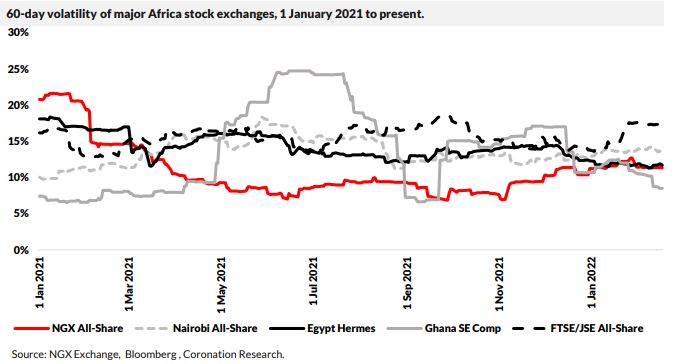

It has now been established that the Nigerian Exchange (NGX) is one of five least volatile exchanges in Africa with the list of floated equities now or then witnessing oscillations in prices, while market participants in like manner have always stayed calm, rational, maintaining a long-term horizon in their investments.

A recent research publication by Coronation Research on the five most volatile markets in Africa shows that the Nigerian equities exchange is the least volatile exchange across the continent after the all-share index beat the overall index.

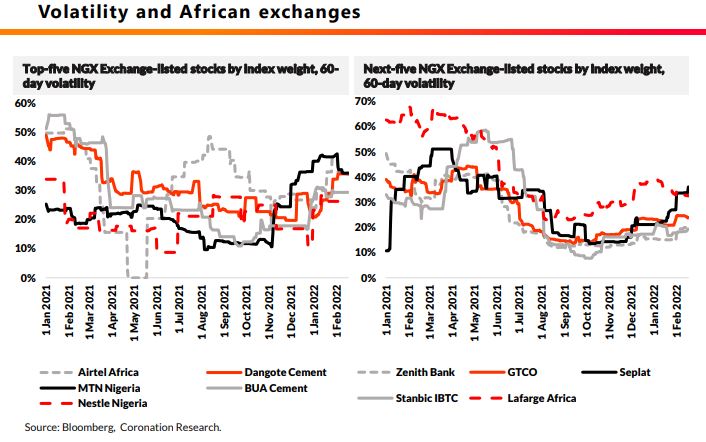

The research found that while the NGX All-Share Index exhibits a degree of volatility, taken in isolation, it has been the least volatile of the African exchanges under examination. It adds that 10 index heavyweight stocks constitute over 78 percent of the NGX Exchange All-Share Index, suggesting high volatility for the index overall.

For weeks now, there have been observations of significant trading activity in global markets following a slew of mixed corporate earnings, military tension in Europe, and expectations of interest rate hikes by central banks in efforts to combat inflation. These factors have led to elevated levels of ‘volatility’ in global indices, and have in turn, created uncertainty among market participants as to how best to manage their ‘risks’ in these times of very high volatility, they observed.

Sometimes, when the volatility of an exchange or market is mentioned to the layman, it may sound technical as a result of the understanding that an investment in equities is too high a risk to gamble on which can lead to unnecessary worry, and knee-jerk reactions climaxing in financial loss.

For simplicity, the risk is the likelihood that an investment will be unable to find value, based on a number of factors. Investments face different kinds of threats, ranging from credit risk; reinvestment risk; interest rate risk; inflation risk; operational risk, etc., which in the long run may erode value and create losses for investors. But volatility, on the other hand, refers to the fluctuations in price or how rapidly an investment changes in price over a period of time. An instance is that in highly volatile periods, investment prices swing abruptly up and down while in less volatile periods their performance is smoother and more predictable. With this brief, let’s dive into Nigerian exchange and volatility.

January on the Nigerian Exchange: A broad-based rally was witnessed in January in the local equities market as the benchmark index closed the month above the 46,000 psychological points and further leapt into February on a bullish rally with the benchmark index currently above 47,200 points at the time of writing this article. The bullish trend so far may have shown signs of the January effect, but it is without a doubt that the widespread corporate actions from companies brought about the re-ignition of risk-on sentiments amongst equity investors.

A cursory look at the stock lineup on the local bourse, ranging from the telecoms sector to the industrial goods, banking index, consumer goods and oil & gas indexes, there can be seen a degree of diversity. The report shows that the more diversified an index is by sector; the less volatile it is expected to be. By contrast, indices with strong exposure to commodity stocks are likely to be volatile.

However, it is typical to see traders favour volatile stocks so long as they are sufficiently liquid to cut their losses when prices fall. It may come as a surprise that the Nigerian bourse has been the least volatile over the past year, but it reflects the diversification by sector among its principal index weights, and its low exposure to commodity stocks.

After a cross-examination of principal stock exchanges in Africa by the Coronation Research team in their report: Nigeria versus Kenya, Egypt, Ghana and South Africa, comparison beginning from the first trading day of the year and using the 60-day average, adjudged the South African Johannesburg Stock Exchange (JSE/FTSE) all share index to be the most volatile exchange among the top five exchanges in Africa with 15.59 percent rate.

Next on the line is the Ghana Stock Exchange (GSE) all-share index. The Ghanaian bourse was the second best performing stock market in Africa, according to a report by the African Markets, after it reported a year to date return of 43.66 in 2021. But in 2022, trading activities on the bourse slowed in January with a -0.81 percent return on the index. Meanwhile, the average 60-day volatility since the start of the year printed at 14.14 percent, just marginally ahead of Nairobi Exchange (NSE) at 13.54 per cent.

The Egypt Hermes saw its indexes record collective regression to close at 11,490.45 points at the end of January, while the benchmark index declined 3.84 percent from December. This negative close was largely driven by selling pressures witnessed across some of the foreign listed stocks, as well as the lacklustre sentiments of investor confidence from tax imposition of capital gains tax.

In computing the 60-day average for the volatility of the top 10 listed equities using the index weight, the findings show that Lafarge Africa is the most volatile stock and that Nestle Nigeria has experienced the least volatility since January 2021. While it may be understandable as to why traders prefer Lafarge Africa, Airtel Africa and Dangote Cement, than Nestle Nigeria, BUA Foods and banking stocks such as Zenith Bank, Guaranty Trust Holding Company, Stanbic IBTC (at least in 2021), it is also good to know that their share prices in the market have been relatively stable over the review period.

Where market participants adversely and collectively react to volatility, traders and investors can create a contagion effect, which ultimately increases the risk. However, Coronation analysts further explained that an investment’s price could fluctuate wildly, largely driven by the market’s perception of what the value is over a short period of time.

“We say a short period of time because, more often than not, factors like significant company news, i.e., quarterly earnings reports, potential merger and acquisitions as well as external factors like government policy, industry landscape changes, change in credit rating – not to mention investor sentiment – can bring about these sudden fluctuations in prices, even though the underlying value remains steady over the long term,” they noted.

Meanwhile, the high volatility witnessed in Dangote Cement does not really translate to high risk on the stock given its long-term earnings growth and dividend payments. Investors in such companies benefit from maintaining long-term investment objectives, in the view of Coronation Research analysts, so as to obtain the benefits of share price appreciation and dividend payments. Volatility can be a distraction.