| What shaped the past week?

Global: Global markets traded higher this week as investors pursued stocks that had declined in recent sessions. Investors were focused on the latest statement from officials from key central banks. The ECB has announced a 75bps monetary policy rate hike, as the region grapples with high inflation and electricity prices. The region’s markets closed in the green this week, as investor confidence was propped up by energy stimulus announcements from fiscal authorities. The expected price cap on electricity prices in the region saw energy prices plunge and improved investor confidence amidst rising concerns about a recession in the region. The German Dax, French CAC, and London FTSE-100 gained 0.31%, 0.83%, and 2.41% respectively w/w. On the other hand, Asian-Pacific markets saw a mixed w/w performance with the Shanghai Composite rising 2.37%, whereas the Hang Seng Index and Korean Kospi fell 0.46% and 1.04% respectively; the focus on the region remains on China’s Zero-COVID policy, as several cities in the country remain under strict lockdowns. Finally, in North America, growth stocks had a strong week, with the Nasdaq rising 3.48%, while the S&P 500 and Dow Jones rose 3.23% and 2.38% respectively. Investor focus in the region was centered on the latest batch of economic data, in particular the Purchasing Managers’ Index report for August. According to the report, service sector activity in the United States fell in August, S&P Global said. The Services PMI Business Activity Index was at 43.7 in August, down from 47.3 in July and lower than the expected 44.1.

Domestic Economy: The National Bureau of Statistics confirmed a slight decline (-1.23% q/q) in Nigeria’s trade flows in Q2’22 (₦12.8 trillion). The decline in trade flows was driven by an 8% q/q drop in imports. Underlying the drop in imports was a significant decline in PMS imports. We understand that PMS imports in Q1’22 were significantly high due to the replacement of off-spec PMS products with newer PMS products between February and March 2022. The subsequent moderation in Q2’22 imports was responsible for the improvement in the trade surplus (+64% q/q). In Q3’22, we expect the commencement of oil production via the Amukpe-Escravos terminal to support crude exports. Imports could remain subdued as FX supply remains tight, giving way for a larger trade balance.

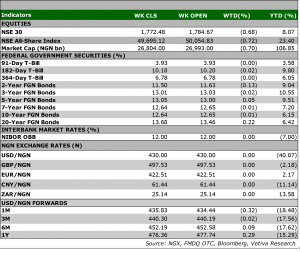

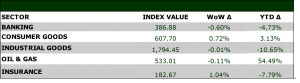

Equities: Nigerian equities closed lower this week, as investors maintain a risk off stance to equities amidst rising rates across the fixed income space. The local NGX index sank 0.70% w/w, as some investors largely stayed on the sidelines, while others cherry-picked fundamentally sound counters across the market. The Consumer Goods sector has enjoyed a promising start to the month, the sector gained 0.72% w/w, and we can attribute this to investor interest in counters in the space that had fallen in recent sessions; UNILEVER gained 9.43% w/w, while FLOURMILL and NB rose 8.02% and 2.98% w/w to help drive the green close. Meanwhile, all other sectors closed in the red; as the Banking, Industrial Goods, and Oil and Gas sectors lost 0.60%, 0.01% and 0.11% respectively. In the Banking space, investors continue to digest the latest financial reports from the banks. Whereas, in the oil space a downturn in global crude prices has weighed investor sentiment in the sector. Finally, in the industrial goods space, investor sentiment was mixed with a slight sell-side bias, as a marginal 40bps loss in WAPCO weighed on the sector’s w/w performance.

Fixed Income: This week’s trading activity in the fixed income space was quite tepid, with mixed sentiments persisting across the three market segments. Bearish sentiments dominated the benchmark curve in the bond market. As a result, average yields on benchmark bonds rose 7bps w/w. Meanwhile, mild bullish sentiments in the OMO space saw average yields decline 2bps w/w. Lastly, minimal trades in the NTB segment led to a flat close in average yield w/w.

Currency: The Naira depreciated 483bps w/w at the I&E FX Window to ₦436.33.

| What will shape markets in the coming week?

Equity market: We still expect similar trading sessions next week, with days of profit taking followed by rebounds, as investors stay cautions in the equity market.

Fixed Income: The bonds market is expected to open next week on a tepid note, with few bargain deals seen across the board, while the NTB market is expected to trade on a bearish note due to a lack of buy interest in the segment.

New dividend strategy raises valuation, outlook for Fidelity Bank

In Fidelity Bank’s H1 financials, the bank reported Gross Earnings of ₦155.7 billion, 45% higher than H1’21. This impressive growth came as the result of a 53% y/y increase in Interest Income (II) to ₦136.2 billion, driven by a 43% growth in income from loans and advances. Meanwhile, Interest Expense for the period was 56% higher y/y at ₦60 billion, after interest paid on deposits grew by 54% y/y to ₦38 billion. Despite this increase, Net Interest Income still came in 50% higher y/y at ₦76 billion, 15% higher than our forecast.

However, the bank posted a 10% y/y decline in Non-Interest Revenue (NIR), which came in at ₦13 billion, mainly due to a y/y decline in trading income, along with net foreign exchange losses worth ₦1.5 billion. Expense-wise, the bank’s impairments were 14% lower y/y at ₦2 billion, while Opex grew 47% y/y to ₦62 billion on the back of a 76% rise in AMCON charges and a 37% increase in personnel expenses. Overall, the bank declared PBT of ₦25 billion, 22% higher y/y, while PAT came in at ₦23 billion, 21% higher y/y. The bank also declared its first ever interim dividend of ₦0.10/share.

FY projections adjusted on H1 performance

With Fidelity Banks’s Interest Income coming in higher than expected, we have raised our FY estimate to ₦263 billion (Previous: ₦243 billion); this is driven by our expectation of steady yield on loans in H2. Furthermore, we have slightly moderated our Interest Expense forecast to ₦126 billion (Previous: ₦127 billion), as we expect cost of funds to remain steady at 4.6%, driven by the bank’s strong CASA mix (83%), up from 74% as at FY’21. Therefore, we raise our Net-Interest Income projection to ₦136 billion (Previous: ₦115 billion).

However, due to the bank’s continued underperformance in NIR, we have lowered our projection for the line to ₦30 billion (Previous: ₦35 billion). Finally, due to the bank’s high Opex in H1, we have raised our Opex forecast to ₦113 billion (Previous: ₦90 billion). Ultimately, we lowered our FY’22 PBT projection to ₦48 billion (Previous: ₦54 billion), which coincidentally falls in line with management guidance.

TP raised amid bold dividend strategy |

Despite the lower profit projection, we acknowledge management’s new strategy of paying out higher dividends, with the bank stating an intention to pay out up to 40% of post-tax profits. Therefore, we have cautiously raised our FY’22 dividend projection to ₦0.50 from ₦0.45, representing 33% payout based on our projections, as well as an upward adjustment in dividends for the outer years. Thus, we have raised our 12-month target price to ₦5.00 (Previous: ₦4.87). FIDELITYBK is currently trading at ₦3.40, 47% below our target price and at a current P/B ratio of 0.3x, below our coverage average of 0.5x. We reiterate our BUY rating on the stock. |