Facebook bans digital currency adverts because of scams

January 31, 20181.4K views0 comments

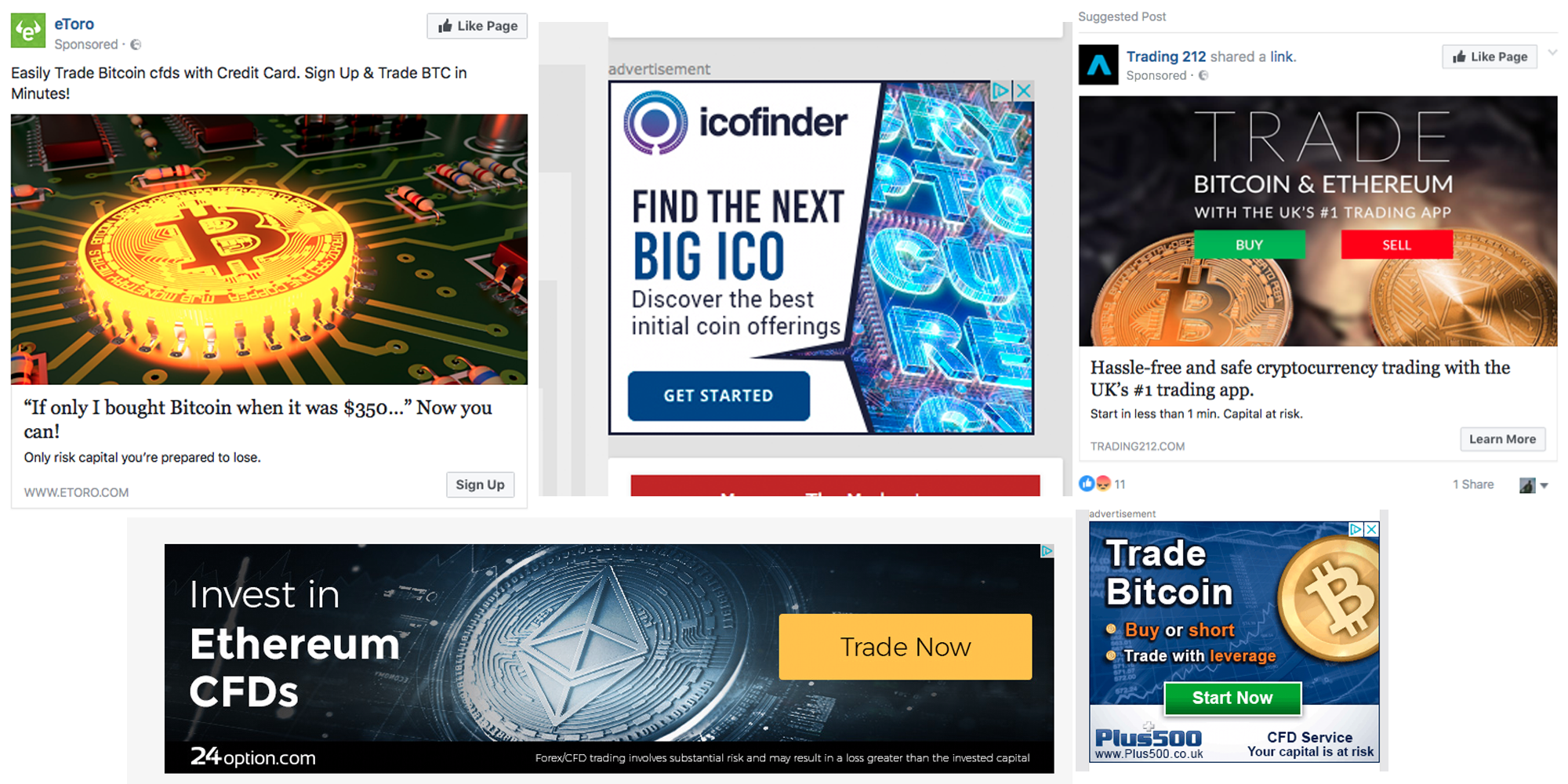

Facebook has banned all advertising for cryptocurrencies because they are “frequently associated with misleading or deceptive promotional practices”.

The company added the rule to its advertising policies on Tuesday, in an update to its list of “prohibited content”.

“We want people to continue to discover and learn about new products and services through Facebook ads without fear of scams or deception,” said Rob Leathern, a product management director at the social network. “That said, there are many companies who are advertising binary options, ICOs and cryptocurrencies that are not currently operating in good faith.”

Specific examples of banned adverts offered by Facebook include “Click here to learn more about our no-risk cryptocurrency that enables instant payments to anyone in the world” and “Use your retirement funds to buy Bitcoin!”

Leathern described the policy as “intentionally broad”, and promised that it would be revisited over time as Facebook learns to “better detect deceptive and misleading advertising practices”. In the meantime, however, the policy applies not just to Facebook itself, but also to adverts on Instagram and to external websites that are part of Facebook’s “audience network”.

Regulators worldwide have begun to examine the cryptocurrency space, as reports of out-and-out scams proliferate. In one instance this week, a company ostensibly raising money to launch a cryptocurrency for labelling fruit and vegetables disappeared overnight, replacing its entire online presence with the word “penis” (although it had only raised around $11 at the time of its disappearance).

Earlier, an anonymous developer had launched “Ponzicoin”, a cryptocurrency which was explicitly and transparently a pyramid scheme. Despite the coin being largely satirical, with its site full of wry commentary on the wider cryptocurrency sector, it genuinely existed – and sold in such large quantities that the developer was forced to shut down direct sales, “because this was a joke”.

In December, the Financial Conduct Authority announced it would be intensifying its scrutiny of cryptocurrency offerings, but also noted that it would be examining whether the sector faced “undue regulatory hurdles”.

Similar actions were taken in the US in January. Jay Clayton, the chair of the US Securities and Exchange Commission, said: “I have instructed the SEC staff to be on high alert for approaches to ICOs that may be contrary to the spirit of our securities laws and the professional obligations of the US securities bar.”

[tribulant_slideshow featured=”true” featurednumber=”” featuredtype=”post”]