Dividends for equity returns in 2023

December 12, 2022863 views0 comments

By Business AM

- Analyst Insight: Coronation Capital

Dividends have made an important contribution to total equity returns in 2022. What is the outlook going into 2023? It helps that the NGX All-Share Index is up this year, but not so much as to reduce the significance of dividends. As is proving to be the case in 2022, we think gross dividends could add some five percentage points to equity performance in 2023. [Penultimate week], the exchange rate at the Investors and Exporters Window (I&E Window) gained 0.22% w/w to close at N445.33/US$1. Elsewhere, the foreign exchange (FX) reserves of the Central Bank of Nigeria (CBN) decreased by 0.18% to US$37.10bn, a 13- week low, as the CBN continues to intervene in the various FX windows. The FX reserve position remains close to its historic high, and we doubt that the CBN wishes to see the exchange rate slip over the coming months. Therefore, we believe that the current I&E Window rate, or something very close to it, can be maintained for at least several months.

Receiving dividends and reinvesting them has added materially to the performance of Nigerian equity portfolios this year. This effect only works because: (a) dividend payments are reasonably generous; and (b) the market overall has been trending up this year (otherwise it would have been better to have held onto dividends in cash). We wrote that the excess performance of the market’s total return over its share price return, year-to-date, is now close to 5.0 percentage points (500bps), which is well worth having.

An obvious problem with this measurement is that it uses the rear-view mirror; we are looking backwards. What could investors have done about dividends at the beginning of this year and what can they do about them in 2023? There are two points to be made. The first is that companies usually pride themselves on their dividend-paying record (partly because dividends provide significant income to core shareholders), so dividends are reasonably predictable and tend not to be cut if at all possible. The second is that dividend yields vary enormously between stocks, though the dividend yield itself does not drive share price performance (for example, banks have good dividend yields but the banking sub-index has performed poorly relative to the broad index of Nigerian stocks year-to-date).

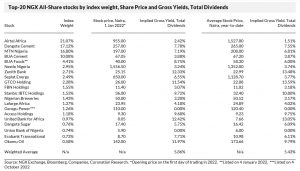

Top-20 NGX All-Share stocks by index weight, Share Price and Gross Yields, Total Dividends

In the table we present the top-20 stocks of the NGX All-Share Index, sorted by index weight, which together comprise 92.03% of the entire market. We have taken their total gross dividends per share (DPS) paid this year and calculated gross yields. The first gross yield is given for the price of each stock at the beginning of the year in order to give an idea of what was in prospect at that time. The second is given for the average price of each stock, year-to-date. For the 20 stocks at the beginning of the year the weighted average gross dividend yield (weighted for index weight) has been 5.86%. Using average year-to-date prices, the weighted average gross dividend yield has been slightly less, at 5.43%. Note that we use the total gross dividends paid during 2022 rather than breaking these up into full-year, interim and other dividends. Most companies paid a full-year dividend during the first half of the year; some paid a full-year and an interim dividend; one (Okomu Oil) paid three; one (Seplat) paid four. Another important point is that most investors (corporates and individuals) are liable for withholding tax on dividends at 10.00%, so the gross dividend yields need to be adjusted downwards accordingly. What does this tell us about 2023? Some companies had bumper profits during 2022, notably Okomu Oil (due to palm oil prices) and Seplat (due to crude oil prices) and paid out accordingly. As both palm oil and crude oil prices have fallen, one might question whether their payouts will be maintained next year. The majority of dividend payers, we believe, will likely attempt to maintain or increase dividends next year. So, it makes sense to think of a weighted average gross dividend yield of approximately 5.00% (unless prices rally sharply between now and the end of the year) as we go into 2023.