What shaped the past week?

Global: Asian financial markets experienced a week of positive trading sentiment. Market performance was influenced by various factors such as the People’s Bank of China’s policy decisions, underwhelming economic data from China, Japan’s GDP exceeding expectations but with a decline in industrial production. Noteworthy developments included inflation surpassing the Bank of Japan’s target and the announcement of a new trade agreement between the US and Taiwan. For the week, the Japanese Nikkei-255 and the Shanghai Composite index gained 4.83% and 0.34% w/w respectively.

Major European stock exchanges also had a positive week of trading. The European Commission’s raised inflation projections and GDP forecast set the tone initially. However, concerns arose as Eurozone industrial production declined. Important economic reports on Eurozone GDP and trade surplus figures impacted market sentiment. European investors also reacted to the release of economic reports and financial statements from companies in the region. The German Dax and French CAC gained 2.26% and 1.08% w/w respectively.

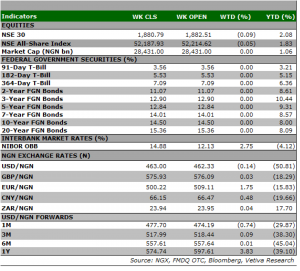

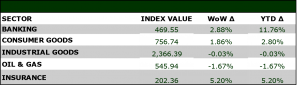

Equities: The Nigerian equities market witnessed a week of mixed trading, characterized by cautious investor sentiment. The Banking and Consumer Goods sector maintained their positive sentiment, extending their gains from the previous week, rising 1.86% and 2.88% w/w respectively. However, the Industrial Goods and Oil and Gas sectors experienced moderate losses, declining by 0.03% and 1.67% respectively. As a result, the ASI closed the week in the red, recording a marginal decline of 0.05%.

Currency: The Naira depreciated No.67 w/w at the I&E FX Window to close the week at N463.00.

What will shape markets in the coming week?

Equity market: We anticipate another mixed week of trading in the equities space, as investors continue to favor fundamentally sound counters.

Fixed Income: Market liquidity remains heavily constrained, and as such we anticipate another week of bearish trading in the secondary market barring any significant improvements to liquidity levels.

March 2023 Inflation – Inflation nudges higher for fourth consecutive time

According to National Bureau of Statistics data, headline inflation increased to 22.22% y/y in April close to our in-house estimate of (Vetiva: 22.18% y/y) and rising 18bps from March (Mar’23: 22.04% y/y). The increase was driven by higher energy and food prices over the previous year. Month on month, headline inflation increased to 1.91% (March’23: 1.86% m/m), owing primarily to seasonal increases in food prices.

Seasonality sends food inflation uphill

Food inflation increased by 16 basis points in April to 24.61% y/y (March’23: 24.45% y/y). The increase was driven by higher farmgate prices (+34% y/y), prices of potatoes, fish, oils and fat, fruits, bread and cereals, vegetables, yams and other tubers rose the fastest. Food inflation rose to 2.13% m/m in April (Mar’23: 2.07% m/m) due to limited supply from the planting season and increased demand from the religious festivities of Easter and Ramadan.

Core inflation advances further

Because of the relatively stable exchange rate, core inflation slowed to 1.46% m/m in April (Mar’23: 1.84% m/m). On the other hand, annualised core inflation increased to 20.14% y/y (Mar’23: 19.86% y/y). The highest pressures were observed on the prices of gas, fuel, air transport, liquid fuel, vehicle spare parts prices, medical devices, lubricants for transport equipment and road transport highlighting high energy and currency pressures compared to a year ago.

MPC likely to maintain hawkish posture as inflation intensifies

We expect headline inflation to rise to 22.45% y/y in May, driven by continued pressure on food prices as a result of the planting season. However, we do not rule out the possibility of a softening due to high base effects. For outer months, we anticipate that the scheduled withdrawal of fuel subsidies in H2’23 could put pressure on consumer prices. Given this, we forecast full-year headline inflation of 23.30% y/y in 2023 (2022: 18.76% y/y).

Looking ahead to the MPC meeting later this month, we expect that the committee could raise interest rates by 50-100 basis points due to rising inflation. Even though the Nigeria apex bank has raised interest rates six times in a row since it joined the hawkish trend a year ago (May 2022), inflation has remained stubbornly high and has continued to rise. The inflation triggers in Nigeria remain largely structural; this could indicate that the CBN’s monetary policy tools may not be sufficient in taming Nigeria’s Inflation.