CASSAVA, WITH ITS derivative products, is a very important crop that typically fits into the class of food security crops. This report examines the importance of cassava to the society, its origin, production, processing, local application, industrial application and exports.

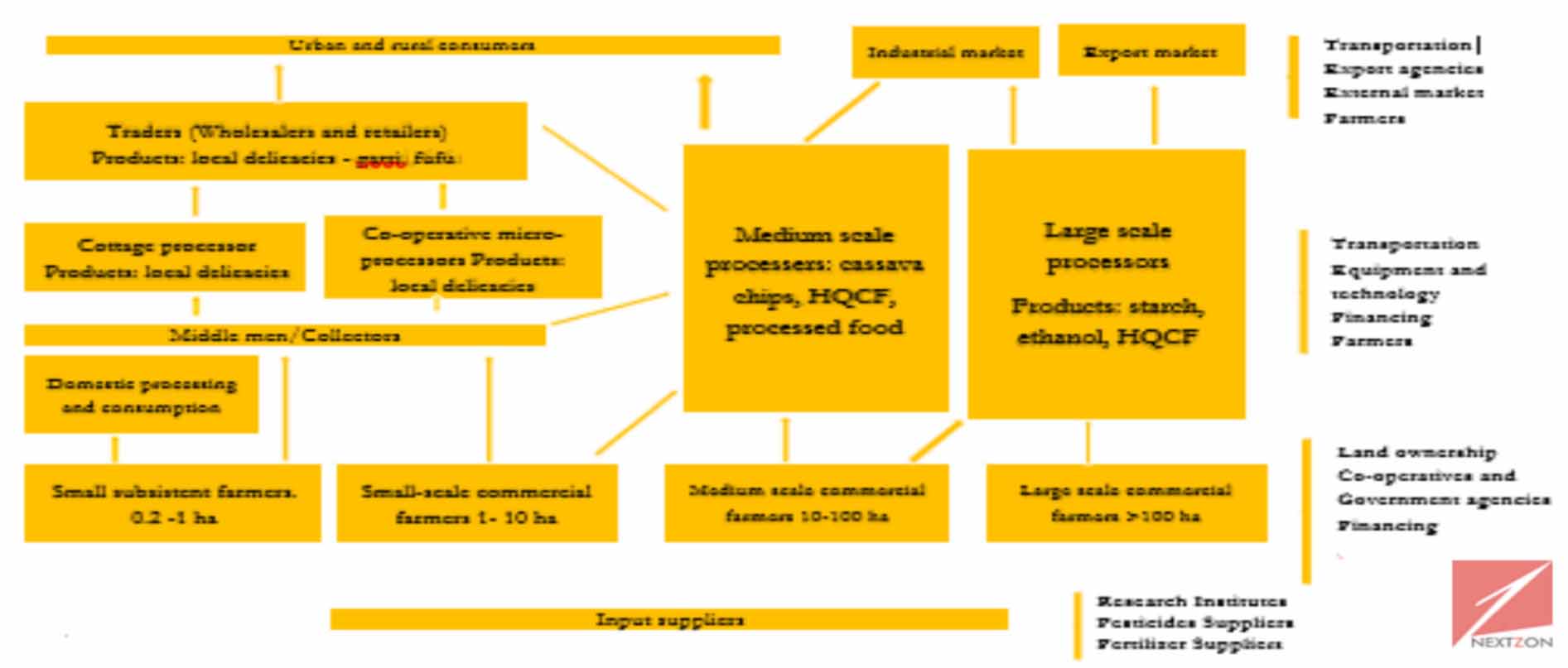

The Cassava value chain in Nigeria is dominated by smallholder farmers to cooperative society producers. It is predominantly grown in the Southern and few of the North Central states, with Delta state being the largest producer in Nigeria. Processors in the chain generally have low-capacity because of lack of investment, bad roads and poor power supply, crude processing methods, education and expertise. Up to 80% of the Cassava produced in Nigeria is used for food, leaving only a small room for exports. The value-chain, from farming to processing for industrial application, will therefore require a strategy that would expand the scope and scale of production to produce at lower cost per unit in order to position for global demand.

Currently, Cassava is mainly produced in Nigeria, Thailand, Indonesia and Brazil. Of the 268million tons produced in 2014, these four largest-producing countries collectively churned out about 50% of the world annual output in that year. Nigeria (54 million tonnes) was the highest producer at 20%, followed by Thailand, Indonesia and Brazil. Less than 20% of the Nigerian annual output is available for export.

Global Demand

Global demand for Cassava products (Flour, Starch, Ethanol, Chips & pellets) runs into several billions of dollars in transaction value with China leading the demand pack at 60% of total imports. Other import destinations could be found in North America, Europe and so on. The local demand value for cassava is projected to hit over $8 Billion in 2022 while global value for exports was put at $51Billion as at 2013.

Cassava applications

Cassava industry is still very attractive, both locally and globally. Cassava has both traditional and industrial application. Traditionally, it is consumed as food in form of fufu or further processed into garri for consumption. The industrial application for cassava includes production of starch, high quality cassava flour (HQCF), ethanol, cassava chips and dried pellets.

In Nigeria, Cassava is playing a major role in economic restructuring through local imports substitution for wheat used in baking bread. There is also large importation of processed starch which are sold by various supermarkets, as well as ethanol and other cassava derivatives into Nigeria. These are opportunities for local investments.

The table below shows the current demand and supply of cassava derivatives in Nigeria.

Conclusion

On the global scene, there is need for Nigeria to join the league of Tier 1 cassava exporting countries like Thailand in order to benefit from foreign exchange earnings that is globally available to traded cassava.

• The industry is largely unstructured and has low regulation (depending on the country).

• There is low concentration ratio (CR4 of about 50% for the top 4 global producers as at 2014) which means the market is very competitive. The time to act is now as only less than 20% of total global produce is traded whereas there is a huge demand gap that is currently not met.

Taking advantage of this gap will require Nigerian government to take a position on Cassava as a National product, as Thailand did, and create the enabling atmosphere for investments in production and processing to meet the local demand-supply gap as well as take advantage of the export market.

Considering that the government cannot do this alone, the private sector will need to drive investment and growth in this sector while bodies like the National Cassava Research Institute should support the industry by engaging in research and development to boost the efforts of the farmers and processors by providing them with timely and relevant information while cassava industry associations should strive to create proper interlinkages between value chain actors to avoid shortage of raw materials for processors and wastage of output for farmer.

____________________________________________________________________

Analyst Nuggets: Nextzon Research & Knowledge Unit