Western Digital group to offer $17.4 billion for Toshiba chip unit, sources say

Businessam Staff

Businessam Staff August 24, 2017

August 24, 2017

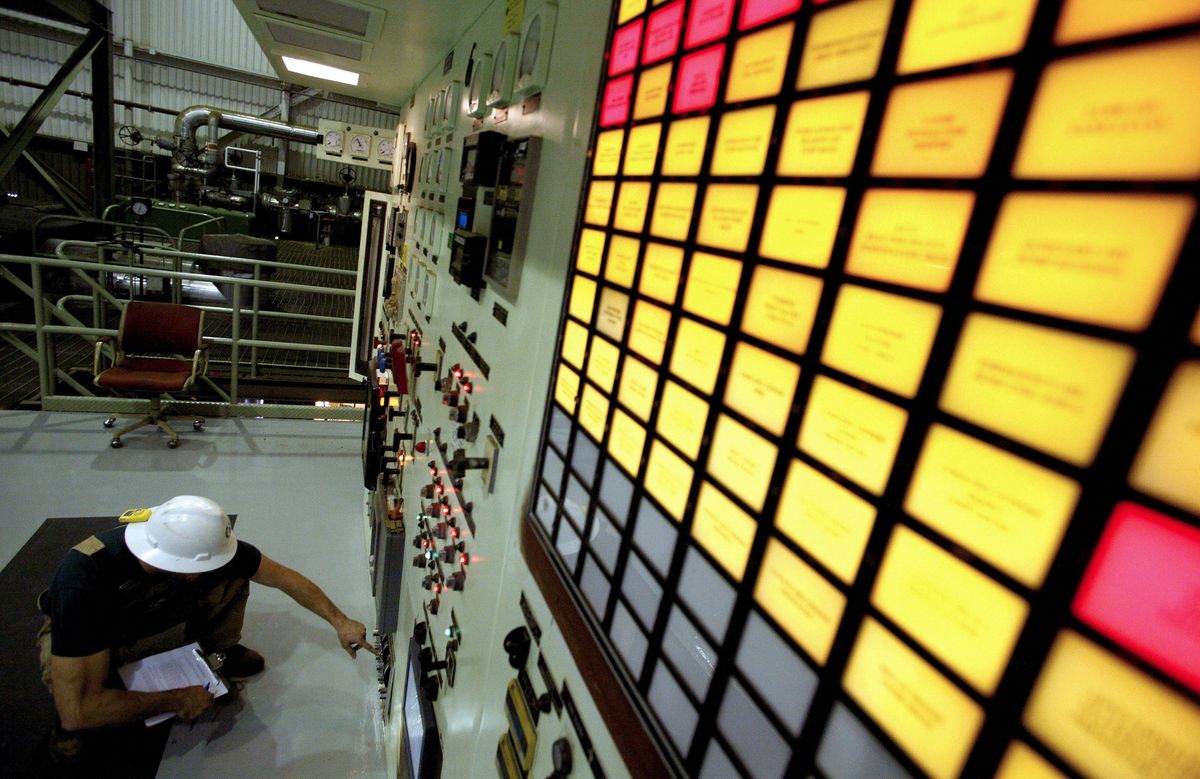

A consortium that includes Western Digital is offering 1.9 trillion yen ($17.4 billion) for Toshiba Corp’s (6502.T) memory chip business, which the Japanese conglomerate is trying to sell to cover losses from its U.S. nuclear business, sources said on Thursday. According to Reuters Western Digital is set to offer 150 billion yen through convertible bonds […]

Draghi, ECB president, defends quantitative easing, says more effective than some economists credit

Businessam Staff

Businessam Staff August 23, 2017

August 23, 2017

Mario Draghi, European Central Bank (ECB) president Wednesday defended the policy of quantitative easing bond-buying, but gave investors little clue as to future monetary policy ahead of a much-anticipated speech at Jackson Hole on Friday. Speaking in Lindau, Germany, Draghi said that quantitative easing (QE) is more effective than some economists credit because of its […]

Drowning in debt, hedge fund billionaires’ home faces budget crunch

Businessam Staff

Businessam Staff August 23, 2017

August 23, 2017

Connecticut, home to hedge fund billionaires alongside cities mired in poverty, is racing against the clock to pass a budget or face further spending cuts to education and municipal aid across the state. Nearly two months without a budget, Connecticut is getting crushed by a burdensome debt load that has squeezed spending and amplified legislative […]

U.A.E. excise tax starts in October to boost nations revenue

Businessam Staff

Businessam Staff August 22, 2017

August 22, 2017

The United Arab Emirates will start imposing a tax on selected goods starting October 1 as Gulf Arab nations seek to deepen government revenue to counter the drop in oil prices. A levy on designated goods; tobacco, energy drinks, and soft drinks, will include those sold at airports and free zones, Younis Al Khoori, Undersecretary […]

Sempra Energy to buy Oncor for $9.45 billion in blow for Berkshire

Businessam Staff

Businessam Staff August 21, 2017

August 21, 2017

Sempra Energy said it will buy Oncor for $9.45 billion in cash after Energy Future Holdings Corp, which indirectly owns Oncor, abandoned a deal to sell the power transmission company to Warren Buffett’s Berkshire Hathaway Inc. San Diego-based Sempra expects to own about 60 percent of a reorganized Energy Future after the transaction that is […]

Energy Capital, investors to buy Calpine for $5.6 billion

Businessam Staff

Businessam Staff August 18, 2017

August 18, 2017

Private equity firm Energy Capital Partners and a consortium of investors have struck a deal to buy U.S. power generator Calpine Corp. for $5.6 billion in cash. Calpine investors will get $15.25 a share as part of the deal, the Houston-based company said in a statement. The investor group was led by Access Industries and Canada Pension Plan […]

Investment philosophy popularized by Warren Buffett may make a comeback

Businessam Staff

Businessam Staff August 18, 2017

August 18, 2017

An investment strategy made popular by Warren Buffett could be back in vogue soon, according to Strategas Research Partners. In a note to clients Thursday, Strategas pointed out that returns stemming from growth investment strategies have reached a point where they could start to underperform. This opens the door for value investment strategies, which have been popularized […]

Central bank makes insurance cover mandatory for projects funded under commercial agricultural lending scheme

Businessam Staff

Businessam Staff August 17, 2017

August 17, 2017

In other to mitigate the risk faced by participating financial institutions in financing agricultural sector, Nigeria’s central bank has revised and amended guidelines of the commercial agricultural credit scheme (CACS) to include compulsory insurance cover for all agricultural facilities and projects under the scheme. In a circular to all banks dated July 15 and signed […]

South Africa’s Standard Bank lifts first-half profit by 11%

Businessam Staff

Businessam Staff August 17, 2017

August 17, 2017

Standard Bank, Africa’s No.2 lender by market value, reported an 11 percent rise in half-year profit on Thursday, as a rebound in commodity prices boosted demand for loans from clients in the oil and mining industry. Headline earnings per share (EPS) totaled 746.4 cents in the six months to June compared with 671.2 cents a […]

Elliott, activist investor Singer’s firm, pulls $33bn weight in Europe

Businessam Staff

Businessam Staff August 16, 2017

August 16, 2017

From mining to chemicals to generic drugs, billionaire Paul Singer’s investment vehicle Elliott Management Corp. is making its $33 billion presence felt in Europe this week. On Wednesday, the activist investor said it boosted its holding in the London-traded shares of BHP Billiton Ltd. to 5 percent from 4.1 percent in April, adding pressure on […]