The stock markets of the world’s developing economies are about to undergo a kind of a revolution.

As index provider MSCI Inc. prepares to carry out its annual review in June, some of the world’s biggest and best-performing equity markets — with assets totaling almost $9 trillion — are poised for reclassification.

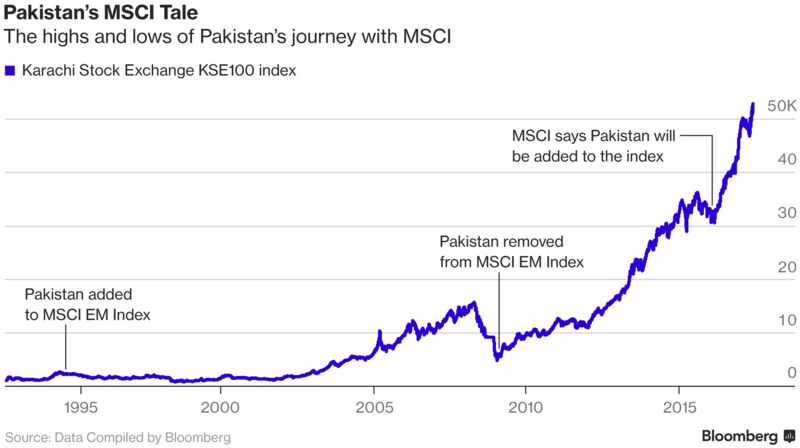

Pakistan

Past

MSCI downgraded Pakistan from an emerging market to a frontier nation in 2009 after it imposed a floor on the stock index to curb excessive selling during the financial crisis. The market’s size has since grown by about five fold.

Present

The nation began trading as an emerging market on June 1. Investors expect it to have a 0.2 percent weighting in the MSCI Emerging Markets Index, and get anywhere between $300 million to $550 million in inflows from tracker funds.

“It’s going to be a small fish in a big pond,” said Andrew Brudenell, a London-based money manager at Ashmore Group Plc.

Future

Pakistan’s economy may grow about 5 percent this year, according to Mattias Martinsson, the Stockholm-based chief investment officer at Tundra Fonder AB, which holds about $150 million in Pakistani stocks.

“You can see growth picking up, you can see companies starting to invest, signs of political maturity and terrorist activity continuing to decrease,” he said. “When it starts to approach 6 percent and 7 percent growth, then suddenly you have a market that for so many people will look like the Philippines, will look like India even.”

Saudi Arabia

Past

Two years after the kingdom opened its stock market to global investors, foreign ownership has languished at about 5 percent and the equity index has lost about 30 percent. The market’s size fell by roughly $140 billion as the changes coincided with the government’s austerity measures.

Present

As part of its plan to revamp the economy and reduce dependence on oil revenue, Saudi Arabia is now seeking inclusion in MSCI’s emerging-market gauge. The country says its bourse has met all the criteria, and there are now enough institutional investors to give the index provider feedback on the investment process.

Future

The country introduced short selling and will probably add a range of sophisticated financial products. An initial public offering by state-run Saudi Aramco may provide the breakthrough the country has been looking for in terms of foreigners’ interest.

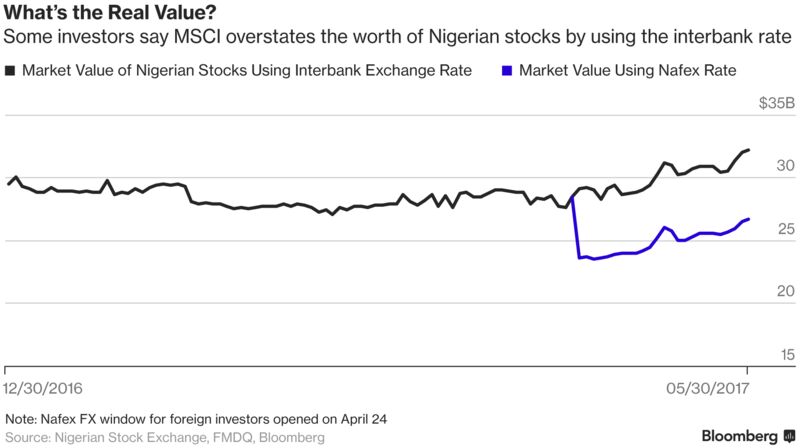

Nigeria

Past

The African country, struggling to restore investor confidence in its currency, has seen its benchmark stock index lose more than 30 percent in dollar terms over the past 12 months. MSCI is considering whether to downgrade Nigeria from a frontier nation to a standalone market.

Present

Investors are giving a thumbs up for a foreign-exchange window that started in April, which allows them to repatriate funds or value their naira holdings at rates more closely aligned to the informal market. A U.S. exchange-traded fund focusing on Nigeria has seen inflows after the start of the new mechanism.

Future

Investors are now making a case for MSCI to use the price of the naira on the window to value stocks instead of the tightly controlled interbank rate. BlackRock Inc., Allan Gray Ltd. and Frontaura Capital LLC have already started using the new rate.

“Using the official rate means that MSCI is overstating year-to-date performance of their Frontier Market Index by about 1 percentage point,” said Tom Egbert, an analyst at Frontaura. “MSCI should switch its valuation away from the official rate, which is now unobtainable and irrelevant to investors.”

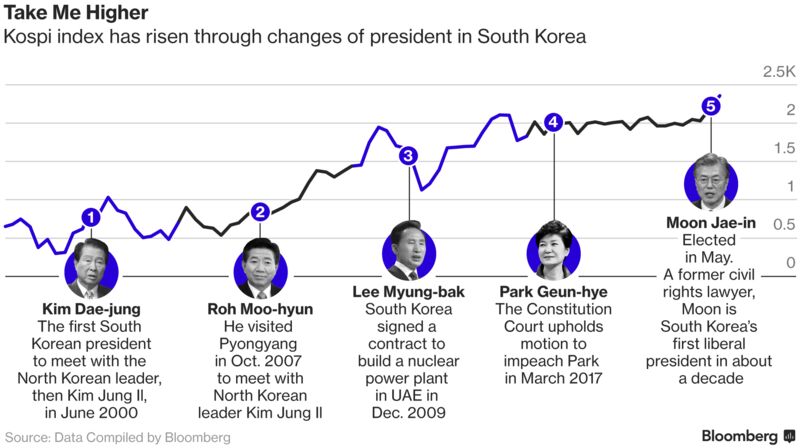

South Korea

Past

The nation won a reprieve last year when MSCI decided not to include China’s domestic stocks in its emerging-market index, which would have reduced South Korea’s 15 percent weighting in the gauge. Since then, the Kospi index has rallied at least 15 percent, more than double the gains in Shanghai composite index.

Present

MSCI is considering whether to upgrade South Korea into a developed market. The nation has a new president, ending a period of political tensions around the previous premier’s impeachment. Samsung Electronics is one of the biggest contributors to the MSCI gauge’s increase this year.

Future

Mark Mobius, the executive chairman of Templeton Emerging Markets Group, said he’s ignoring South Korea’s tension with the North and is betting on President Moon Jae-in overhauling the conglomerate-dominated economy.

“This means that the so-called Korea discount narrows, and you have bigger opportunities for investing,” he said.

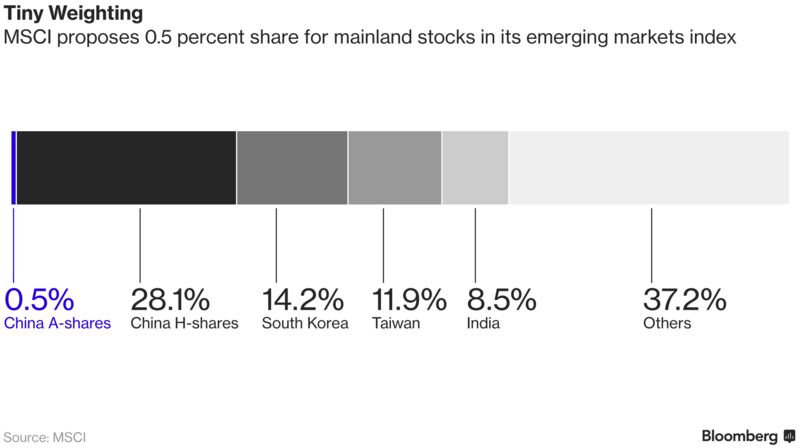

China

Past

China’s domestic equities were denied entry into MSCI Inc.’s benchmark indexes for a third year last June despite a flurry of measures to address the index compiler’s concerns, including repatriation limits and excessive trading suspensions.

Present

MSCI is surveying stakeholders for the fourth time on the merits of including members of the nation’s $6.6 trillion equity market in its benchmark indexes. But China still has some way to go to win approval, said MSCI Chief Executive Officer Henry Fernandez on May 24.

Future

Only 169 mainland-listed companies will be considered for inclusion, down from 448 under a previous proposal, and all will be large-cap shares currently accessible to foreign investors through exchange links with Hong Kong. With MSCI scaling down the scope of its proposal, China is likely to get little more than a 0.5 percent weighting, half of the previously suggested level.

The index provider will use the offshore yuan for its calculations rather than the onshore currency.

Argentina

Past

The free float of the peso in late 2015 has spurred a rally in Argentine stocks that’s made them the world’s best performers this year, after Venezuela. The Merval index is trading near a record both in terms of price and market capitalization.

Present

Shares of the nation’s stock exchange operator, Mercado de Valores de Buenos Aires, began trading on the public market in May as investors prepare for MSCI’s June 20 decision. Inflows into a U.S. exchange-traded fund focusing on Argentina surged to a record in May.

Future

BlackRock Inc. and Morgan Stanley are among those favoring Argentine stocks because of its strengthening economy, lower inflation and a positive earnings outlook.

Courtesy Bloomberg

What will you leave when you’re gone?