BY OLIVIA NNOROM

The Central Bank of Nigeria (CBN) has been charged to embark on monetary tightening to tame inflation and ensure that targeted concessionary credit to the private sector is sustained for Micro, Small and Medium Enterprises (MSMEs).

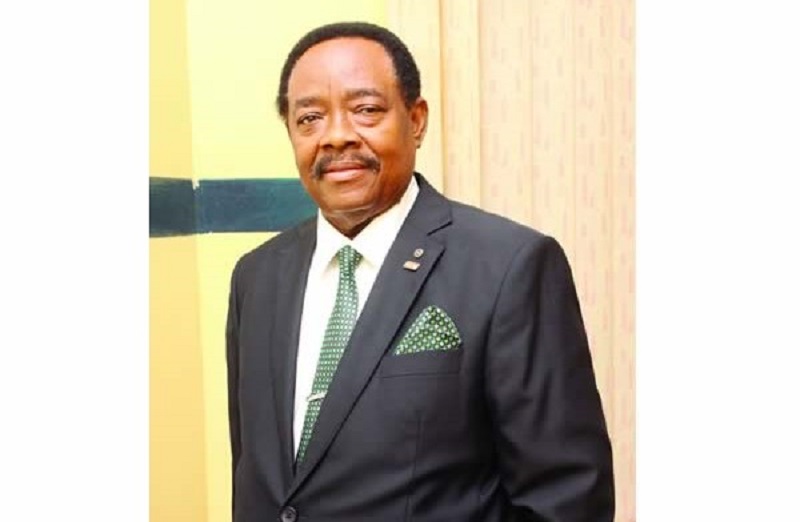

Michael Olawale-Cole, president, Lagos State Chamber of Commerce and Industry (LCCI), gave the charge in Lagos while addressing journalists on the state of the Nigerian economy.

Nigeria’s inflation figures hit an 11-month high of 17.71 percent in May 2022, up from 16.8 percent the previous month. The high rate of inflation and dwindling naira have eroded Nigerians’ purchasing power and worsened the standard of living.

The LCCI president said there was a need for the CBN to initiate a gradual transition to a unified exchange rate system and allow for a market-reflective exchange rate.

“The CBN also needs to roll out more friendly supply-side policies to boost productive sectors, bolster investor confidence and help attract foreign investment inflows into the economy,” Olawale-Cole said.

“There is a need to address structural bottlenecks and regulatory constraints that contribute to the high cost of doing business. A supportive and conducive investment environment is critical in facilitating private sector involvement in the economic recovery and growth process,” he said.

He called on the government to initiate moves towards having cost-reflective tariffs in the power sector in order to attract the needed investment to boost power supply and possibly end the frequent crashes of the national grid.

“We should also begin to initiate special-purpose interventions in boosting the deployment of renewable energy,” he said.

The LCCI president also identified interest rate hike by the CBN and rising energy costs as two major factors that will hold back the growth of Nigeria’s economy in the third quarter (Q3) of 2022.

He said the chamber had earlier drawn the attention of the public to this development, stating that rate increase alone would not curb the inflationary pressures facing the economy.

Olawale-Cole called for the removal of fuel subsidies and for oil theft to be curtailed to provide fiscal space for subsidized production of goods and services as well as for infrastructure, health, and education financing.

Although fuel subsidy removal will increase tax on citizens, it is an effective way to control inflation and regulate supply and demand, such that producers produce more goods and/or services, increasing the overall supply and decreasing the prices of goods and services.

With the costs of diesel skyrocketing above N800/litre, Jet-A1 at N710/litre, and PMS selling above the government-regulated price of N165/litre, production costs would continue to rise, leading to a decline in manufacturing and increase in job losses, he said.

The LCCI president urged the policymakers to pay attention to supply-side support to reduce rising production costs caused by the high cost of energy and raw materials.

“The chamber warns of heightened fears of contracting output, constrained production, and recession risks as it expects Nigeria to witness some fiscal challenges, occasioned by the country’s huge debt burden, accompanied by high debt servicing and heavy subsidy costs,” Olawale-Cole said.

Speaking further, he said the worsening security situation in many parts of the country would continue to threaten agricultural production, and manufacturing value chains and logistics if not properly tackled.

On food security, the LCCI boss said for Nigeria to be self-sufficient in food production, the country must boost its agricultural output sustainably and discourage dependence on imports, warning of a looming food scarcity, which would worsen the plight of the poor if nothing is done quickly.