| What shaped the past week?

Global: It was another rough week for global equities, as broad-based investor pessimism weighed on markets. Global investors were focused on the latest rate hike decisions from central banks around the world. Most central banks hiked their monetary policy rates as the global fight to bring down inflation persists. Widespread selloffs were observed across global equities and bonds markets, driven by investors’ worries that said rate hikes could trigger a global recession. Starting in the Asian region, The Bank of Japan and The People’s Bank of China left key interest rates unchanged at -0.10% and 3.65% respectively, in line with investor expectations; the Shanghai Composite sank 1.22% w/w, while the Japanese Nikkei-225 fell 1.50% w/w. Moving to Europe, where high energy prices remain in focus, markets fell sharply due to concerns over the impact of these prices on the region’s post pandemic recovery. The German AX lost 3.42% w/w, while the French CAC and London FTSE 100 lost 4.80% and 3.22% respectively. Finally, in the U.S., it came as no surprise that the U.S. FED raised its monetary policy rate by 75bps to 3.25%, given that inflation remains outside of the 2-3% region. Tech stocks were the biggest losers this week, with NASDAQ down 4.74% w/w at time of publishing; investors remain unnerved about the prospects of a recession due to the hawkish stance of the FED, as this was evident in the widespread selloffs seen across U.S. markets.

Domestic Economy: According to the Debt Management Office (DMO), Nigeria’s debt stock increased by 2.98% q/q to $103.3 billion (₦42.8 trillion) in Q2’22. The debt stock rose primarily due to a $3.2 billion (₦1.24 trillion) accumulation in domestic debt. In Q2’22, we witnessed a 6.7% q/q uptick in FGN bond issuances which spurred domestic debt.

Due to the increase in the official debt stock, Nigeria’s official debt-to-GDP ratio now sits at 24.3%. Adjusting the official debt figure with ways and means advances, this brings the overall debt-to-GDP to 36.6%, slightly below the DMO’s threshold of 40%. Nigeria’s activities in the external market were muted as a result of the high borrowing costs in the international debt market and terms guiding sourcing from multilateral agencies. Hence external debt rose marginally by $96 million in Q2’22. This brings the domestic-external debt mix to 61:39, as the government leans on domestic debt amid tight global financing conditions.

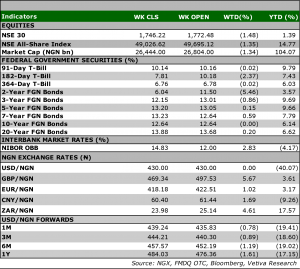

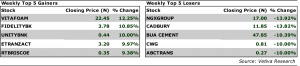

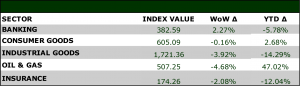

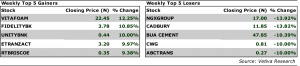

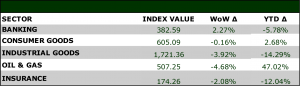

Equities: Local investors remain bearish on equities as it was another red w/w close for the market The benchmark NGX lost 0.91% w/w, due to losses in the Industrial Goods and Oil and Gas sectors. Starting with the Industrial Goods space sank 3.92% w/w, as losses in BUACEMENT were the primary driver of the sector’s w/w performance; the counter sank 10.39% w/w. Likewise, in the Oil and Gas space, where lower oil prices have led to a downturn in sentiment, TOTAL, SEPLAT and ADROVA saw their prices dip 9.98%, 3.85%, and 4.48% w/w respectively. Moving to the Consumer Goods space, investor sentiment was mixed w/w, with a moderate sell-side bias as the sector sank 0.16% w/w. Finally, a recovery in the Banking sector following weeks of selloffs, saw the space rise 2.27% w/w, driven by broad based gains in the sector, with ACCESSCORP (+6.02% w/w) and FIDELITYBK (10.85% w/w) leading the gainers.

Fixed Income: This week’s trading activity in the fixed income space was quite active, with bullish sentiments persisting across the three market segments. Starting off in the bonds space, as buy-side activity dominated the short end of the benchmark curve, average yields on benchmark bonds eased 8bps w/w. Similarly, mild bullish sentiments in the OMO space saw average yields decline 1bp w/w. Lastly, with demand persisting at the mid end of the NTB segment, average yields in the space closed 28bps lower w/w.

Currency: The Naira appreciated 8bps w/w at the I&E FX Window to ₦436.33.

| What will shape markets in the coming week?

Equity market: Despite Friday’s improved activity, the week’s average volume was 112m units, a 20% decline from prior week’s 141.2m units, and we are likely to see another tepid start to next week’s trading as investors await the MPC’s response to the inflationary pressure.

Fixed Income: We expect the market to kick of the week on a quiet note, as investor focus shifts to the MPC decision slated for next week, while liquidity levels will dictate activity across the NTB and OMO segments of the market.

U.S. Fed hikes cash rate for the fifth time in a row

The U.S. Federal Reserve has hiked interest rates for a fifth consecutive time, to 3.25% (previous: 2.50%) as the central bank seeks to tame inflation that is running at a 40-year high. The latest rate hike comes on the heels of an August inflation print of 8.3%. In his briefing to the press, Federal Reserve Chairman, Jerome Powell, stated that “there would be some pain” involved, highlighting that the rate hikes were key to easing

demand pressures and curbing long-term damage to the economy. Already, the Fed Funds Rate, which opened the year at near zero, is now at 3% for the first time since early 2008. As such, for U.S. consumers, the latest hike will lead to an increase in interest costs; for instance, we have already witnessed a repricing in the U.S. mortgage market, where rates have surged to 6% for the first time since the 2008 crisis.

Equities – EM/FM markets should see a downturn in sentiment

Regarding the equities space, the latest rate hike should see an extended bearishness across global markets, as a shift to the fixed income market by fund managers weighs on equity markets. For emerging and frontier

markets, foreign portfolio managers will remain bearish, as the dollar continues strengthening on stronger interest rates. For the Nigerian market, we believe that local fund managers will take a cue from their foreign counterparts and remain sell-side driven as well, in anticipation of further rate hikes as the Central Bank of Nigeria continues its fight against inflation.

Fixed Income – Eurobond and local yields should witness a repricing due to rate hike

Given this latest Fed’s hike, the yield on all debt instruments including Eurobonds, among others denominated in Dollar may also increase. As a result, Nigeria should see borrowing costs go up on the back of this. Furthermore, with central bankers in advanced economies maintaining an aggressive stance in the fight against inflation, we believe the Central Bank of Nigeria will be limited in its options on what it can do with its own monetary policy rate. The CBN has raised rates twice this year from 11.50% to 14.00%, and with inflation in the country still climbing, we cannot rule out the possibility of another rate hike as the apex bank seeks to tame inflation. |

|