LAFARGE AFRICA PLC FY’22 Earnings – Revenue growth offsets rising costs

March 6, 2023875 views0 comments

What shaped the past week?

Global: Global stock markets showed mixed trading as inflation and interest rate uncertainties influenced market sentiment. Asian stock indexes traded lower, following Wall Street’s drop due to hotter-than-expected Personal Consumption Expenditures price index data. The market however closed the week higher on Friday, with a sharp recovery in the services sector across China and Japan.

Meanwhile, US markets closed higher on Monday, thanks to economic data on durable goods and pending home sales. On Wednesday, US markets closed mostly lower, as Federal Reserve officials cautioned against premature monetary policy easing, indicating they might consider rate hikes during the next central bank meeting. On Thursday, Wall Street closed positively after Atlanta Federal Reserve President Raphael Bostic said the Fed could stop raising interest rates by summer’s end.

In Europe, stock markets gained strongly on Monday after the EU and the UK confirmed the “Windsor Framework.” The rest of the week’s market sentiment was driven by a mixture of economic data releases and central bank official comments. On Thursday, European stock exchanges gained after Eurozone inflation eased in February, and ECB officials showed hope the Eurozone would avoid a recession and the region extended these gains on Friday after a series of data releases.

Read Also:

- Focus for the week: TOTAL NIGERIA PLC 9M’24 Earnings Release: Higher…

- Experts advocate efficient cybersecurity frameworks amid rising digital threats

- FG, States, LGCs Share N1.411trn October 2024 Revenue

- Africa's prospects in new Trump's era (2)

- ADF releases $99m initial financing for development of rice cultivation…

Domestic Economy: Following the conclusion of the Presidential elections, the Independent National Electoral Commission (INEC) declared Asiwaju Bola Ahmed Tinubu of the All Progressives Congress (APC) the winner. According to the commission, Tinubu received 35% (8.8 million) of the total votes cast (21.8 million). Atiku Abubakar of the People’s Democratic Party (PDP) finished second with 27.9% (6.9 million votes), followed by Peter Obi of the Labour Party (LP) with 24.4% (6.1 million votes).

Domestic Economy: Following the conclusion of the Presidential elections, the Independent National Electoral Commission (INEC) declared Asiwaju Bola Ahmed Tinubu of the All Progressives Congress (APC) the winner. According to the commission, Tinubu received 35% (8.8 million) of the total votes cast (21.8 million). Atiku Abubakar of the People’s Democratic Party (PDP) finished second with 27.9% (6.9 million votes), followed by Peter Obi of the Labour Party (LP) with 24.4% (6.1 million votes).

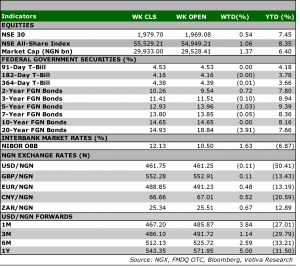

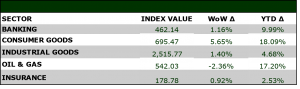

Equities: The Nigerian stock market experienced mixed trading sessions during the period week. The consumer goods sector consistently emerged as the best-performing sector, while banking and industrial goods stocks were also actively traded. Market breadth varied, and activity levels were generally mixed, with traded volumes and turnover declining on some days but increasing on others. Notable gainers and decliners throughout the period include but not limited to SEPLAT (-9.43% w/w), DANGSUGAR (+10.03% w/w), and DANGCEM (+2.21%). Overall, the market closed the week up 1.06% w/w.

Fixed Income: The fixed income market had a slow start on Monday with little activity in the NTB space, resulting in a flat close. The benchmark bonds saw mild selloffs leading to a 13bps increase in the average yield. However, the market traded positively on Tuesday and Wednesday, with demand witnessed across the curve. The yield on some benchmark bonds eased, and the NTB and OMO segments remained tepid. On Thursday, there was some mild buyside activity in the bond market, which dragged the average yield down by one basis point. The week ended quietly, with investors shying away from the T-bills segment, and bond investors were sell-side driven during the session.

Fixed Income: The fixed income market had a slow start on Monday with little activity in the NTB space, resulting in a flat close. The benchmark bonds saw mild selloffs leading to a 13bps increase in the average yield. However, the market traded positively on Tuesday and Wednesday, with demand witnessed across the curve. The yield on some benchmark bonds eased, and the NTB and OMO segments remained tepid. On Thursday, there was some mild buyside activity in the bond market, which dragged the average yield down by one basis point. The week ended quietly, with investors shying away from the T-bills segment, and bond investors were sell-side driven during the session.

Currency: The Naira depreciated N0.50 w/w at the I&E FX Window to close the week at N461.75.

Currency: The Naira depreciated N0.50 w/w at the I&E FX Window to close the week at N461.75.

What will shape markets in the coming week?

Equity market: We expect mixed sentiments in the market next week, as investors anticipate more full-year earnings results.

Fixed Income: We expect the bonds market to trade on a mixed note to start the week, as bargain hunting activity will likely drive the market. Meanwhile, we expect the T-bills market to trade in line with system liquidity.

LAFARGE AFRICA PLC FY’22 Earnings – Revenue growth offsets rising costs Lafarge recently released its audited result, with PAT for the FY’22 period increasing by 5% y/y, as the strong 9M’22 performance offset the 18% y/y decline in bottom-line for the Q4’22 period.

FX revaluation loss drags bottom-line

In Q4’22, revenue came in 40% higher y/y to ₦103 billion, on the back of higher cement prices and increased volumes during the financial year. Naira weakness, as well as the challenging FX crisis, continued and further impacted cost of sales, causing a surge in inputs costs such as fuel and raw materials as they are FX-linked. That said, cost of sales increased by 26% y/y to N41 billion. As revenue outpaced the growth in cost of sales, gross profit grew by 52% y/y to N61 billion, with gross margin expanding by 4ppts to 59%.

Persisting inflationary pressures remained evident, evinced by the jump in operating expenses (+45% y/y) to N33 billion. This can be attributed to the sustained high prices of diesel, which remained a headwind for selling and distribution costs. However, the knock-on effect of the topline growth supported EBIT margin, as it increased by 4ppts to 27%. Similarly, EBIT for the Q4’22 period increased by 63% y/y to N27 billion.

Further down the income statement, net finance cost for the Q4’22 period increased to N11 billion, driven by significant FX revaluation losses which dragged PBT lower by 14% to ₦15 billion. Finally, after accounting for a 9% y/y decline in tax expenses, PAT declined for the second consecutive quarter, down by 18% y/y to N8 billion.

Price-induced growth outweighs slowdown in volumes

Despite the flattish growth in volumes, attributed to the broad-based gas supply disruption, full year revenue grew by 27% y/y to N373 billion, supported by a 27% jump in price per ton. The worsening FX crisis persisted, driving cost of sales higher by 18% y/y to N177 billion, as most of Lafarge’s input costs such as raw materials and fuel are FX-linked. Nonetheless, the passthrough from the robust topline growth bolstered gross margin by 4ppts to 53%.

The unabating inflationary pressures remained a headwind, further stoking the selling and distribution (+57% y/y) component of operating cost and is attributable to the continuous rise in AGO prices. That said, the 44% y/y surge in operating expenses to ₦112 billion pressured EBIT margin slightly downward by 1ppt to 23% y/y.

In the same vein, Lafarge’s finance cost increased 3x to ₦15 billion, due to FX revaluation losses of ₦13 billion recorded in the FY’22 period, primarily reflecting the exacerbating FX liquidity in the economy. However, the effect of the FX loss was tempered by the impressive topline performance and a 43% y/y decline in tax expense, causing PAT to grow by 5% to N53 billion.

Strong prices to sustain growth

Following the industry-wide energy disruption that constrained volumes and the harsh effect of the FX crisis, we expect Lafarge to intensify efforts to improve its fuel mix and cost optimization, using alternative fuels and other means of distribution in a bid to preserve margins.

Furthermore, should the energy situation worsen, we expect this to restrict volumes, despite the ongoing debottlenecking process to free up additional capacity. That said, in the near term, we expect cement prices to remain elevated to reflect the impact of the current inflationary trend and mask the possible slowdown in volumes.

Finally, we estimate that revenue and PAT will grow by 5.7% y/y and 8% y/y to N394 billion and N58 billion, respectively. We value Lafarge at a 12-month TP of N31.92 and place a BUY rating on the stock.