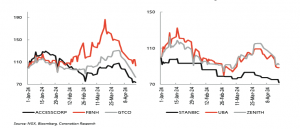

Markets do not like rights issues, as shareholders suspect dilution to the value of their shareholdings. Since the publication of the CBN’s circular on recapitalisation of banks, the NGX Exchange-listed bank sector index has corrected 23.4%. Has it corrected enough already? Without specific details on transactions it is difficult to know but, following a theory of rights issues and values, we think that the sector, in aggregate, has corrected enough.

The theory…

Take the notional example of a shareholder who, just before the publication of the CBN circular (with its implications of rights issues), owned one thousand shares in Naija Bank Plc at a market price of N10.0 each. The number of shares outstanding was one billion, the Net Asset Values (or the Total Shareholders Funds, given in the 2023 accounts) was [N]25.0 billion; the NAV per share was N25.0. Note that the Price-to-Book value (P/BV) of the shares was (N25.0/N10.0), 0.4x.

Let us say that the shareholder made some assumptions about the upcoming rights issue and assumed that his/her shareholding will be diluted in the rights issue, not least because the shares were trading at a substantial discount to their book value (which makes life difficult because more shares have to be sold to raise a given amount of money). The shareholder assumed that the rights issue will involve issuing one new share for every two currently held.

In terms of voting rights (assuming all shares have one vote) it is straightforward to calculate the amount of dilution, 33%. But in terms of value, or NAV per share, it depends on the price at which shares are issued.

Now assume that the shareholder simply wanted to preserve his/her NAV per share without purchasing new shares in the rights issue. The shareholder quickly sold at N10.0/s, effectively selling N25.0/s of NAV. Assuming there are 500 million new shares issued in the rights issue at N7.7 per share, the new NAV per share, post-rights issue, will be N19.2. By spending his/her N10.0 again to buy 1,300 new shares, the shareholder will preserve the amount of NAV per share he/she owns (1.3 x N19.2/s = N25.0).

So, given certain assumptions, the shareholder expects 23% dilution, and sells in the expectation that he/she will buy in the rights issue at N7.7/share.

. . . and in practice

How useful is the theory? The NGX Exchange’s index of bank stocks has corrected by 23.4% since the publication of the CBN’s circular on 28 March. The average P/BV at that time was 0.6x but some of the largest banks were valued at close to 0.4x. So, our theoretical guide suggests that the banking sector was due some 23% downside, even assuming a severe level of equity dilution of one new share for every two currently in issue. Given that our assumption is severe, this suggests that the correction has gone about far enough, if not too far.

Of course, this is only a rough guide to the listed banking sector as a whole. There are many specifics to be worked out, and very few banks have announced rights issues and the amount they wish to raise. Our intention, before working on specific details, is to estimate how much of a correction the bank sector overall is due.