Philip Eyam-Ozung

Principal Consulting & Coaching Executive

IN THE UNVEILING OF THE ENTREPRENEUR’S THREE-LEGGED DANCE in last month’s Edition, it was established that the three-legged Dance is a metaphor for profitable entrepreneurship which is practiced through a novel concept termed Trilateral Entrepreneurship. It was also established that the fundamental importance of Trilateral Entrepreneurship is underscored by the conclusive evidence that entrepreneurship ultimately rises and falls on profit-making capability. Furthermore, it was established that Trilateral Entrepreneurship facilitates profit-making by targeting and tapping operating, financing and investing activities as the most important profit-impacting groups of business activities. Whenever profit-making is the end-goal, Trilateral Entrepreneurship is applicable to all businesses and all sizes of enterprises playing in all industries and markets. Predictably, Trilateral Entrepreneurship is multidimensional and its three dimensions include: Operating activities entrepreneurship Financing activities entrepreneurship and Investing activities entrepreneurship The three-dimensional focus of Trilateral Entrepreneurship is influenced by the recognition of the fact that quite often, businesses fail primarily because may entrepreneurs tend to maintain a narrow focus on the quality of their core products and services instead of maintaining a broad focus on their products and services and the financial and investment mechanisms that make the development and delivery of those products and services possible! Therefore, Trilateral Entrepreneurship challenges entrepreneurs to broaden their business horizon especially by extending their ownership beyond their core products and services to include the financial and investment mechanisms which enable them to design, develop and deliver their products and services to market on a profitable and sustainable basis. This challenge is especially important because the reality is that every business uses money as the sole means of procuring and processing business inputs into marketable product and service outputs that are sold to earn revenue and profits! There is overwhelming evidence that not a few entrepreneurs who are guilty of being more focused on their core products and services and less on the financial and investment mechanisms that are used to support their businesses have operated for reasonably long periods of time before discovering that though they may have been both achieving their sales targets and growing their customer base, they were doing so a loss!

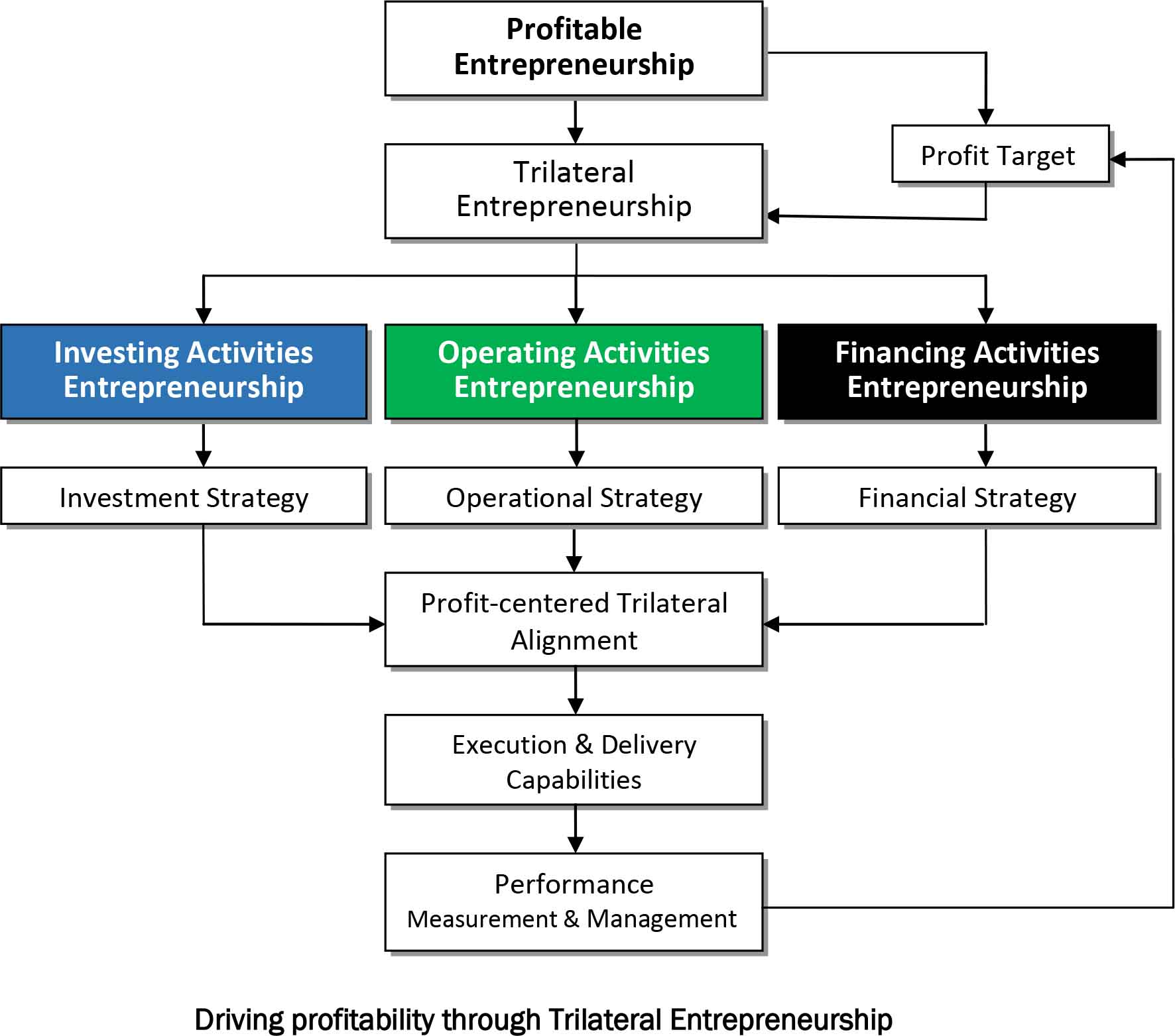

One of the invaluable lessons that Trilateral Entrepreneurship teaches is that the conscious or unconscious choice that an entrepreneur makes between maintaining a narrow focus on his core product or service and maintaining a broad focus on his core product or service and the financial and investment mechanisms that he uses to support the design, development and delivery of his core product or service on a profitable and sustainable basis is what fundamentally determines his ability or inability to operate profitably. The crux of this lesson is that the mismatch (or lack of alignment) between the operating, investing and financing activities of a business is the biggest threat to its profitability. The mismatch between operating, financing and investing activities poses such a big threat to business profitability because it can easily trigger a chain of operational, financial and investment risks that an entrepreneur may be ill-equipped to deal with at a go! The key to ensuring the voidance of the mismatch between operating, financing and investing activities which poses the biggest threat to business profitability is to learn how to drive profitability through Trilateral Entrepreneurship as shown in the graphic below.

The summary of the Big Story that the Trilateral Entrepreneurship graphic tells is simply that after taking courses and/or building distinctive experience in business plan writing, business analytics, business modeling, business strategy, product development, technology and innovation, finance and investment as well as marketing and customer relationship management, the key to profitable entrepreneurship is to channel all the lessons learnt and the experience built across these key result areas of business into the practice of Trilateral Entrepreneurship. As a matter of fact, it can be argued that no matter the number of high-value business and entrepreneurship courses that an aspiring Entrepreneur takes and no matter the length of industry experience that he builds, if such courses and experience are not supported with sufficient grounding in the disciplines and sustained practice of Trilateral Entrepreneurship, profitability will remain elusive. Understanding the impact of entrepreneurial disciplines on Trilateral Entrepreneurship The entrenchment of key entrepreneurial disciplines is one of the key requirements for the successful practice of Trilateral Entrepreneurship. As a matter of fact, the articulation of the operating, financing and investing strategies that are used to drive Trilateral Entrepreneurship requires good understanding of how operating, financing and investing activities are impacted by the four most important entrepreneurial disciplines which include: Ownership Personal sacrifice The willingness to go the extra mile and Innovation The evidence is that Trilateral Entrepreneurship succeeds best when it is undertaken by an Entrepreneur who can demonstrate the ability to consistently think and act as an owner who is committed to supporting his business acumen with the highest degree of personal sacrifice, the willingness to go the extra mile to secure the best interest of his business and the continuous search for new and better ways of improving the profitability and sustainability of his business! The practice of Trilateral Entrepreneurship is greatly-helped by the understanding that: 1. Ownership impacts all dimensions of entrepreneurship by encouraging long-term focus, insistence on the consistent use of high quality business input to create and deliver high quality products and services through high quality processes and the commitment to always act in the best interest of the business 2. Innovative business approaches impact operating activities by increasing operational efficiency, boosting lead times and lowering operating cost. Improved operational efficiency and lower operating cost in turn improve the financial activities of a business by increasing profit margins especially by reducing both production cost and keeping borrowing to the barest minimum. Innovation also impacts investing activities by generating new investment opportunities such as investment in the development of new technologies or new manufacturing processes or a new drug

3. Personal sacrifice impacts financing activities by encouraging delayed gratification which facilitates the re-investment of profits in the business. Personal sacrifice also impacts financing activities by making business owners and employees willing to give more to the business than they are taking out of it especially when the main consideration for such sacrifices is to support either the growth of the business or its recovery from any unusual event that threatens its earnings and/or going concern and 4. The impact of the willingness to go the extra impacts operating activities especially in terms of dealing with difficult customers, solving problems that occur outside business hours and responding to contingencies. There is a lot of competitive mileage to be gained through the willingness to go beyond the point where the vast majority of peer businesses and competitors are stopping! The impact of ownership, innovation, personal sacrifice and the willingness to go the extra mile is most needed to achieve and sustain profit-centered trilateral alignment between operating, financing and investing activities. The crux of Trilateral Entrepreneurship The crux of Trilateral Entrepreneurship is to develop and retain a three-dimensional view of business that is influenced by the understanding that there is a big world of difference between developing and delivering highly-innovative and value-adding products and services and doing so profitably and sustainably. The fundamental logic of Trilateral Entrepreneurship is that though innovation and value-addition are key requirements for business success, they can only act as critical success factors on the basis of their profitability. The key to business profitability is to develop distinctive operating activities, financing activities and investing activities entrepreneurship and the ability to maximize the profit-centered alignment between them. The BIG CHALLENGE of Trilateral Entrepreneurship is to find answers to the following BIG QUESTIONS: What are the fundamentals of operating activities entrepreneurship? What are the key drivers of operating activities profitability? What are the fundamentals of financing activities entrepreneurship? What are the key drivers of financing activities profitability? What are the fundamentals of investing activities entrepreneurship? What are the key drivers of investing activities profitability? These big questions are best answered within the ambit of profit-centered trilateral alignment between operating, financing and investing activities-this mainly involves using identified orderwinning criteria (or competitive edge factors) to align business goals (competitive product/service development & delivery, production/service cost, product/service pricing, profit margins, growth), resources (human, material, financial), processes (strategic, operational and enabling) and key production/service timelines.