| What shaped the past week?

Global: Coming into the week, global investor focus had shifted to the latest CPI data for the United States; markets traded in a mixed manner at the start of the week, however following the release of the data on Thursday, which showed a 7.7% y/y increase in inflation, markets rallied as optimism over a softer rate hike from the U.S. Fed drove buy-side interest across global equities. Starting in the Asian region, investor confidence was also boosted by the latest developments around China’s Zero covid policy; the country announced a slight easing of COVID-related restrictions, quarantine for close contacts will be cut from seven days in a state facility to five days and three days at home. We also saw oil investors respond favorably to this development with Brent up 2.94% in today’s trading.

Likewise, across European markets, the positive sentiment stemming from the U.S. CPI release filtered into the region, as markets rallied during their Thursday and Friday sessions. However, the latest economic data out of region suggests that the broader European economy remains under pressure; the United Kingdom’s GDP fell 0.2% in Q3’22, while inflation in the region’s largest economy, Germany, rose to 10.4% y/y.

Finally, in the United States where focus was on the nation’s midterm elections and the CPI release, the Republican Party is in position to sweep both the House of Representatives and the Senate; this would come as a blow to President Biden in the run up to the 2024 U.S. Presidential Election. Meanwhile, following the release of a better-than-expected inflation print, markets in the region railed, with investors favoring tech stocks.

For the week, the Hang Seng Index was the best performer across global markets, rising 7.21%, fueled by a 7.74% rally in Friday’s session. Likewise, in the Asian region, the Nikkei-225 and Shanghai Composite rose 3.91% and 0.54% w/w; the markets climbed 2.98% and 1.69% respectively on Friday. Across Europe, the German DAX rose 5.44% w/w, while the French CAC and Swiss SMI gained 2.66% and 3.14% respectively. Finally, across the U.S. the Nasdaq was the top performer up 6.90% w/w at time of publishing, driven by a 7.49% rally in Thursday’s session.

Domestic Economy: According to the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), crude oil production (excluding condensates) averaged 1.01 million bpd in October. This represents a 76,000 bpd increase over September’22 output but remains below OPEC’s 1.8 million bpd allocation. Total oil production, including condensates, reached 1.23 million bpd, the highest level since July. The increased oil output is primarily due to the resumption of oil production via the Trans-Forcados terminal. Oil output from the country’s largest oil facility increased by 18 times m/m in October. We attribute the improvement to the pipeline surveillance contract awarded to Tompolo. Given the current high oil prices, continued improvement in output levels could help boost crude export earnings and the CBN’s ability to defend the Naira. Already, we are seeing retracements in the parallel market as reduced demand volatility resulted in a 19% w/w appreciation in the Naira. This supports our medium term outlook that an imminent rebound in the production could serve as a tailwind for the Naira. Nevertheless, the downturn in external reserves could be a worry in the near term.

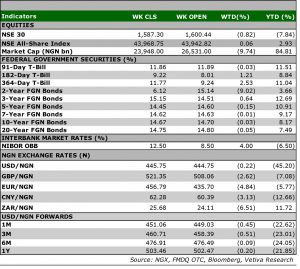

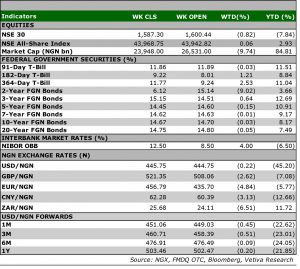

Equities: Nigerian equities closed marginally higher, rising 0.06% w/w, as buy-side momentum in the banking space propped up the broader market. The Banking sector was the only sector to close in the green, rising 0.17% w/w, due to interest in the likes of UBA (+2.86% w/w), ACCESSCORP (+1.26% w/w), and FBNH (+3.54% w/w). On the other hand, all other sectors closed in the red, with the Consumer Goods sector being the worst performer; the space sank 1.95% w/w, as losses in GUINESSS (-9.95% w/w) dragged the sector’s performance. Likewise, the Industrial Goods sector fell 0.29% w/w, due to a 0.62% loss recorded in DANGEM. Finally, across the Oil and Gas space, losses in SEPLAT (-1.01% w/w) and players in the oil marketing space, translated to a 0.74% w/w loss for the sector.

Fixed Income: Amidst robust system liquidity throughout the week, the fixed income market traded in a positive manner during the week; across the NTB space, investors reacted to the latest NTB auction results, where stop yields offered at the long end were marginally lower than rates offered at the previous auction. Yields eased 31bps on average, fueled by renewed interest at the mid-end of the NTB space. Meanwhile, bond yields closed marginally higher w/w, as investors sought to position themselves ahead of the upcoming bond auction.

Currency: The Naira depreciated ₦0.22 w/w at the I&E FX Window to ₦445.75.

| What will shape markets in the coming week?

Equity market: Market sentiment was positive today with only 7 counters closing the day in the red, amid reduced activity level. However, we are likely to see market trend sideways at the start of trading next week.

Fixed Income: We expect to see a quiet session across the market as focus shifts to the bond auction; meanwhile, system liquidity will drive activity across the NTB segment of the market.

Capital Market Update – Central bankers raise rates as inflationary pressures persist

It was a week of rate hikes from key central banks around the world, as monetary officials continue the fight to tame inflation in their respective economies.

With inflation across these economies expected to remain elevated due to a multitude of factors, such as the ongoing Russia-Ukraine conflict, global monetary conditions should remain tight as central banks seek to drag inflation into their respective target bands.

Eastern Europe conflict remains a risk to the fight against inflation

The ongoing Russia-Ukraine conflict remains a headwind to the taming of inflationary pressures, given its impact on global food prices. In July, a U.N. backed deal was brokered between Russia and Ukraine, to allow grain, oil, and other food shipments to pass through the Black Sea, with Russian ships guarding the shipping lanes. As the reduction of food supply pressures remains the top priority in bringing down global inflation, maintaining exports from the region would help counter inflationary pressures across the globe, and support calls for central banks to relax their hawkish stance.

Nations sell USD reserves to defend currencies

On the back of rate hikes from the U.S. Fed, the Dollar index, which measures the strength of the dollar against a basket of eight major currencies, has surged this year due to investors fleeing to safety. The Japanese Yen has been hit hard this year, driven not only by a stronger Dollar, but also due to divergence in monetary policy between the U.S. Fed and the Bank of Japan. In response to the Yen slump, fiscal authorities have intervened on several occasions in the FX market to quell the slide in the currency.

Additionally, the dollar strength, coupled with inflationary pressures, has translated to higher commodity prices, making raw materials and commodity-based imports more expensive. Given that the U.S. Dollar remains the preferred currency of trade between nations and businesses, we expect a surging dollar to weigh on global trade, in turn dragging growth prospects. Looking at the Drewry World Container Index, which tracks the freight costs of 40-foot container via eight major routes, global container rates have been falling since the first U.S. Fed rate hike; container rates are down 67% y/y. What this indicates is that some USD-indebted foreign borrowers are experiencing USD shortages to service their debt, due to higher interest payments and as a result, this has weighed on global trade activity.

Global outlook – Expect further rate hikes, rise in recession concerns |

Central banks are determined to maintain a restrictive environment as they look to tame inflation. The European Central Bank (ECB) has been quite aggressive in its fight to tame inflationary pressures in the region, hiking rates by 200bps in just three months. Looking forward, we expect interest rates to rise further, given that inflation is expected to remain elevated in the near term as pressures persist. Additionally, statements from central bank officials in advanced economies, suggest that they would push rates higher as they seek to bring inflation within their respective target bands, with the unanimous choice being at 2%, although a continually restrictive environment may raise the prospects of a global recession. |