What shaped the past week?

Global: Global investors remain risk averse across global equities markets as trading activity was largely mixed this week. While some markets recorded gains this week, notably the Shanghai Composite rose 2.76% w/w, overall sentiment in the Asian region remained bearish, weighed down by ongoing COVID-induced restrictions in China and the ongoing Russian-Ukraine conflict. The Japanese Nikkei-225, Hong Kong Hang Seng Index, and the South Korean Kospi Composite all closed in the red, easing 2.13%, 0.52%, and 1.52% w/w respectively. Global uncertainties caused primarily by the Russian-Ukraine crisis, as well as the slowdown in activity in China, will continue to weigh on investors’ risk appetite across the global equities space. Moving to Europe, investor focus shifted to the latest production numbers for the Eurozone, as well as on the latest Q1’22 financial reports out of the region. Germany-based Deutsche Telekom AG saw its net revenue for the period come in at €28.02 billion, an increase of 6.2% year on year while net profit rose to €3.9 billion from €3.0 billion in the same period. The positive performance boosted sentiment in the German market, with the DAX rising 2.39%, supported by recorded in Deutsche Telekom AG, which rose 5.99% w/w. Finally, across U.S. markets growth stocks continue to see capital deprecations in their valuations, as investors react to the latest interest rate hike from the U.S. FED, in addition to inflation data for April. U.S. inflation moderated to 8.3% y/y in April, well above economic forecasts of 8.1%. At time of writing, the tech-heavy NASDAQ Composite was down 3.07% w/w, with the Dow Jones and S&P 500 down 2.11% and 2.50% w/w.

Domestic Economy: The Independent Petroleum Marketers Association of Nigeria (IPMAN) has warned that the refusal of relevant agencies to pay outstanding debts could lead to another fuel crisis. Should this risk crystallize, a new wave of fuel scarcity could worsen inflationary outcomes as consumers bite under the impact of high PMS and diesel prices. We believe this risk could counter the soothing effects of border re-opening.

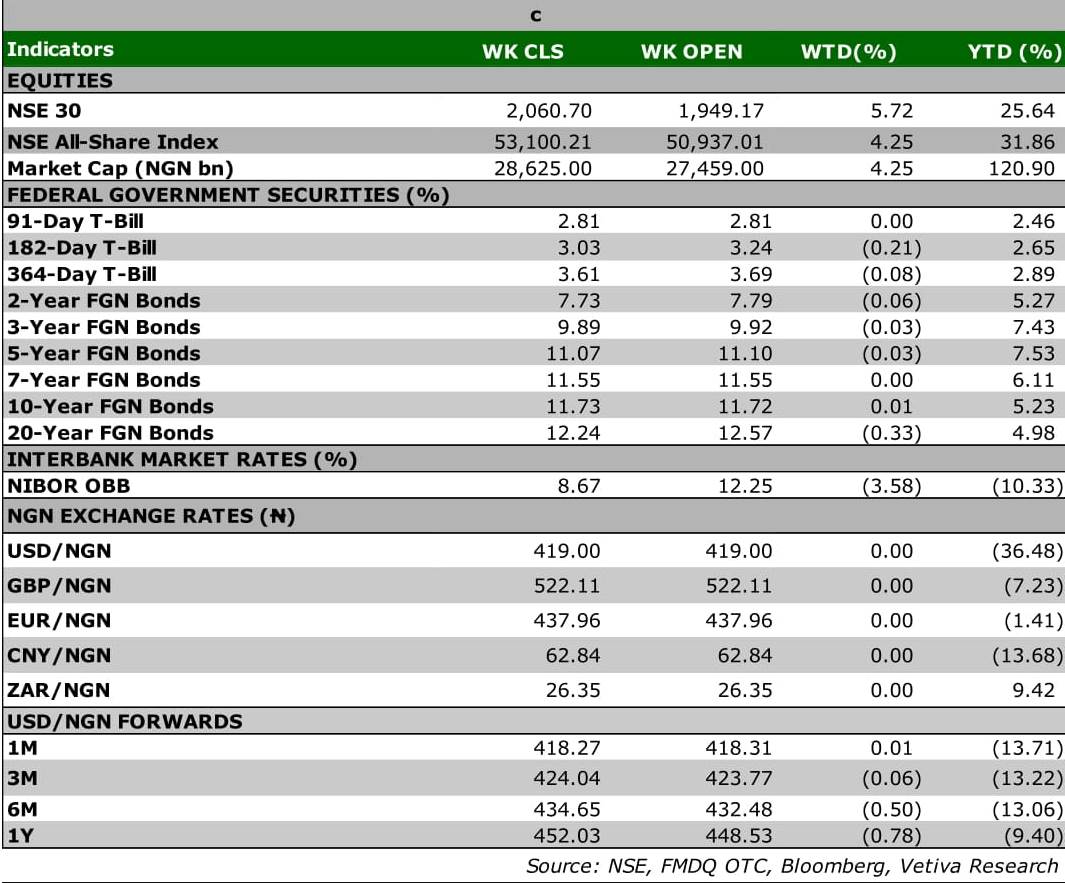

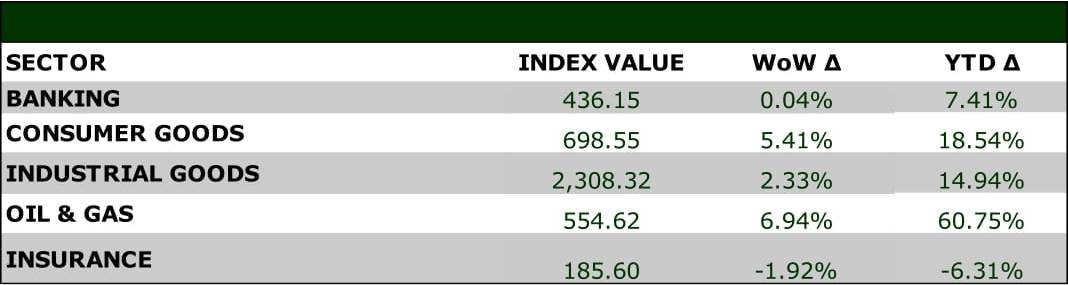

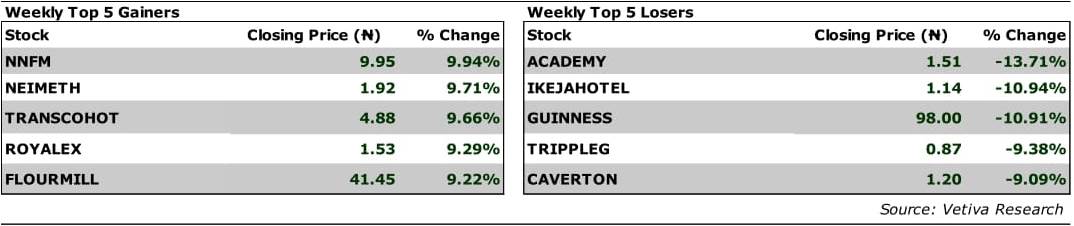

Equities: Nigerian equities extended last’s week positive performance into this week, as broad-based gains across key sectors pushed the NGX Index higher. The market gained 4.25% w/w, as investors remain bullish on the Consumer Goods and Oil and Gas sector. Starting in the Consumer Goods space, expectation of easing food and core inflation, continues to fuel buy-side action in the sector as it gained 5.41%; the sector has been the best performer so far in May, up 13.01% YTD. Its weekly performance was driven by widespread gains in the sector, with DANGSUGAR, FLOURMILL, and the VETGOODS ETF rising 6.79%, 20.14%, and 5.75% w/w respectively. Moving to the Oil and Gas space, SEPLAT continues to set new all-time highs rising 8.33% to settle at ₦1,300; the stock’s fungibility as well as elevated crude prices continue to push its valuation higher. Additionally, oil marketers continue to post impressive gains, with ARDOVA rising 10.14% w/w; the counter is up 29.91% YTD. Likewise, in the Industrial Goods space, Lafarge Africa (NGX: WAPCO) continues to enjoy strong investor patronage, as the cement maker stock rose 14.18% w/w to settle at ₦31.4. It has been an impressive year for the counter, as it has returned 30.80% YTD. Finally, in the Banking sector gains in the small-mid cap players saw the sector rise 0.04% w/w.

Fixed Income: The fixed income market traded largely bullish this week, with yields trending downwards across all three segments of the secondary market. For the bonds space, the yield on benchmark bonds eased 5bps on average, driven by buy-side activity at the short-end of the market. Similarly, the NTB saw demand at the midpoint of the curve consequently average yield declined 15bps. Finally, in the space yields declined 7bps on average, driven by buy-side activity at the short end of the market.

Currency: The Naira depreciated by ₦2.00 at the I&E FX Window to close at ₦419.00.

What will shape markets in the coming week?

Equity market: Given the sustained buy-side activity seen throughout this week, coupled with the possibility of the CBN raising rates at next week’s MPC meeting, we anticipate a quiet start to the week, as investors remain on the sidelines in anticipation of the Monetary Policy Decision before committing further to equities.

Fixed Income: To open the week, we expect the bonds market to trade on a muted note, as investors await the PMA. Similarly, we anticipate tepid trading in the NTB segment as players await the outcome of the MPC meeting for rate direction.

Currency: We expect the naira to remain largely stable across the various windows of the currency space as the CBN maintains interventions in the FX market.

CAPITAL MARKETS REVIEW AND OUTLOOK

U.S. Fed raises rates – how we got here, and what comes next

The outbreak of the novel coronavirus (COVID-19) brought the global economy to a screeching halt with the Great Lockdown of 2020. To shield their economies from the socio-economic impact of the COVID induced lockdown, advanced economies around the world injected $10 trillion dollars into the global financial system. Through various instruments, global central banks such as the Bank of England (BOE), Federal Reserve of the United States (FED), European Central Bank (ECB) and the Bank of Japan (BOE) injected this liquidity into the market in under three months. In comparison, $12 trillion dollars had been injected into the global financial system since the 2008-09 financial crisis.

Given the nature of advanced economies, the aim of the stimulus program was to jumpstart consumer spending so that the economies could recover. However, the stimulus program has failed to have the desired effect and consumer sentiment in the global economy remains tepid at best. Additionally, the latest consumer surveys suggest that consumer spending is yet to return to pre-pandemic levels, as inflation weighs on volume growth.

The stimulus response from central bankers seems to have created a bubble in the global financial system and is a key driver behind the runaway inflation being observed across the globe. The pace at which money was injected into the global financial system was the first of its kind. To combat rising inflation, monetary officials across advanced economies raised policy rates despite a fragile economic recovery.

Rising rates in advanced economies will lead to capital outflows from developing economies like Nigeria. This will add increasing pressure to a fragile economy that is grappling with low foreign exchange receipts and double-digit inflation. A rise in U.S. interest rates through monetary policy will lift long-term US domestic interest rates and increase borrowing costs for countries with lower grade credit ratings like Nigeria. Ultimately, capital flows out of the country will see the Naira weaken against the U.S. dollar.

If the dollar keeps gaining strength (as is expected), we could see another devaluation of the Naira by the Central Bank (CBN) as the currency becomes weaker due to a stronger USD. With further rate hikes expected from the U.S Federal Reserve, we can expect the demand for USD to rise. We expect this to result in an increase in the NGN/USD rate as the domestic policy rate remains unchanged at 11.50%.

For government spending, when interest rates rise, we should expect to see capital outflows from an emerging economy like Nigeria, as investors will seek risk-free safety over the risk premium that comes from investing in emerging markets. Additionally, higher interest rates will drive up the debt servicing costs on foreign denominated debt, as higher rates will lead to a strong U.S. dollar.

Whilst reasonable care has been taken in preparing this document to ensure the accuracy of facts stated herein and that the ratings, forecasts, estimates and opinions also contained herein are objective, reasonable and fair, no responsibility or liability is accepted either by Vetiva Capital Management Limited or any of its employees for any error of fact or opinion expressed herein.