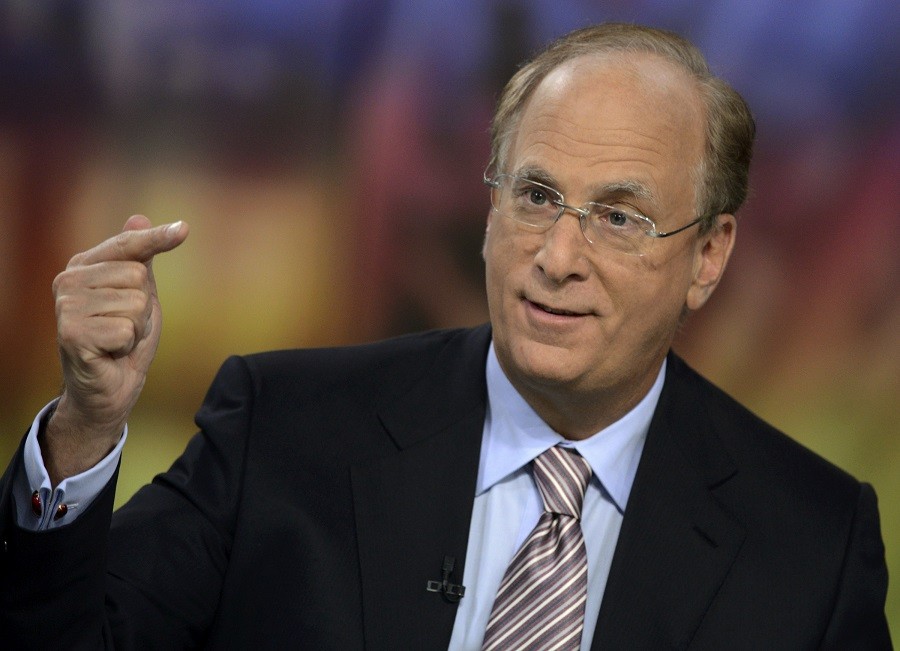

BlackRock Inc Chief Executive Larry Fink on Monday said it will be hard for the United States to reach the 3 percent annual growth target set by President Donald Trump.

Fink has repeatedly sounded a cautious note on the economy this year even as stock markets have risen, citing uncertainty over the restructuring of U.S. tax policy and other variables.

In an interview tied to BlackRock’s second-quarter earnings, Fink told Reuters that U.S. growth rates would likely be around 2 percent to 2.5 percent, echoing comments last week by Federal Reserve Chair Janet Yellen.

Meanwhile, economic prospects elsewhere in the world are on the upswing.

“The world feels very good,” Fink told Reuters from Copenhagen, where his company’s board is meeting, citing economic performance in Europe, China, Japan and Canada.

“There are still some dark clouds in the United States.”

JPMorgan Chase & Co (JPM.N) Chief Executive Jamie Dimon on Friday lashed out against political gridlock in Washington and how it is stalling growth, saying it is “almost an embarrassment being an American citizen traveling around the world.”

But Fink remains bullish on the United States, saying “we have the greatest companies in the world” and that he was “very encouraged” by the Fed’s policies.

Fink is among several executives whose advice Trump has sought since taking office through a business advisory council.

New York-based BlackRock’s assets under management jumped 16 percent to nearly $5.7 trillion, but revenue gained just 6 percent to $2.97 billion and earnings per share rose 10 percent to $5.22, or $5.24 after adjusting for non-recurring items and other charges.

That performance fell short of Wall Street analysts’ earnings per share and revenue targets, according to Reuters.