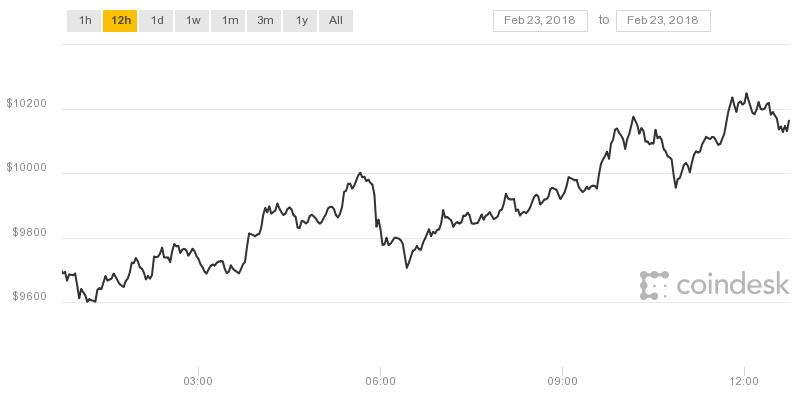

Bitcoin, the world’s number 1 cryptocurrency fell below $10,000 after nearly reaching $12,000. According to Coindesk, it reached $9,604.84 as of 06:00 am (GMT) following a report by the Bank of America that cryptocurrency could represent a substantial threat to its business in its annual filing with the SEC.

A global investment craze over bitcoin and other cryptocurrencies in the last year have seen wild gyrations in their valuations, making fortunes for some investors, while costing others a fortune.

Bitcoin, the best known virtual currency, lost over half its value earlier this year after surging more than 1,300 percent in 2017.

In New York, another government official has offered his critique on cryptocurrency, MarketWatch reported.

William Dudley, the New York Federal Reserve President said that a “speculative mania” surrounds cryptocurrencies. He made the comment at a media event about Puerto Rico’s economy following the hurricanes it has faced. Only a day before, Mark Carney, Bank of England Governor had commented that bitcoin is failing as a currency.

The second largest bank in the United States by assets, BoA gives a warning that is the first of its kind for the institution, it has never in the past warned investors about technologies’ potential to be risk factors.

However, on balance, BoA only made about three references to digital currency forms in the 13,000-word filing, and crypto was far from the only threat listed. Brexit and cybercrime also made the list, and were mentioned more often.

But the mention at all, according to Financial Times reports, indicates that BoA is taking crypto seriously, past being a fad or fuel for a massive investing bubble. It may not be a likely risk to its business model — but that doesn’t mean it is not at all a risk.

The filing also noted that crypto — among other possible advances — could prove to be a costly competitor for the bank if it manages to find an audience among mainstream consumers.

“The widespread adoption of new technologies, including internet services, cryptocurrencies, and payment systems, could require substantial expenditures to modify or adapt our existing products and services,” it said.

The bank also noted that the presence of digital currency could prove to be a regulatory compliance issue for the bank, as the nature of the blockchain makes tracking bitcoin exchanges more difficult. BoA is also one of many big banks that has officially barred its customers from using their credit cards to buy digital currency — and barred clients of its Merrill Lynch brokerage unit from making bitcoin-related investments.

“It’s just our view that customers should be careful here,” Brian Moynihan, chairman, and chief executive, told reporters last month.