A new perception analysis report focusing on 55 insurers operating in the Nigerian economy designed to provide some level of guidance to the insuring public and help customers know their insurers better, has placed a ‘no deal’ verdict on three, while 10 of them have been placed on ‘too close to call’ advisory.

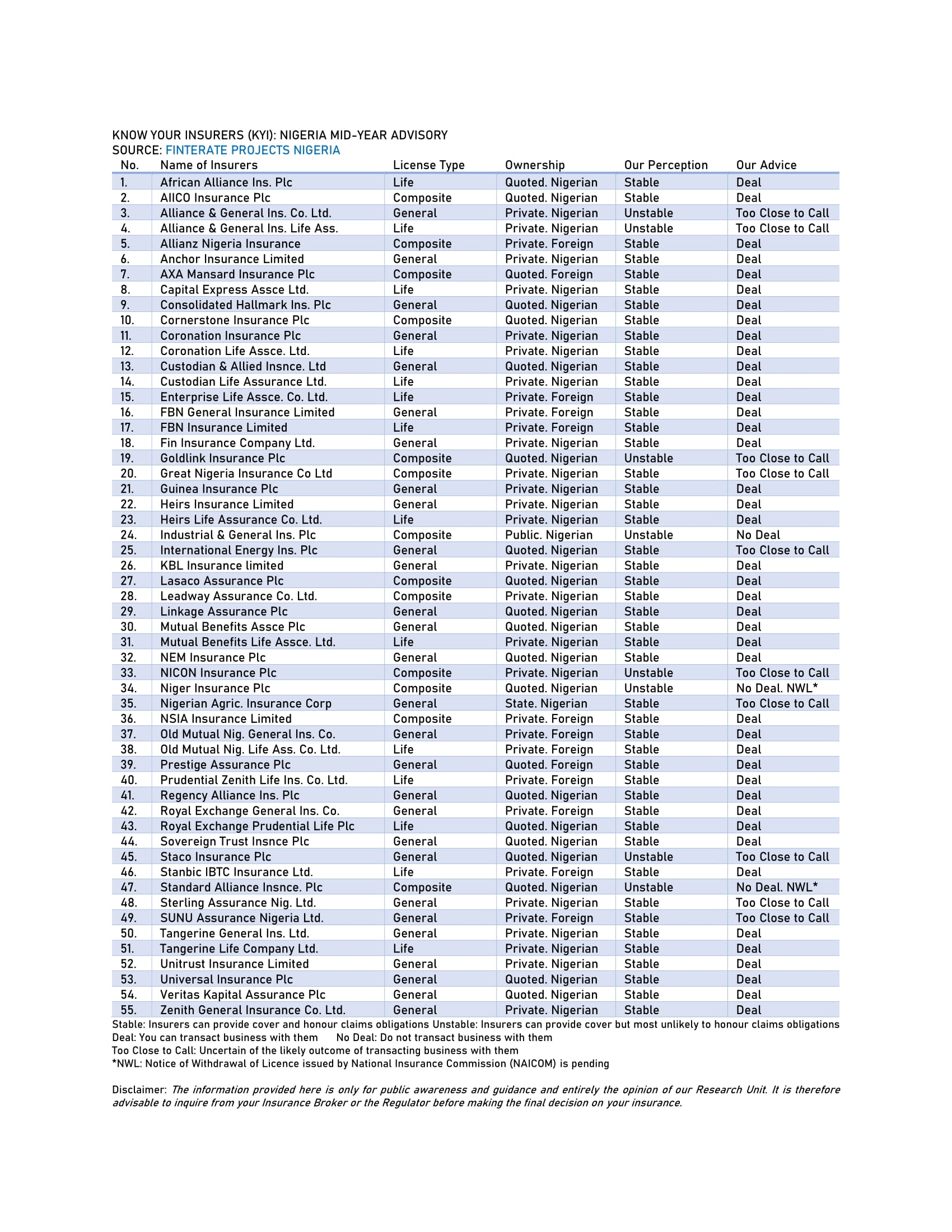

The mid-year advisory research on the insurers was carried out by Finterate Projects Nigeria and it categorised its findings as stable, to represent insurers that can provide cover and honour claims; unstable, for insurers that can provide cover but most unlikely to honour claims obligations.

For potential customers it goes further to provide three levels of advisory, namely, ‘DEAL’, in which case you can transact business with them; ‘NO DEAL’, means do not transact business with them; and ‘TOO CLOSE TO CALL’, which advisory represents, uncertainty over the likely outcome of transacting business with them.

The result of the research shows that three out of the 55 insurers examined, Industrial and General Insurance (IGI), Niger Insurance, and Standard Alliance produced a ‘No Deal’ advisory outcome from the research.

Ten insurers, Goldlink, Great Nigeria Insurance, Alliance and General Insurance, International Energy Insurance, NICON, Sterling Assurance, Standard Alliance, SUNU Assurance, Staco Insurance and Alliance and General Life Assurance, that were also examined for the report had a ‘Too Close to Call’ advisory placed on them.

Interestingly, a perception analysis table produced by the Finterate Projects Nigeria, also shows that the 10 companies with the ‘Too Close to Call’ advisory placed on them had varying degrees of stability perception call on them.

Finterate Projects Nigeria explained that in the case of one insurer, Niger Insurance, which it placed a ‘No Deal’ advisory on, there is a pending execution of a ‘Notice of Withdrawal of Licence’ issued by the industry regulator, the National Insurance Commission (NAICOM).

Finterate said its report contained information meant only for public awareness and guidance and entirely the opinion of its research unit.

It said that for insurance customers and members of the public it would be advisable to inquire from their insurance broker or the insurance regulator before they make any final decision on their insurance.

The Nigerian insurance market has long been seen as punching below its weight in an economy that is the biggest in Africa by GDP size. Many say it has never risen to general expectation and that it has failed to build genuine trust with business and individuals.

Trust issues have often come up in the payment and settlement of claims and this has made many people develop apathy towards insurance and denied many the chance of getting information on the benefits that insurance can provide.

Finterate Projects Nigeria has been a champion and advocate for insurance, providing information that can help members of the public to better understand insurance and enjoy the benefits that it can offer.

Ports as power: Nigeria’s economic lifelines under transformation