Paradigm shifts do not come often in economics. From Adam Smith to John Maynard Keynes, there is only a handful of scholars who can claim to have radically changed the way we think about how markets should work and what governments can do to improve their functioning.

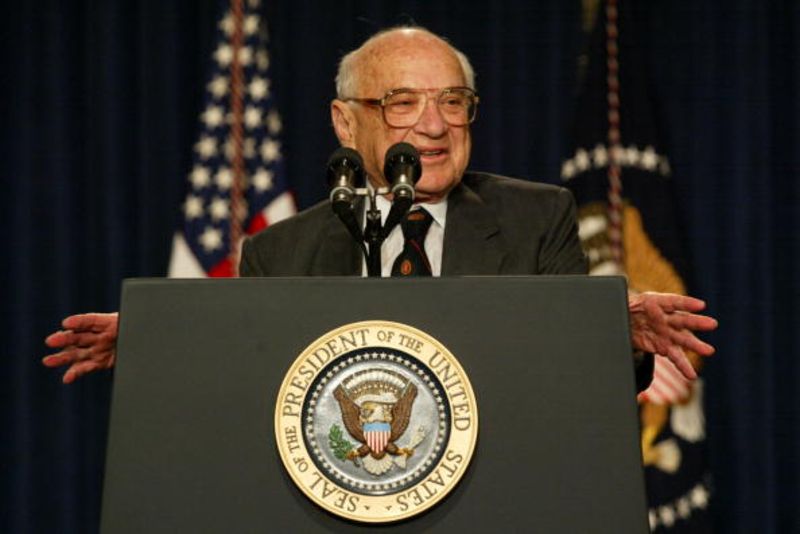

One such moment came almost 50 years ago when Milton Friedman delivered his presidential address to the American Economic Association in Washington D.C. The subject of the speech was the role that monetary policy can have in reducing unemployment and boosting growth. In Friedman’s view, central banks cannot reduce the long-run rate of unemployment at which an economy operates (the “natural rate of unemployment”). Were the monetary authorities to stimulate demand then, they would only prompt workers to demand ever higher wages and cause inflation to accelerate.

It was a matter of only a few years before Friedman’s speech acquired a near-prophetic status. In the 1970s, central banks tried to fight off the recession caused by oil shocks by slashing interest rates, but these policies only caused inflation to spiral out of control. This led to a major rethink of how monetary policy should work: Ever since central banks have primarily sought to ensure that inflation remains low and stable and have turned wary of stimulating the economy when they think it has hit the natural rate of unemployment. In this respect, Friedman’s thinking is alive and well today.

This does not mean, however, that his 1967 presidential address has passed the test of time entirely. Olivier Blanchard, the former chief economist at the International Monetary Fund and now a fellow at the Peterson Institute of International Economics, is reviewing the usefulness of the natural rate hypothesis — known as the “non-accelerating inflation rate of unemployment” or Nairu — for a forthcoming publication. His assessment, which was presented in Italy last week at the University of Naples Federico II, offers a thoughtful account of the various critiques which have been levied at Friedman, but does not refute a central implication of his address: that structural policies are needed to ensure more people can find work when the economy is running at full capacity.

Blanchard’s work clearly shows that downturns cause far more persistent scars than Friedman’s theory would suggest. His analysis of all the recessions that took place in 22 advanced economies over the past 50 years shows that, on average, the unemployment rate remains higher than it was during the boom, well past the moment of the crisis. This effect, which economists call “hysteresis,” is primarily the consequence of what occurs in the labor market after workers lose their jobs in a recession: The longer they remain unemployed, the higher the risk they become “disenfranchised,” either because they lose the necessary skills for companies to hire them or because they become discouraged and stop looking for a job. This means that the “natural rate” is far less rigid than Friedman thought or made it seem.

The hysteresis hypothesis, which has been the subject of a multitude of studies in the last 30 years, has major implications for today’s central banks, especially in the U.S. and the euro zone. The U.S. Federal Reserve has begun tightening monetary policy as the unemployment rate is now stable at around 4.5 per cent, near what most economists would consider the “natural rate.” Yet, labor force participation only stands at 62.8 percent, which may help to explain why wage growth remains subdued. Some economists, including Minneapolis Fed President Neel Kashkari, would like the Fed to pause raising rates, as there is scope for increasing employment without stoking inflation.

Similarly, in the euro zone, the European Central Bank is mulling when to taper its program of quantitative easing as the recovery strengthens: At 9.3 percent, unemployment has fallen to its lowest rate since 2009, but the ECB believes a real measure of slack in the economy may be nearly twice as high because of underemployment — that is, people taking work that is part-time or temporary or for which they are overqualified. Assuming the “natural rate” is not stable, the ECB should keep its stimulus for some time yet to ensure more workers are absorbed back into the labor force.

Blanchard is careful, however, not to draw excessive policy implications. He is right to be cautious. While he has a strong case that the scars of a recession are deeper than Friedman’s theory suggests, it is far less clear than simply pressing on with the monetary stimulus can bring workers who have lost their skills back into the workforce.

More likely, what is needed is a combination of cyclical and structural policies. For central bank stimulus to help lower the “natural rate” of unemployment, governments have to put in place well-targeted retraining programs, which allow workers to rejoin the labor force. There may also be a case for tweaking the welfare system to encourage the long-term unemployed to look for work: Blanchard suggests that in a boom the U.S. government should be harsher with their disability benefits, which discouraged workers use as a form of income support during a crisis.

Fifty years on from the speech that changed macroeconomics, it is pretty clear that we should not treat the “natural rate” as if it were a mathematical constant, immune to the effects of monetary policy. But an important lesson of Friedman’s speech remains valid: If we want to ensure more people are well-employed, central banks alone will certainly not suffice.