BY VETIVA CAPITAL

What shaped the past week?

Global: It was another week of buy-side action across the global space, as investors reacted to the latest policy decisions from the European Central Bank (ECB) and the U.S. Federal Reserve. As inflation continues to drive prices higher across the globe, global central bankers have taken an aggressive stance towards taming soaring inflation by strengthening their respective currencies. Starting in the Asian-pacific region, the Nikkei-225 posted a strong w/w performance rising 4.20% as investors reacted favorably to a m/m drop in inflation. The positive sentiment in the region filtered into markets in Hong Kong and mainland China, as the Hang Seng and the Shanghai Composite rose 1.53% and 1.30% respectively. Moving to Europe, where the ECB raised rates for the first time in over a decade, the 50bps rate hike from the bank improved investor confidence in the region; the German Dax soared 3.38%, with the French CAC and London FTSE-100 rising 3.12% and 1.58% respectively. Finally, in the US tech stocks were the top performers this week, as earnings season kicks into high gear. The NASDAQ was the best performer in the region rising 4.86% w/w, as gains in TESLA, NVDA and a bevy of other counters boosted its performance. Additionally, the S&P 500 and Dow Jones also benefited from the improved sentiment in the region, as they gained 3.47% and 2.59% respectively.

Domestic Economy: The Monetary Policy Committee (MPC) raised the benchmark rate by 100bps to 14%. The decision was based on sustained inflationary pressures. However, with fuel scarcity (a structural issue) being the dominant driver of inflation, monetary policy tools may be insufficient to keep inflation under control. Going forward, we see room for more rate hikes, as inflation could continue to trend upwards.

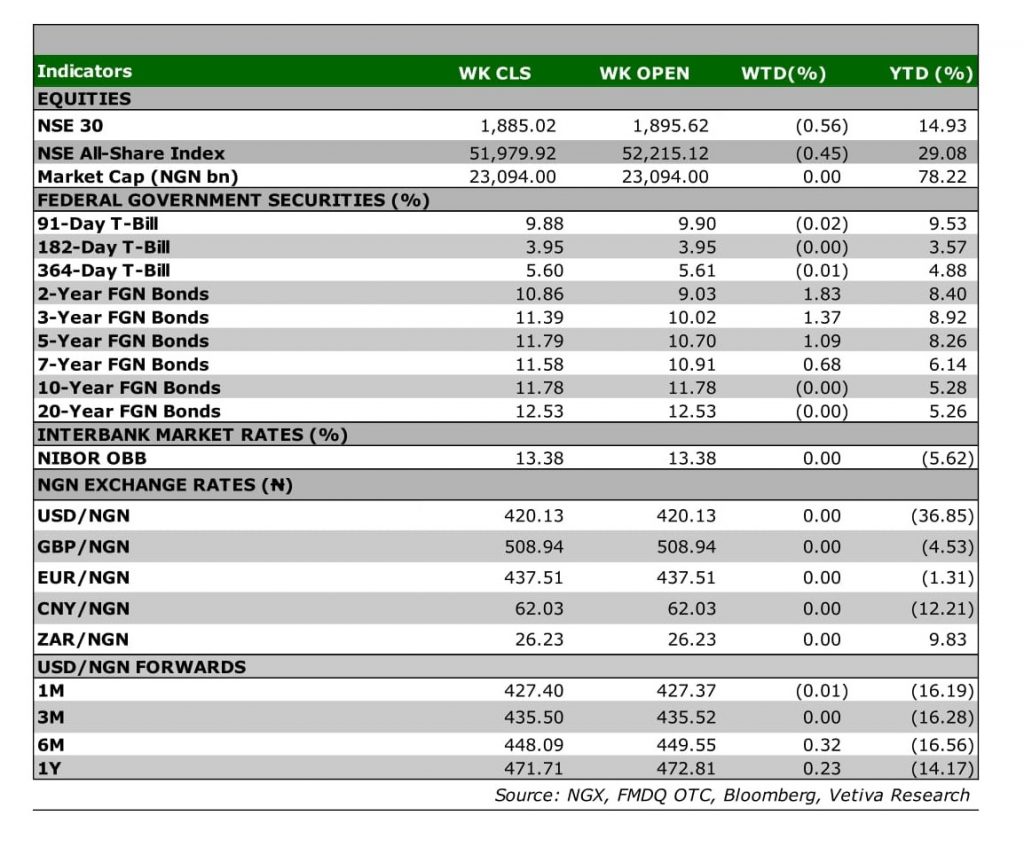

Equities: Local equities posted another week of losses, as the NGX sank 0.45% w/w to 51,979.92pts. The performance of the banking sector weighed heavily on the index, as it lost 4.06% w/w. Losses in the sector we broad based, with ZENITHBANK, ETI and UBN easing 6.53%, 5.66% and 6.42% respectively. Likewise, losses in key names in the Consumer Goods sector, saw it sink 1.97% w/w, notably, NB lost 10.92% w/w, with INTBREW also dipping 6.90% w/w. Moving to the Industrial Goods space, losses in WAPCO amongst others, saw the sector lose 0.49%. Finally, it was a positive week for the Oil and Gas space, as interest in SEPLAT (+10.00% w/w) saw the sector gain 3.60% w/w..

Fixed Income: This week, the fixed income market was largely bearish, as average yields increased across the board. Bond yields increased 42bps w/w due to selloffs across the benchmark curve. Similarly, the NTB and OMO segments were primarily sell-side driven following the increase in MPR and constrained liquidity levels. Hence, average yields in the NTB and OMO markets increased by 8bps w/w and 191bps w/w, respectively.

Currency: The Naira depreciated by ₦3.87 w/w at the I&E FX Window to close at ₦426.13.

What will shape markets in the coming week?

Equity market: Market sentiment has been bearish all through the week, following Tuesday’s MPR hike with 4 consecutive negative closes. While this may bring about attractive entry points in some counters, we are likely to see tepid trading sessions next week as investors continue to trade cautiously. However, better than expected Q2 results next week may give the market the necessary positive boost.

Fixed Income: Next week, we anticipate increased activity in the bonds market, due to coupon inflows of ₦30 billion from the 10.00% FGN-JUL-2030 bond. Meanwhile, the NTB segment is expected to trade on a muted note due to weak demand, as investors continue to stay on the sidelines ahead of Wednesday’s NTB auction.

Currency: We expect the naira to remain largely stable across the various windows of the currency space as the CBN maintains interventions in the FX market.

MONETARY POLICY DECISION – Nigeria delivers a surprise 100bps rate hike

Recently, the Monetary Policy Committee (MPC) voted to raise the Monetary Policy Rate (MPR) by 100bps to 14.0%. This is the first time interest rates will be raised in two successive MPC meetings under Godwin Emefiele. While the decision to raise rates was unanimous, 6 of the 11 members present, opted for a 100bps hike.

The hawkish momentum continues

The world continues to battle skyrocketing inflation, worsened by the war in Ukraine and sanctions on Russia. While advanced economies battle inflation, policymakers are wary of pushing the economy into a recession (especially after the US recorded an output decline in Q1’22). The high level of inflation justifies further aggressive monetary policy tightening from developed countries, as the European Central Bank’s first-rate hike and the US Fed’s 7bps rate hike loom. These hawkish decisions could heighten the pace of capital flow reversals in emerging economies, as investors rotate out of gold and equities into fixed income investments, to take advantage of the higher yield environment.

On the domestic front, the Committee highlighted the likelihood of subdued output growth, stemming from the ongoing war and high oil prices, Nigeria’s net-oil importing status, and aggressive normalization of advanced economies.

The sustained surge in domestic inflation remained of primary concern to the Committee. Although the Committee recognized that inflation was driven by both demand and supply-side approaches, we note that the current inflationary surge is majorly driven by the scarcity of PMS, which is outside the purview of the apex bank. We note that despite the 90bps inflationary surge in Apr’22 that spurred the initial rate hike in May, the surge in inflation has averaged 89bps in succeeding months (May’22: +89bps, June’22; +88bps). This partly reflects the ineffectiveness of monetary policy tools in handling the current inflationary surge. In subtle acknowledgement of the weak transmission of the earlier rate hike, the CBN called on the Federal Government to strike a balance between the pricing and supply of PMS. In our view, this has been partly addressed by the covert approval of a PMS price adjustment to a band of ₦170/litre to ₦180/litre. Nevertheless, headline inflation could still trend upwards in the near term, as high PMS prices passthrough to food prices.

While the rate hike came in earlier than expected, we note that the apex bank’s change in policy stance (in line with its peers in Ghana and South Africa) implies that more rate hikes could be on the table should inflation remain on the uptrend