What shaped the past week?

Global: US stock markets experienced a mixed week, shaped by inflation expectations, economic data, and corporate earnings. On Monday, markets saw gains, which were followed by a volatile session on Tuesday due to slightly higher-than-anticipated annual inflation reports. The mid-week saw gains fueled by a batch of positive economic data and strong earnings reports. However, the market closed lower on Thursday and Friday due to concerns over rising producer prices, jobless claims, and China’s decision to sanction American weapon manufacturers.

Asia-Pacific stock markets traded mixed this week, with concerns over higher inflation and the Federal Reserve’s policy decisions. Market sentiment was initially mixed on Monday, followed by mixed trading on Tuesday, with the Bank of Japan’s governor nomination. Markets fell on Wednesday, following the US’ higher-than-expected inflation report. Thursday was mixed after Japan’s trade balance update and concerns over China and Moscow’s relationship. On Friday, markets fell ahead of the People’s Bank of China’s interest rate decision and Japan’s inflation update.

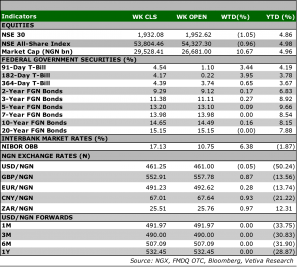

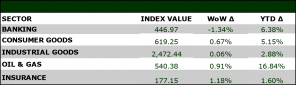

Equities: The Nigerian stock market had a positive start to the week, as all sectors closed positive on Monday, with the Oil and Gas and Banking sectors closing as the top performers. However, on Tuesday, only the consumer and industrial goods sectors maintained their gains, as banking counters accounted for 42% of the day’s total declines. Meanwhile, Wednesday saw marginal improvements, with the ASI mirroring the index’s 2bps uptick. Thursday closed up 3bps, with the consumer goods sector being the only positive contributor due to gains in brewery counters. However, the week ended on a negative note as the market sank 1.31% to end the week down 0.96% w/w.

Fixed Income: This week’s market was mixed, as the bond and T-Bills segments experienced bearish trading sessions. Benchmark bond yields slightly decreased by 1bp, and the NTB space continued its positive trend, with an average yield decline of 6bps. However, on Tuesday, yields in both segments rose due to sell-side pressure, resulting in an average yield increase of 23bps in the NTB segment and 8bps in the bond space. On Wednesday, yields surged across the curve, with an average yield increase of 183bps in NTBs and 114bps in the OMO space. On Thursday, bond yields moderated slightly while T-Bills and OMO segments closed bearish. Finally, it was a relatively quiet session on Friday, as yields rose 2bps on average in the bonds space, while closing flat across the T-bills segment.

Currency: The Naira depreciated N0.15 w/w at the I&E FX Window to close the week at N461.25.

What will shape markets in the coming week?

Equity market: Over the course of the week, we have seen a correlation between the performance of the market with that of the NGX30, as these large-cap counters dictate market direction. With elections starting next week, we expect a relatively quiet trading week, amid a cautious trading pattern.

Fixed Income: Ahead of the Presidential election scheduled to hold next week Saturday, we expect bond investors to trade cautiously, while the T-bills segment is due for a subdued trading week due to tight system liquidity.

January 2023 Inflation

Fuel scarcity, cash crunch lift inflation to 17-year high Headline inflation rose faster than expected in January, reaching 21.82% y/y (Dec’22: 21.34% y/y). The increase was 52bps higher than the Bloomberg consensus estimate of 21.30% y/y (Vetiva: 21.38% y/y). This uptick was mainly driven by the current cash crunch and the continued scarcity of Premium Motor Spirit (PMS).

Over the course of the month, there was a broad-based uptick in month-on-month inflation. Headline inflation ticked up to 1.87% m/m, 16 basis points higher than the previous month (1.71% m/m), driven by higher food and fuel prices. The largest pressures were observed in energy (+2.62% m/m); food (+2.08% m/m); transport (+1.99% m/m); and the housing, water, gas, and other fuels segments (+1.55% m/m). This highlights supply chain pressures from higher fuel costs, FX pressures, and the cash crunch.

Processed food drove food inflation higher

In January, food inflation reached a 7-month high of 2.08% m/m (Dec’22: 1.89% m/m). Despite lower farm produce price inflation, Nigeria recorded higher processed food inflation (+2.08% m/m). This can be linked to increased logistics costs amid moderate exchange rate pressures. Overall, food inflation rose 56bps higher to 24.32% y/y (Dec’22: 23.75% y/y), due to higher fuel prices and currency volatility.

Core inflation maintains its ascent

Core inflation increased to 19.16% y/y (Dec’22: 18.49% y/y), owing primarily to persistent energy pressures. Similarly, continued fuel scarcity and higher parallel market exchange rates drove the core index higher to 1.82% m/m (December’22: 1.33% m/m).

Cash crunch could fuel inflation

The Naira crash crunch has heightened price distortions within the economy, in addition to the lingering incidences of fuel scarcity. While the extended deadline for the cash-swap has elapsed, consumer prices could be rattled by currency racketeering amid the scarcity of new Naira notes. As a result, we anticipate that this, alongside the lingering energy scarcity, could lift inflation to 22.16% y/y in February. Beyond February, we still factor in the fuel subsidy removal planned for April – June 2023. With this in mind, we raise our full-year headline inflation estimate for 2023 to 22.35% y/y (2022: 18.76% y/y).