,836,605 votes, representing 58.784 per cent, while the non-regional executive directors had 2,689,959 votes or 41.216 per cent.

People familiar with the situation told Business A.M. that even when there are no misgivings, when a powerful shareholder like the United States has an agenda to pursue the diplomatic horse-trading is often fierce.

One source in London put it bluntly: “Would you want to be on the wrong side of President Trump?” He asked, in reference to how such a diplomatic horse trading could play out should the US press some regional shareholders to take its position.

The fact that the US has taken an interest in the matter at the AfDB is something that Business A.M. learnt makes the situation bad as it is. “I’ve always thought the only thing worse than being ignored by the US is being noticed by the US,” the source said.

But the real battle that lies ahead will be in the boardroom, given the voting power equation. As someone said, “the fate of Akinwumi Adesina is not in the hand of African countries but foreign investors.”

But while the ordeals of the President Adesina evokes sympathy, it appears a lot of voices in his support, either from his home country Nigeria, or from other African countries, as shown in media reports over the weekend, have dwelled more on African sentiments than looking at more potent issues that could ultimately determine the direction of events after the moment when the frenzy of supports gets to saturation point.

“In corporate governance, noise is different from facts. Whether the defenders of the embattled AfDB President know it or not, the real battle is more in the boardroom and the ultimate determinants are numbers. In this case, the numbers will play up in a number of ways, one of which is the voting powers of countries,” explained a Lagos-based diplomat.

Nigeria as the largest shareholder has 9.3 per cent voting power. It is followed by the United States which has 6.6 per cent voting power. Others with significant voting powers are Japan (5.4%); Germany (4.2%); Canada (4%); France (3.7%); Italy (2.4%); U.K (1.7%); Sweden (1.5%); Switzerland (1.5%);

Apart from Egypt with 5.4%, South Africa with 4.9%, Algeria with 4.2%, the rest of 8 African nations from Cote d’Ivoire to Kenya have nominal status from 3%-1% voting power.

The vulnerability of most African regional member countries can thus be seen from the table. And when it comes to wielding powers, guess where the pendulum would swing and what factors would sway the vulnerable and the weak to the side of the strong.

And if the US, rightly or wrongly accused of orchestrating the crisis, decides to exit the AfDB, might there be an exodus of other non-regional members? In the unlikely event that this happens, what is the future of the bank? Will it remain afloat or go bankrupt? What will be history of the bank in ten years’ time, should this happen: that the bank ran into financial crisis while regional members try to save one helmsman?

There are insinuations that, post-COVID-19, China might step up its regional interests in Africa. If those interests extend to financial institutions, it will be one of the most egregious mistakes to give China any greater leverage in AfDB than it currently has, even if the motive is to spite the US. The experiences of countries in Europe recently should be a good guide as they are insisting that the stakes of China in their businesses must be kept to the barest minimum.

The question that comes to the fore is this: Is Africa now trying to have it both ways? So, if any of them raise any objection, would they be heard?

How did Africa get here after setting up a bank, then they gifted it to Asia, Middle East, Europe and America? And, what would other countries think of Africa’s reactions to the US?

One analyst said: “I really don’t know enough of the details. But, big picture, especially at this moment, financing in Africa in general and the ADB in particular needs this kind of on-going controversy over governance and transparency like a hole in the head. An internal inquiry, however exhaustive, was never going to have the credibility of an independent probe.”

The future image and credibility of the bank is very important. And external inquest would help in burnishing, not tarnishing, that image. If disallowed, a dark cloud of aspersion may hang precariously and dangerously on the bank for a long term as a bank where public confidence doesn’t matter so much as insiders’ judgment. It may affect the ratings of the bank henceforth and the prospects of getting more funds raised from countries outside Africa. The desperately needed development may therefore suffer needless setback.

So where is this heading to right now? “Well… three weeks is a long time in ADB politics. But it’s not good for Adesina, if only to have failed to prevent it reaching this point,” said one diplomatic source.