| What shaped the past week?

Global: Global markets traded in a bearish manner this week, as major markets across the globe closed in the red w/w. Starting in Asia, sentiment in the region remains weighed down by movement restrictions in China, as the country continues to battle the COVID pandemic. The Royal Bank of Australia highlighted that it is appropriate to start lifting certain monetary support measures, while Tokyo’s inflation was reported to be 2.5%, year-on-year, in April. For the week the Shanghai Composite eased 1.49% while the Nikkei-225 recorded modest gains, rising 0.58% w/w. Moving to the European region, sentiment was sell-side driven, with all major markets in the space closing in the red. Notably, the German Dax eased 3.02% w/w, with the French CAC and London based FTSE-100 dipping 4.45% and 0.98% respectively at time of writing. The U.S. Fed’s latest announcement on the 0.5% interest rate hike seemingly rocked stock markets across the globe. Finally, moving to the United States, sentiment was largely bearish as well; tech stocks continue to see aggressive sell-side action in the space as the NASDAQ eased 1.15% w/w, with the SP 500 and Dow Jones down 0.28% and 0.52% w/w. Earlier in the week, the United States Federal Reserve raised rates by 50bps to take the monetary policy rate to 1.00% and this weighed on investor sentiment in the equities space.

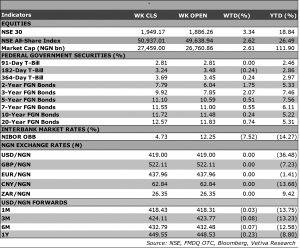

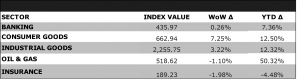

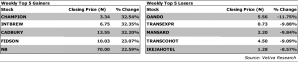

Domestic Economy: Recently, the Federal Government of Nigeria ordered the reopening of four additional land borders – Idiroko (Ogun), Jibiya (Kastina), Kamba (Kebbi), and Ikom (Cross Rivers) borders. This is happening two years after the reopening of the Seme (Lagos), Maigatari (Jigawa), Illela (Sokoto), and Mfum (Cross River) borders ahead of the take-off of the Africa Continental Free Trade Area (AfCFTA). While the borders were closed to prevent the smuggling of weapons and support the local cultivation of food, the prices of food items have risen nonetheless as supply fails to keep up with demand. In the near term, we expect the reopening of the borders to support volatile food supply from food-producing states, boost intra-African trade and culminate to lower inflation outcomes. Equities: Nigeria equities extended last week’s gains into this week, as the NGX rose 2.62% w/w, to settle at 50,937pts; taking its YTD performance to +19.24%, which is the highest in the west African region. The Consumer Goods Space was the best performer this week, rising 7.25%, fueled by buy-side action in the breweries space, with INTEBREW and NB rising 32.35% and 22.59% w/w to settle at 6.75/share and 70/share respectively. Likewise, broad based gains across the NGX saw the Banking sector climb 0.26%. Moving to the Industrial Goods space, persistent interest in WAPCO (+1.85% w/w) amongst other players in the space, saw the sector rise 3.22% w/w. Finally, in the Oil and Gas space, the sector eased 1.10% following sessions of strong gains recorded in the sector.

Fixed Income: The fixed income market traded largely bearish, with yields trending upwards in the bonds and NTB spaces, while the OMO segment majorly saw bullish activities. For the week, the yield on benchmark bonds rose 9bps on average, driven by sell-side action at the short-end of the market. Similarly, the NTB saw selloffs at the midpoint of the curve consequently average yield increased 12bps. Finally, in the OMO space yields declined 3bps on average, driven by buy-side activity at the short end of the market.

|

Currency: The Naira appreciated by ₦2.00 at the I&E FX Window to close at ₦417.00.

| What will shape markets in the coming week?

Equity market: The Bulls continue to dominate the market, amid strong Q1 financial performances and positive investor sentiment. We expect the green closes to persist in next week’s session, although we do anticipate some profit-taking on this week’s strong performers. Fixed Income: In the absence of market catalysts in the coming week, we expect current sentiment to persist in the bonds space, while anticipating muted activity in the NTB segment ahead of the PMA. Currency: We expect the naira to remain largely stable across the various windows of the currency space as the CBN maintains interventions in the FX market.

MTN NIGERIA PLC Q1’22 Earnings Release Data business to boost FY’22 earnings MTNN reported a solid performance in Q1’22, with revenue and profitability margins all witnessing expansion. The company’s revenue came in 22% higher y/y at ₦471 billion (Vetiva estimate: ₦464 billion), and revenue growth was primarily driven by expansion in its data business. Revenue from this service line grew 54% y/y, underpinned by increased area coverage that has driven the usage of MTNN’s network as a primary data provider. For more colour, MTNN has continued to enhance its network coverage and due to service quality and availability, the company has seen a rise in data demand and active data subscribers. The company recorded a 10% y/y increase in active data subscribers and also witnessed net add-ins in data subscribers q/q.

Also, despite a y/y decline in mobile subscriber base, voice services still posted a 6% growth to come in at ₦218 billion. The company’s mobile subscriber base is still dealing with the aftermath of the NCC’s NIN-SIM linkage policy; however, subscriber base returned to net-positive additions in Q4 and has maintained an upward trajectory since then. Thus, a growth driver for the company’s voice business was the fact that they recorded higher usage from their active SIM base, helping to offset the impact of the NIN-SIM restrictions.

Margin-wise, EBITDA margin further improved to 55% y/y (Q1’21: 53% Q4’21: 54%), as a faster growth in topline and the company’s cost-saving drive helped accelerate margin expansion. Consequently, EBITDA advanced 26% y/y to ₦257 billion, while PBT came in at ₦143 billion (up 39% y/y) and net profit for the year increased 31% y/y to ₦96 billion. Moving away from the income statement, the company’s cash position remained solid, with cash generated from operations up 64% y/y to ₦227 billion. However, given the company’s higher capex spend during the period, net cash position was down 40% y/y.

For subsequent quarters, we believe the company will continue to expand its 4G coverage, thus we project a 33% y/y growth for its data business. The company’s voice service is however expected to record marginal growth of 5% y/y as the NCC’s directive to bar outgoing calls in respect to the SIM-NIN policy and the growing preference for internet calls is likely to affect growth. Overall, we see 2022 revenue coming in at ₦1.9 trillion (up 18% y/y). Meanwhile, given the likely payment of $275 million for the recently acquired 5G license, we believe that this may drag bottom line and expect PAT to come in slightly lower y/y at ₦293 billion. Other than this, normalized PAT would have come in 27% higher y/y. Overall, we estimate a target price of ₦261.99 per share and rate MTN a BUY.

|

Whilst reasonable care has been taken in preparing this document to ensure the accuracy of facts stated herein and that the ratings, forecasts, estimates and opinions also contained herein are objective, reasonable and fair, no responsibility or liability is accepted either by Vetiva Capital Management Limited or any of its employees for any error of fact or opinion expressed herein.