- Met for the 274th time on Monday in Abuja to decide key variables

- Kept all monetary policy parameters constant to evaluate current uncertainties

- Anticipates a marginal negative territory for year-end 2020, with strong recovery prospects in 2021

By Charles Abuede

The Central Bank of Nigeria (CBN), after the 274th meeting of the Monetary Policy Committee (MPC) in which it kept all its monetary parameters unchanged, has justified the expectations of financial experts and analysts who predicted that it would maintain the status quo despite the dilemma faced by the apex bank to cut rates following the monetary policy easing implemented by other central banks globally.

Analysts who spoke to Business A.M. before the Monday meeting had said the committee would hold all rates constant against the general trend by different world central banks to cut rate in a bid to boost capital investment, thus credit to the private sector and create jobs.

Both Uche Uwaleke, professor of capital markets at the Nasarawa State University, and Kalu Aja, financial planner and analyst, had told Business A.M. pre-MPC meeting, that “the status is likely to be maintained, that the MPR may not be further reduced to the inflation rate that was 12.4 per cent as of May”.

What effects could the reduction have on the economy?

Uwaleke, in his response to the attendant effect, the reduction in the MPR could have had on the economy, said “a reduction in the MPR even by 50 basis points from the current 12.5% will result in negative real interest rate, which is inimical to capital inflows from foreign investors. A reduction in the Cash Reserve Requirement (CRR) would have been ideal to free up liquidity for the deposit money banks, but the challenge will be its potentials to put more pressure on the forex market and by extension on external reserves.”

Aja, in response to questions on the attendant effect said: “If rates are cut, it could trigger more credit in the credit space and thus spark inflation, putting pressure on the naira. I think these factors will weigh up and rates may be good,, while left alone.”

Lukenan Okunnuga, senior research analyst at FXTM, noted that “given how inflation has found comfort above the Central Bank of Nigeria’s target interest rate band of 6%-9% for over five years, there is little room for the CBN to ease monetary policy.”

One analyst had observed that the apex bank will sustain the rates to ensure the effective employment of heterodox measures already initiated to strengthen the asset quality and financial soundness of the nation’s banking sector, including the recent Global Standing Instruction, which, according to the CBN, will facilitate repayment of loans by bank customers, reduction in non-performing loans which currently stands at 6.41% as at June 2020.

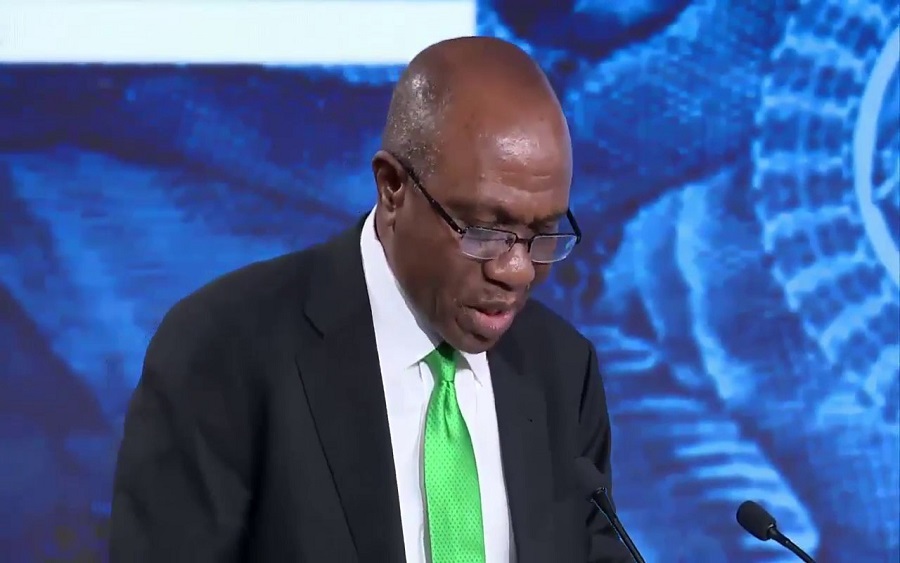

Godwin Emefiele, CBN Governor, disclosed that all monetary policy parameters will be held unchanged as voted by committee members.

The CBN governor revealed that the decision to retain the main rate at 12.5 per cent, with the asymmetric corridor of +200/-500 basis points around the interest rate; the Cash Reserve Ratio at 27.5 per cent; and the Liquidity Ratio at 30 per cent, by the committee is to evaluate the effectiveness of these tools at addressing the current challenges, particularly with the mounting uncertainties within the domestic economy, as well as the external vulnerabilities.

According to the CBN governor, “After reviewing the three options, the MPC noted that the imperative for monetary policy at the May 2020 meeting was to strike a balance between supporting the recovery of output growth and reducing unemployment while maintaining stable prices, noting that the economic fundamentals have marginally improved by the end of June 2020, following the gradual pick-up of economic activities as the positive impacts of the various interventions permeate into the economy”.

What next for the economy for the remainder of 2020?

The CBN, in its released communique highlighted the outlook based on provisional data on key domestic macroeconomic variables which indicated that the nation’s economy may post negative growth in quarterly GDP during the 2nd quarter of 2020, but there is guarded confidence that the year may end in marginal negative territory, with strong recovery prospects in 2021.