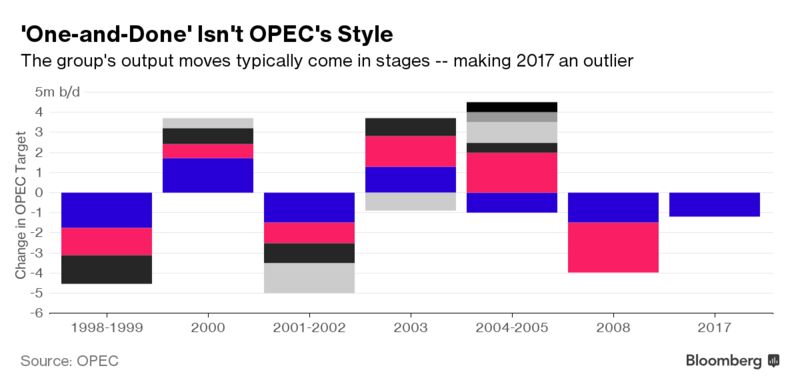

The chorus in the oil market calling for deeper production cuts gets louder almost every day. By resisting the clamor, OPEC is breaking with its own history.

As crude sank below $50 a barrel — less than half the price of two years ago — market-watchers from Goldman Sachs Group Inc. to former OPEC officials said supply curbs imposed this year need to be intensified. That would be consistent with past behavior, when production cuts or increases often arrived in stages a few months apart.

This time is different. The emergence of U.S. shale oil producers — who can adjust supply more rapidly than OPEC’s previous rivals — means the Organization of Petroleum Exporting Countries cannot act with the same freedom it once did. As economic pressure mounts for exporting countries, using the old playbook runs the risk that new American supplies would fill in any extra cutbacks.

“When OPEC was in control, it would often act in stages,” said Chakib Khelil, a former Algerian energy minister who was OPEC president in 2008. “The market is different than in 2008. Today, non-OPEC plays a larger role in supply. And the major issue is how long can they sustain this supply.”

“In the past if it didn’t work, OPEC would adjust lower,” said Mike Wittner, head of oil market research at Societe Generale SA in New York. “It’s a process. That’s what supply management means.”

The last time OPEC intervened, when the global recession took hold in 2008, it initially agreed a supply cut in October and, when prices continued to plunge, supplemented this with another reduction in December, the biggest in the group’s history.

Not Sacrosanct

Between 2004 and 2005, the organization increased output targets six times to satisfy booming consumption in China. And three cuts were made in quick succession from 1998 to 1999 as oil demand tumbled in the wake of the Asian financial crisis.

“One-and-done has certainly not been sacrosanct policy,” said Helima Croft, head of commodity strategy at RBC Capital Markets LLC.

While the organization didn’t always take a sequential approach, “when the situation required further action,” it wasn’t unusual for OPEC to take it, said Adnan Shihab-Eldin, director-general of the Kuwait Foundation for the Advancement of Sciences and former OPEC secretary-general.

With the world’s fuel inventories still brimming, the organization needs to revert to that old approach with a “deeper cut,” said Nordine Ait-Laoussine, president of Geneva-based consultants Nalcosa and former energy minister of Algeria.

Although the organization and its partners — known as the Vienna Group — agreed last month to prolong the cuts until next April, they’ve shown no interest yet in amplifying them. Saudi Arabian Energy Minister Khalid Al-Falih reiterated on June 19 that global markets are already on the path to re-balancing, while a committee of producers that met in Vienna the next day was said to have given additional cutbacks no serious consideration.

United Arab Emirates Energy Minister Suhail Mazrouei said in Paris on Thursday that there are “no plans or talks” to enlarge the cuts.

Shale Difference

The key difference from previous OPEC efforts is that U.S. shale producers can rebound quickly enough to undo their work, according to Bob McNally, president of consultants The Rapidan Group LLC. That concern had deterred OPEC from reducing output in this crisis until late last year.

“Sequential steps were seen during the big price busts of 1998 and 2008,” McNally said. “Arguably we are seeing a soft repeat of sequencing with the extension. The difference is that shale’s bounce back is helping to frustrate the Vienna Group’s attempts to normalize inventories and thereby remove the threat of a price collapse.”

U.S. crude producers, who unleashed the glut OPEC is now fighting to clear, have recovered almost all the output they lost during the market’s three-year rout, as the nation’s shale-oil drillers learn to live with lower prices. National output is projected to hit a record next year, according to the Energy Information Administration.

Old Habit

Still, the very resilience of shale supply could yet lure OPEC back to its old habit of making supplementary cuts, according to McNally and Wittner.

With inventories still swollen and prices in a rut, the organization may soon face two main options: accept that their efforts have failed and reverse the cutbacks, or take the gamble of deepening them.

Cutting output any further would also mean betting on a big enough jump in prices to offset the loss of exports. While that happened in the first quarter, according to the International Energy Agency, the benefit has been fading, with Saudi Arabia’s foreign reserves dwindling this year by about $35 billion, or 6.7 percent.

Saudi Arabia’s Al-Falih has promised to do “whatever it takes” to re-balance the market. The kingdom — architect of the current policy — may be unwilling to endure the humiliation of a reversal, said Wittner.

That could see OPEC “double-down on their decision and cut significantly more,” he said. “But an additional cut brings its own dangers, which is a U.S. production recovery.”

Courtesy Bloomberg

When applause travels faster than hunger