Anchor Borrowers’ debts: CBN must bark and bite

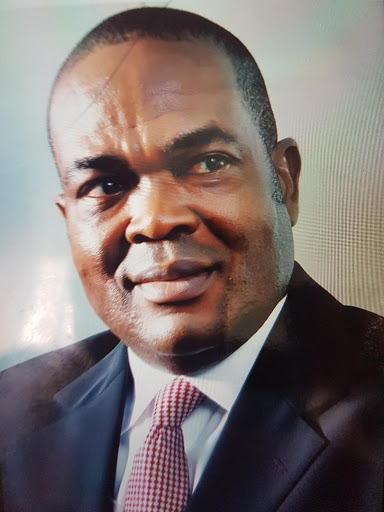

Marcel Okeke, a practising economist and consultant in Business Strategy & Sustainability based in Lagos, is a former Chief Economist at Zenith Bank Plc. He can be reached at: obioraokeke2000@yahoo.com; +2348033075697 (text only)

October 3, 2022634 views0 comments

Without any iota of doubt, the Central Bank of Nigeria (CBN), in the pursuit of its economic development initiatives (mainly through its Development Finance Department), has impacted several sectors of the Nigerian economy. One of such sectors is agriculture – which has arguably received the most attention from the monetary authorities – in the bid to diversify the economy as well as address the food insecurity/insufficiency of the country. In this regard, a prime initiative of the apex bank has been the Anchor Borrowers Programme (ABP) to which it has sunk about a trillion naira as loans to farmers across the country. But while the CBN has made tangible strides and covered a lot of mileage in pursuit of the ABP objectives, one of the visible challenges of the otherwise lofty initiative has been the poor rate of loan recovery.

Apparently taking the ABP loans as their own shares of the ‘national cake’, many of the beneficiary farmers have allegedly resisted the overt and covert moves of the CBN for a long while to recover the loans. It is even believed that some of the farmers, from the very beginning, opted to divert the loans or part thereof to something else other than farming. And so, it has become a notorious fact that the apex bank is not having it easy with the ABP debtors – now numbering millions across the country. On a number of occasions, the CBN had issued veiled threats to the recalcitrant debtors. It had also applied some ‘moral suasion’ to little avail.

Sequel to all these, the CBN issued a ‘final demand notice’ to seven companies who are beneficiaries from the ABP loans but now collectively have outstanding or non-performing loans to the tune of about N5.67 billion. In pursuit of this, the apex bank recently directed its subsidiary – NIRSAL Microfinance Bank (NMFB) Limited (coordinators of the ABP loans) – to recover all non-performing ABP loans from the debtors. Consequently, the NMFB, in a demand notice issued in Abuja said, “following the Central Bank of Nigeria’s (CBN) directive to NIRSAL Microfinance Bank Limited (NMFB), to recover all non-performing intervention loans granted by NMFB under the Anchor Borrowers’ Programme, notice is hereby given to the under-listed customers, to offset their indebtedness to NMFB under the said intervention scheme of the CBN.

“Earlier Demand Notices have been issued by NMFB to the last known addresses of the aforesaid customers, hence, this Public Notice serves as the final demand notice.” The NMFB’s list of these debtors included: SADOLEN Interworld Ltd promoted by Saidu Audu Adaji and Nura Musa Hassa with N2.050 billion loan amount; Gum Arabic Farms and Commodities Ltd promoted by Yusuf Ibrahim Babangida, N1.220 billion; Prime Synergy Global Solutions Ltd promoted by Mercy Ikeji and Jennifer Nyesom-Effiong, N1.451 billion; ASUJ Food Production and Processing promoted by Abubakar Umaru Jibrilla, N581.416 million; Souvenire Seeds Nigeria Ltd promoted by Roseline Omokora and Con Investment Ltd promoted by Lady Josephine Waze.

As the ‘demand notices’ were being taken to the ‘last known addresses’ of the adamant debtors, the CBN through another channel, made known its decision to directly deduct the outstanding debts from the accounts of the defaulters. A top official of the CBN (Development Finance Office, Port-Harcourt), Celsus Agla, disclosed the decision of the apex bank at a recent meeting with maize farmers and other stakeholders.

Agla said, “Some farmers that obtained loans through the Anchor Borrower Programme have ignored appeals to repay, and some describe the loan as [a] grant. This has led CBN into considering the Global Standing Instruction (GSI).”

The Global Standing Instruction allows the CBN to deduct money from accounts of loan defaulters to settle their debt. “The GSI is a system whereby, if you have an account with any bank, and there’s money in another account, because your BVN is attached to these loans, if the GSI is triggered, the monies in those accounts can be collected by the apex bank to repay the loan to the one being owed,” he explained. Although he said GSI will be the last resort to recover the overdue ABP debts, “the GSI shall serve as a last resort by a creditor bank, without recourse to the borrower, to recover past due obligations (principal and Accrued Interest only, excluding any penal charges) from a defaulting borrower through a direct set-off from deposits, investments held in the borrower’s qualifying bank accounts with participating financial institutions.”

In more ways than one, all these circuitous routes to ABP loan recovery question the documentation and assessment processes of the loans ab initio. Did the loan processing go through normal rigorous and professional checks and approvals or were they given out on some other ‘patronage’ considerations? Apparently, owing to the observance of some lapses and gaps in the conditions precedent to the disbursement of those loans, the apex bank had to issue “revised guidelines” by late 2021 – about six years after the ABP took off in November 2015.

Chapter three of the revised guidelines for the ABP issued in September 2021 makes tight provisions for loan repayment, collateral requirements as well as eligibility criteria for the facilities. Specifically, it provides that “loan repayment shall be by produce and/or cash as may be prescribed by the CBN. The loans granted under the Programme shall be fully repaid within the tenor of the facility. Where the facility was accessed through a Commodity Association, the leadership of the Association shall be responsible for full repayment of [the] facility granted to its members.” Collateral requirements included, Irrevocable Standing Payment Order (ISPO) where state governments are involved; and the Global Standing Instruction (GSI) with a mandate, among others.

All these, however, go to show that the “revised guidelines” are aimed at giving the CBN better grip on the ABP loan beneficiaries. Perhaps, it was the absence of such tight provisions from the outset in 2015 that gave vent for the massive default and resultant huge debt under the ABP initiative. Now that the apex bank has elected to ‘make amends’ and to recover public money, it should go the whole hog. Really, the huge and rising indebtedness of ABP loan beneficiaries has generated bad publicity for the CBN, the NMFB and all who have been involved with the ABP loans disbursements. After all, farming is a business and should be treated as such; and which is why the core objectives of the ABP are: to stimulate and drive commercial farming via improved access to finance, diversification of the economy, job creation and pursuit of inclusive growth. And now, more than ever before, these objectives should be pursued with vigour and single-mindedness.

- business a.m. commits to publishing a diversity of views, opinions and comments. It, therefore, welcomes your reaction to this and any of our articles via email: comment@businessamlive.com