Nigeria could benefit from new insurance cutting $29bn natural disaster bill for poor countries

Businessam Staff

Businessam Staff July 12, 2017

July 12, 2017

Nigeria could be in line to benefit from new types of insurance that are seen capable of cutting the costs of natural disasters for poorer countries and reduce the amount of humanitarian aid needed, according to a report commissioned by Britain’s international development ministry. The cost of natural disasters to some of the world’s poorest […]

Deeper probe ordered by UK regulator in Tesco, Booker proposed deal

Businessam Staff

Businessam Staff July 12, 2017

July 12, 2017

The United Kingdom’s competition regulator has ordered a deeper probe on the proposed 3.7 billion pounds ($4.75 billion) takeover by supermarket Tesco’s of wholesaler Booker. It involves a detailed investigation and been at the behest of the companies who had requested that it “fast track” the process. Tesco, Britain’s biggest retailer, and Booker announced the […]

Deutsche Bank pushes wealth management hard in Saudis’ direction

Businessam Staff

Businessam Staff July 12, 2017

July 12, 2017

Germany Deutsche Bank is said to be pushing hard towards the Middle East, targeting wealthy individuals in the Kingdom of Saudi Arabia, in wealth management, as it works to regain grounds following asset losses suffered last year over concerns about its capital levels, Bloomberg has reported. Some of the bank’s clients had left in the […]

AIICO insurance transfers assets to PTAD

Businessam Staff

Businessam Staff July 12, 2017

July 12, 2017

AIICO joins league of insurance companies to transfer assets to PTAD The American International Insurance Company Limited (AIICO) on Tuesday formally handed over and transferred landed property, private equity holding and cash as legacy funds to the Pension Transitional Arrangement Directorate (PTAD), reports the News Agency of Nigeria (NAN). Sharon Ikeazor, executive secretary of PTAD, […]

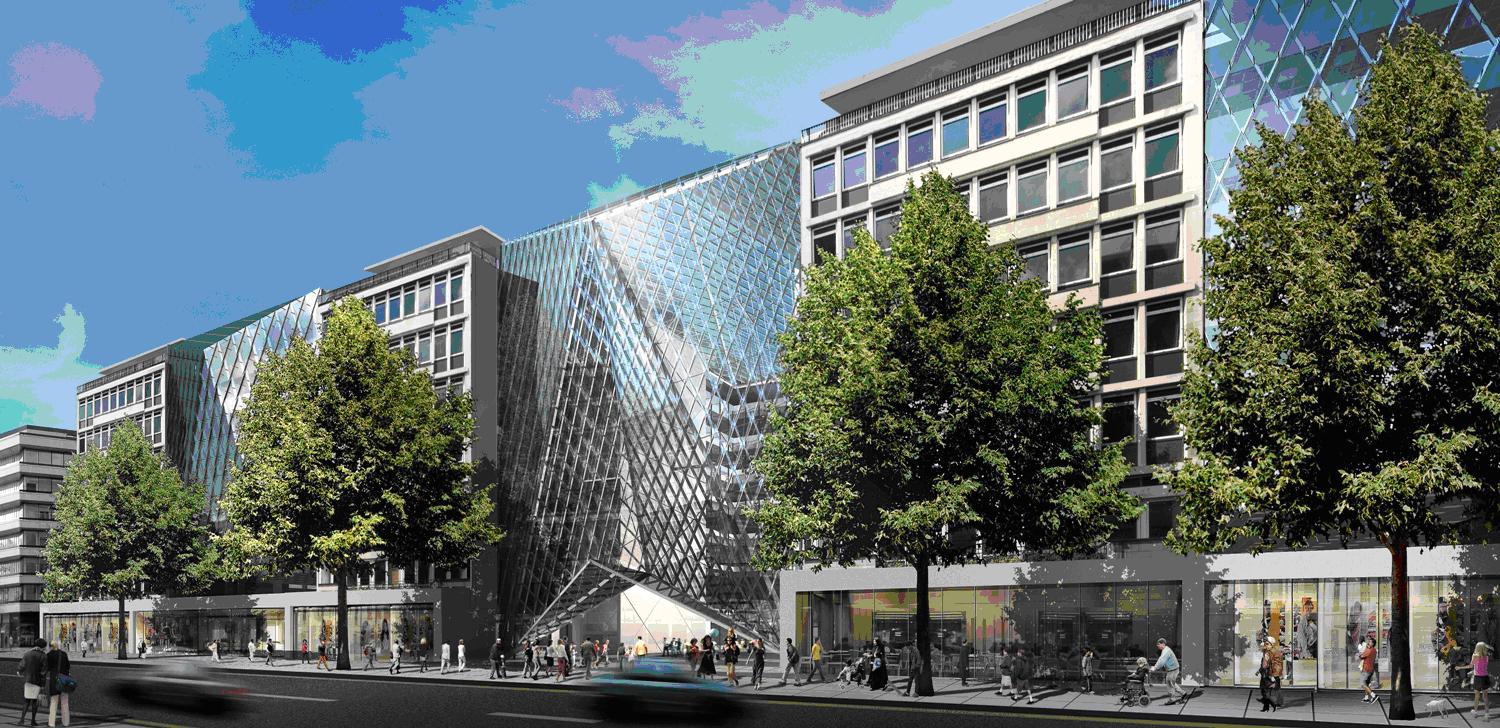

Banks begin London exodus as hopes of transitional deal fade

Businessam Staff

Businessam Staff July 12, 2017

July 12, 2017

While that is the premise of Snap Inc’s popular messaging platform, investors also saw any gains from its red-hot IPO disappear when shares plunged far below their initial sale price on Tuesday. Morgan Stanley, a lead underwriter on the company’s initial public offering, slapped a price target of $16 on the stock – a buck […]

Pearson cashes in $1 billion of its Penguin Random House stake

Businessam Staff

Businessam Staff July 11, 2017

July 11, 2017

Pearson is set to raise $1 billion from the sale of a 22 percent stake in book publisher Penguin Random House to majority owner Bertelsmann, in the British group’s latest bid to rebuild following a string of profit warnings. Hit by a sharp downturn in its biggest markets, Pearson has sold off some of its […]

Toshiba revives stalled $18bn chip business sale with Wetern Digital, Foxconn

Businessam Staff

Businessam Staff July 11, 2017

July 11, 2017

Toshiba Corp is in talks with Western Digital Corp and Taiwan’s Foxconn, as well as with an already preferred bidder, as it seeks to revive a stalled $18 billion sale of its chip business, banking sources told Reuters on Tuesday. The Japanese conglomerate confirmed it was in talks with suitors, but did not name them, […]

Elliott’s Buffet challenge on Oncor deal set at $18.5bn

Businessam Staff

Businessam Staff July 10, 2017

July 10, 2017

Elliott Management, the largest creditor of the bankrupt parent of Oncor Electric Delivery Co, said it was putting together an offer that values the utility at about $18.5 billion, including debt. Warren Buffet’s Berkshire Hathaway made a $9 billion offer Friday for Oncor’s parent, Energy Future Holdings Corp, valuing the utility at $18.1 billion. Elliott, […]

Sweden’s Volvo sells stake in engine maker Deutz

Businessam Staff

Businessam Staff July 7, 2017

July 7, 2017

Sweden’s AB Volvo said on Friday it had sold its 25 percent stake in German diesel engine maker Deutz AG as the truck maker continued to trim assets outside its core business. Volvo said in a statement that proceeds from the sale, which was carried out through a bookbuilding process, amounted to 1.9 billion Swedish […]

Investors bet on comeback: UK’s Alan Howard amasses $3 billion

Businessam Staff

Businessam Staff July 7, 2017

July 7, 2017

Investors are betting Alan Howard can reclaim his touch as a star macroeconomic trader, helping Brevan Howard Asset Management amass more than $3 billion (2.4 billion pounds) for a hedge fund he alone will control. Howard, one of Britain’s best known money managers, has raised more than $700 million from outside investors for the new […]