DANGOTE CEMENT PLC – Renewed demand reaffirms strong outlook

August 31, 2022610 views0 comments

| What shaped the past week?

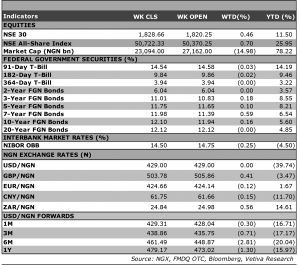

Global: Global investors were largely upbeat this week, as the fall in oil prices boosted investor sentiment across markets. The announcement from the Organization of Petroleum Exporting Countries and its allies (OPEC+) to increase daily production by 100,000 per day in September, eased supply concerns in the energy market, where brent prices were down 8.25% w/w to $93.95/bbl, at time of writing. Meanwhile, as central bankers remain steadfast in their fight against inflation, monetary officials in Australia and the United Kingdom raised their respective cash rates, , from 1.35% to 1.85% in Australia and from 1.25% to 1.75% in the U.K., marking the latest round of rate hikes. On the equities front, U.S. tech stocks were the best performers this week, with the NASDAQ up 4.66% at time of publication. In Europe, interest in the Industrial Goods and Semiconductors spaces, saw the German DAX rise 2.48% w/w; with carmaker VOLKSWAGEN AG and chipmaker INFINEON AG rising 6.16% and 11.22% respectively w/w. Likewise, in France interest in the Banking sector and Luxury good items drove the performance of the French CAC which gained 2.14% w/w; BNP Paribas and Hermes International lead gains across the CAC, where they rose 8.12% and 11.69% respectively. Finally, in the Asian-Pacific region, sentiment was more mixed as the Chinese markets saw another round of losses, while the Japanese Nikkei and Australian ASX closed higher. In China, worsening sentiment in the real estate sector weighed on the performance of the Shanghai Composite which sank 2.85% w/w; while the Hang Seng index also lost 2.18% as well. Finally, the U.S. Bureau of Labor Statistics released its job report for July, which showcased an increase of 525,000 new jobs, which was well above expectations.

Read Also:

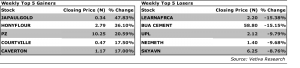

Equities: Nigerian equities traded in a mixed manner this week, as investors snapped up stocks that had lost in recent sessions. Investors sought after stocks in the Banking and Consumer Goods sectors, which gained 2.63% and 3.00% respectively. In the Banking space, recoveries across the sector were broad based, with STANBIC and ZENITHBANK rising 9.15% and 5.80% respectively. Likewise, in the Consumer Goods space, key names across the stock drove its w/w performance, as FLOURMILL, DANGSUGAR, and NESTLE posted strong gains, on the back of positive sentiment stemming from the release of their latest quarterly financials. On the other hand, losses in BUACEMENT weighed on the Industrial Goods sector, which lost 5.76% w/w. Meanwhile, in the Oil and Gas space, capital appreciations in small-mid cap players, saw the sector rise 0.60% w/w. Finally, interest in the telecommunications sector supported the market’s performance as well, where MTNN gained 7.40% w/w as investors reacted favorably to the company’s H1’22 financials.

Currency: The Naira closed flat w/w at the I&E FX Window at ₦429.00. Despite the contraction in bottom line, our outlook for DANGCEM remains strong and is predicated on renewed demand by the FG for infrastructure projects and the management’s concerted efforts to combat the rise in energy costs, using alternative fuel and local energy sources at its Obajana and Ibese plants. Altogether, we forecast a revenue and PAT growth of 20% and 22.9% to ₦1.66 trillion and ₦448 billion respectively for FY’22. We value DANGCEM at a 12-month TP of ₦350.05 and place a BUY rating on the stock. |