It is often said that two businesses that will always be required in this world are the Food business and the Clothing business. After all, these are fundamental to our existence. One is tempted to add the jewellery business to this ‘must-have’ list! I am saying this only in half-jest as there is historical evidence to indicate that from the earliest of days, mankind has been adorning oneself with jewellery in their quest to look (and perhaps, to feel) good. While relics from ancient civilizations (Egypt, Incas, India, etc.) indicate indulgence with intricate jewellery, the plunder of gemstones from these ruins are also legendary. The fascination with Gems & Jewellery and the demand for these products has continued and even today this industry remains a cynosure of all eyes.

However, the fashion and luxe business has remained a fickle and tricky business to be in. And, it also faces major scrutiny from time to time. Behind the glamour of this global industry lies many challenges. Let’s take a closer look at the current scenario in India.

First, a look at the size of the market. Official estimates indicate that there are over 5 Lakh firms in the domestic market, most of whom are small players, contributing to nearly 7% of the nation’s GDP. Besides, being an export oriented and labour intensive sector, it is also a sizeable employer to a vast pool of labour, both skilled and non-skilled, and a major creator of foreign exchange to the country. India’s exports from this sector were over US$ 32 Billion (most of which was cut and polished diamonds, about US$ 20 Billion), and the overall market is expected to grow at a Compound Annual Growth Rate (CAGR) of about 16% for the period to 2019. Further, our largest export markets continue to be the UAE, US, Russia, Singapore, Hong Kong, Latin America and China. It is important to note that given the major role of this sector, the government has always paid special attention to it. Consequently, 100% Foreign Direct Investment (FDI) in this sector is permitted through the automatic route.

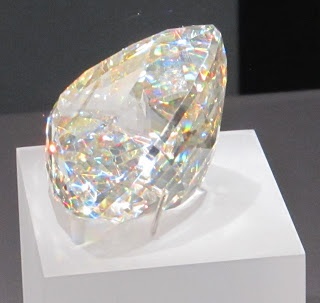

While the vicissitudes of the global economy have taken its toll on Indian exporters – even though we export 95% of the world’s diamonds – the saving grace is the domestic demand. It is a well-accepted platitude that India is a gold market with the adage that all Indian household want to save some gold jewellery for the next generation (even at the cost of everything else). But, tastes in jewellery are changing. The early efforts of market creation of the fabled De Beers’ Diamond Trading Corporation (and some other players) is now paying off as there a rise in diamond jewellery purchase all round. A new generation of young consumers now aspire to not only own and flaunt their diamond jewellery but this has provided a lift to other precious stones as well.

The wider acceptance of western tastes, fashions, and preferences in the Indian middle class, coupled with rising disposable incomes has seen a new surge of branded jewellery players in the market. Credibility in the eyes of the customer has been built through the early contribution of trusted names like Tatas (Tanishq) and that has paved the way for more branded chains to follow. Like in many other sectors, it is evident that the small and local ‘family’ jeweller is going to be marginalized and will have to make way for the bigger national chains (Reliance, Kalyan, Alukkas, etc.) who can offer greater variety at various price points, more exotic choices and a greater promotional spend to ‘pull’ customers to their stores not only for big occasion spends (think weddings) but also impulsive binges (think indulgent celebrations).

The promise of growing demand from the rising tide of consumerist middle-class India has lured many Private Equity (PE) players too to this sector. They are fuelling the growth of some of the old and traditional jewellery families – two cases in point are Warburg Pincus in Kalyan Jewellers and Creador in PC Jewellers – who are even building stores overseas in the Middle East, South East Asia, etc. Apart from this is the emergence of on-line stores where major investments are being made to win and secure customers for the future.

The promise of the future is also luring many other luxe jewellery brands into India. And, with the overall improvement in the investment climate in the economy, the mining majors (DeBeers, Rio Tinto, and Gemfields) have increased their explorations in some states.

Looking ahead, while there will always be market fluctuations due to a variety of factors, what one can still safely predict is greater demand creation by all the major Gems & Jewellery players as the trio of World Gold Council (WGC), World Diamond Mark Foundation and the Platinum Guild International (PGI) will continue to fuel demand through their promotional activities. This is one sector where the luster never fades!

Article by – Jay, courtesy Empowing Times