Trading in equities on the Nigerian Stock Exchange is already half way gone. While investors, analysts and casual observers must now be anxiously looking forward to what the final indices, including the All-Share Index (ASI), the NSE 30, as well as the different sectoral indices, will post at the close of trading on Friday, analysts at Lead Capital had made a buy call to investors on five stocks, before the market opened on Monday.

The stocks, four in the banking sector and one in the technology sector, appear to have received reasonable investor interest in the first three days of the week, going by the results of trading activities that were released on Monday, Tuesday and today (Wednesday). It is not clear, though, if investors had taken a heed to the by recommendation of the analysts, but it sure would be interesting to see what happened when the week comes to an end on Friday.

The buy recommendations were made on the stocks of Zenith Bank, MTN Nigeria, United Bank for Africa (UBA), FBN Holdings, which has First Bank Limited under its belt; and Guaranty Trust Bank. So, far, all of these stocks have featured in the top volume and top value traded stocks in since Monday, again suggestive of investors heeding the analysts’ recommendation.

Serious analysts often make their ‘buy’ or ‘sell’ recommendations based on certain financial modelling, some of which are sometimes proprietary (so do not expect all analysts to come up with similar recommendations all the time), but those based on financial indices and economic fundamentals tend to work across the board as the numbers used to reach a recommendation are basically the same; except, perhaps, you run into voodoo analysts making voodoo recommendations.

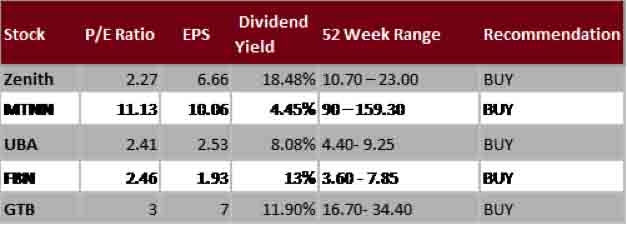

For this week, here’s what Lead Capital analysts had to say about the five stocks, Zenith, MTN, UBA, FBNH, and GTB, for which they stuck their necks out advising investors to make a ‘buy’ order to their brokers, should they be participating in the market this week.

Zenith Bank:(CP:N15.05) With a moderate growth in its first quarter earnings by 0.6% and stellar performances over the years, Zenith Banks remains a buy recommendation for investors. Asset quality remains strong with an NPL ratio of 4.3%, and we do not expect a significant depreciation in near term, as its loan books have been diversified to reduce exposure to high risk sectors i.e. oil and gas sector to 14.6%.

However, we expect growth to be pressured this year, due to the outbreak of COVID 19, but with a CAR of 20%, liquidity of 41.8% and sustained cost efficiency, Zenith Bank would still remain in good standing.

MTNN: (CP: N111.60) MTNN continues to remain the market leader in the telecommunications sector, accounting for 38.47% of the market share. Its first quarter earnings were impressive, with 5.6% growth in the bottom line, on the back of revenue from voice (6.14%) and significant growth in the data subscription (59%).

Consequent to the outbreak of the pandemic, we expect a significant growth in profit in the next quarter, on the back of increase in revenue from voice and data subscription.

UBA:(CP: N6.20) United Bank for Africa remains one of the fundamentally sound banks in Nigeria with strong branch network within Nigeria and its presence in some Africa countries, the UK, USA and France. It recently released its Q1’20 result, as the bank recorded double-digit improvement across all its major income lines. Consequently, the bank grew its gross earnings by 11.8% year-on-year growth to N147.2 billion as against N131.7 billion recorded in Q1’19. The bank’s total assets and shareholders’ funds also advanced by 13.4% and 2.46% respectively, to N6.4 trillion and N612.6bn in the period under review, compared to N5.6 trillion and N597.9 billion recorded in Q1’19. The bank’s PBT and PAT climbed 8.5% and 5% respectively to N32.7 billion and N30.1 billion, it also sustained strong profitability, recording an annualized 20% Return on Average Equity. UBA remains a BUY with Target Price of N12.90

FBNH: (CP: N4.70) We maintain our BUY recommendation for FBN Holdings with Target Price of N8.65, following a positive set of Q1’20 results, with 47% year-on-year and 6% quarter on quarter increase in net profit. Fundamentally, the bank, which represents a strong portion of the holding company, has shown recovering NPL levels in its recent earning filings. We foresee value over the medium to long term.

GUARANTY:(CP: N21:00) GTB’s Q1’20 earnings grew modestly with PAT growing only 1.55% year-on-year to N112.86 billion and 8% growth in assets respectively. Although, we expect a slower growth in EPS over the next quarter. Given its stronger capitalization level and higher operational efficiency, the bank remains the toast of investors across investment horizon and orientation spectrum. GUARANTY remains a buy recommendation, on the back of strong performance over the past years, sustained growth alongside remarkable cost efficiency.