The latest joint study by the Association of Chartered Certified Accountants (ACCA) and KPMG has revealed that the standards of corporate governance code practiced by majority of African countries have enhanced their economic prosperity and growth.

The report specifically noted that 14 African countries, including Nigeria are now well aligned with the Organisation for Economic Co-operation and Development (OECD) principles of corporate governance released in 2015.

The study ranked South Africa number one, having adopted the largest number of OECD principles, with Kenya, Mauritius, Nigeria, and Uganda completing the top five.

Overall, a majority of markets (10 out of 15) have aligned their corporate governance requirements with more than 80 per cent of OECD Principles.

The report entitled: “Balancing Rules and Flexibility for Growth,” which focused on 15 countries across the continent, also examined the corporate governance requirements for listed companies against the benchmark across four tenets of corporate governance.

The study found all 15 African markets to have a corporate governance code or equivalent in place, with most countries adopting their first codes from 2000 onwards.

Irving Low, partner and Head of Risk Consulting, KPMG in Singapore, said: “A number of countries have had corporate governance codes for some time and the experience of implementing them has created practical learning points. The African markets will be able to leverage the lessons learned in the evolution of similar codes in other markets.

“We hope this study can contribute to raising the standard of corporate governance requirements across Africa. Each market needs to consider their specific political, legal, economic, social and cultural environment when making decisions about developing, defining and enforcing corporate governance requirements.”

But looking at the comparison within this study, and from phase one of the same reports that comprised 25 markets globally, Irving added: “Implementing corporate governance well will prepare companies for the opportunities that come with the anticipated high growth rates of the African markets.”

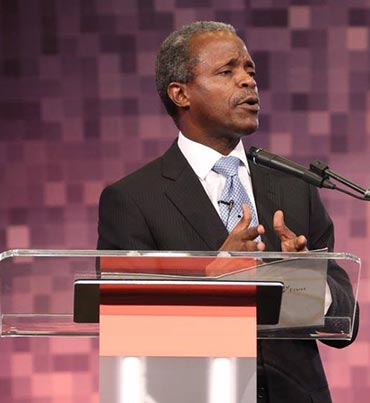

Jamil Ampomah, director, sub-Saharan Africa ACCA, said: “As these markets grow and evolve, more awareness and effort will be needed to strengthen remaining critical areas of corporate governance, particularly for remuneration structures, performance evaluation, risk governance, and board composition and diversity.

He said that most markets mandate are the basic corporate governance requirements such as financial disclosure, shareholders’ rights and the role of the board, supplementing these with non-mandatory guidelines for good practice.