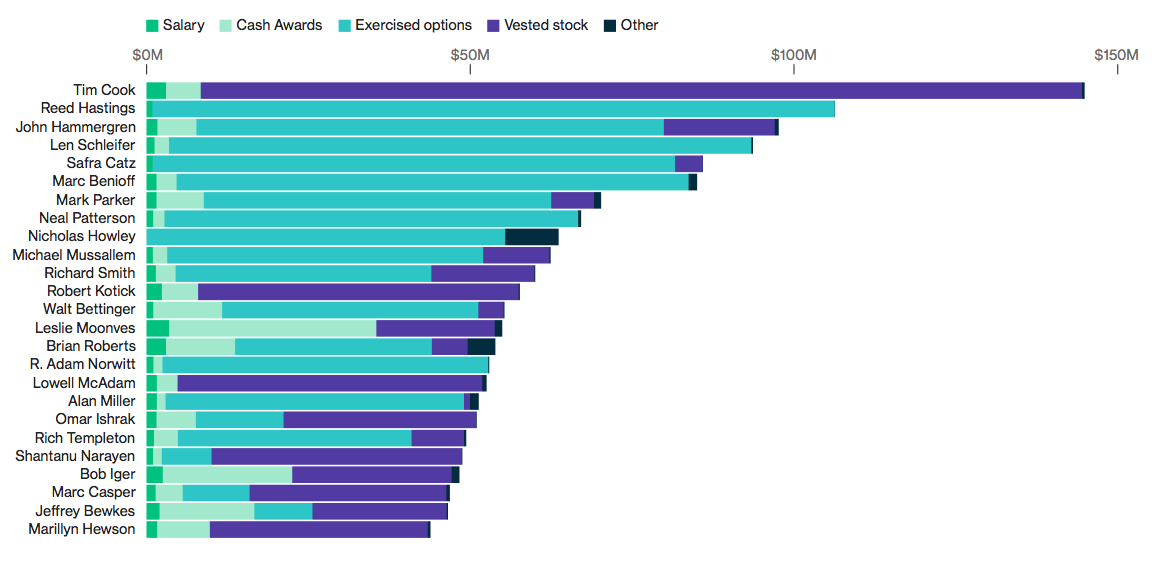

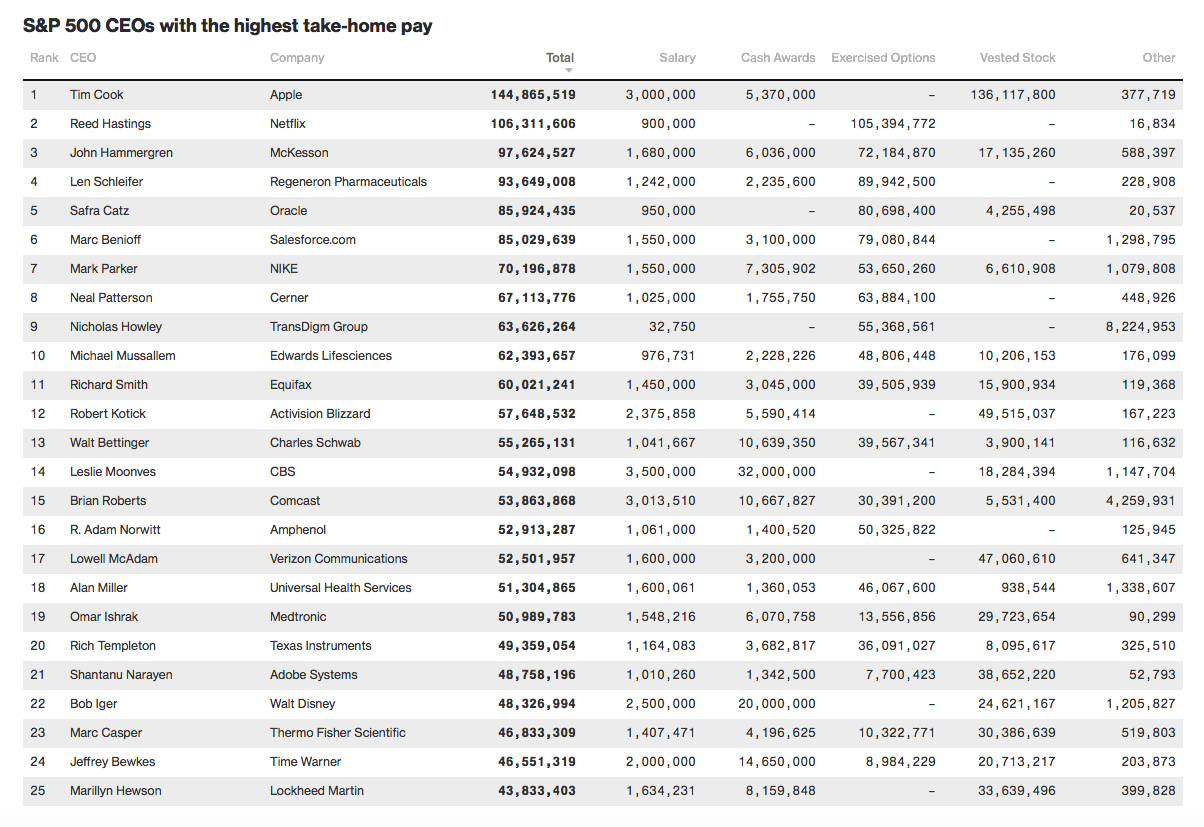

Don’t be fooled by Tim Cook’s 2016 reported pay of $8.75 million, which ranked the Apple Inc. chief executive officer in the bottom third of all CEOs in the S&P 500. Cook, 56, actually took home $145 million, almost all of it from awards granted back in 2011.

He’s not the only chief executive officer of a publicly traded U.S. company to cross the $100 million threshold for take-home pay, commonly referred to as realized pay. Reed Hastings, 56, of Netflix Inc., reaped $106 million last year.

Take-home pay for the top 25 S&P 500 CEOs who served in their positions for the last full fiscal year totaled about $1.65 billion. Bosses in the technology, health care and media industries dominated the list.

Take-home pay is the sum of the values of stock vested and options exercised during the fiscal year, along with cash from salaries, bonuses and perks. Companies typically grant equity to executives as incentives each year. Those awards are reported at their target values in the summary compensation tables of annual proxy statements.

But CEOs don’t necessarily take ownership of those awards in the year they’re given. A better measure of earnings is the value of options that the CEOs exercised and the shares that vested during the year. Those figures can vary significantly from companies’ original estimates as stock prices change.

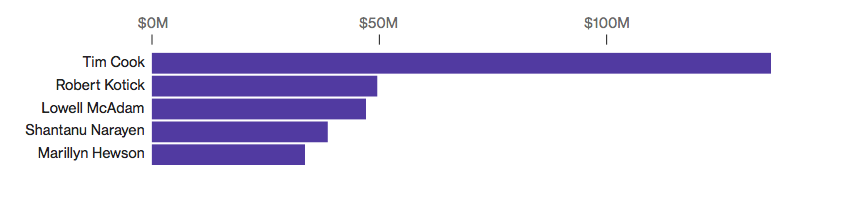

Cook’s 2016 take-home pay came primarily from the vesting of 1.26 million shares, valued at $136 million, which were awarded after he became Apple’s CEO in 2011. About one-fifth of the shares were tied to the firm’s three-year total shareholder return relative to the S&P 500 Index. Shares of the iPhone maker gained 78 percent in the 36 months through the fiscal year ended Sept. 28, placing it in the top third of the index. The remaining 980,000 shares vested solely on his continued employment.

Cook has now amassed more than $320 million from vested shares of the 2011 award. His $145 million total take-home pay for fiscal 2016 also includes a $3 million salary, a $5.37 million cash bonus and $377,719 in perks. In a 2015 interview with Fortune magazine, Cook said he plans to donate his fortune to philanthropy.

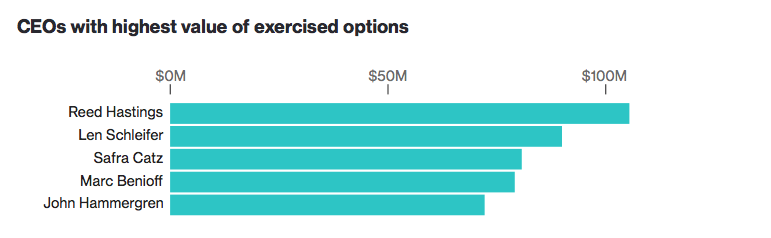

Netflix’s Hastings took home $106 million, the second highest in 2016 for S&P 500 chiefs, almost entirely from exercised options that were granted as early as 2006. Netflix shares have surged more than 3,000 percent through the 10 years ended Dec. 31, 2016.

Options, which generally can be held for up to a decade, were also given to the heads of tech and biopharmaceutical companies last year. Leonard Schleifer, 64, CEO of Regeneron Pharmaceuticals Inc., earned $90 million from exercising options. His $94 million in take-home pay ranked him fourth. Oracle Corp. Co-CEO Safra Catz, 55, and Salesforce.com Inc.’s Marc Benioff, 52, collected $86 million and $85 million, respectively. Option exercises accounted for more than 90 percent of their total.

CEOs with highest value of vested stock

Media chieftains got the most cash. CBS Corp.’s Leslie Moonves, 67, reaped a $32 million cash bonus that was the largest since he became CEO in 2006 and accounted for almost 60 percent of his total take-home pay. Walt Disney Co.’s Bob Iger, 66, got a $20 million cash as an incentive in 2016. His payout was tied to financial metrics, such as operating income and returns on invested capital, and was 10 percent lower than the previous year. Iger can earn a retention cash bonus of as much as $60 million in 2018 if the company posts aggregate five-year operating income of at least $78.3 billion. Here’s the full ranking, sortable by column.

Courtesy Bloomberg