What shaped the past week?

Global: There was a bullish bias from global investors this week, with some key markets across the globe closing in the green, while select markets in the Asian-Pacific region closed lower. Starting in the Asian-pacific region, South Korea’s Central Bank raised interest rates for a second consecutive session, by 25bps to 1.75%, to combat soaring inflation in the country, which stood at 4.8% in April. For the week, the South Korean Kospi eased moderately, losing 0.05%, while the Shanghai Composite and Hang Seng Index fell 0.52% and 0.10% respectively; on a positive note, however, the Nikkei-225 extended last week’s green close into this week, rising 0.16% w/w. In the UK, the British government is implementing a 25% tax on the profits of energy companies to alleviate the impact of rising energy costs on consumers in the region. As such, the London FTSE-100 closed 2.61% higher w/w. Elsewhere in the Eurozone, where the Russian-Ukraine conflict remains in focus, markets posted strong gains this week after last week’s steep selloffs. Accordingly, the German Dax and French CAC both closed well in the green, up 3.13% and 3.51% respectively. Finally, in North America, investors bought the dip, with growth stocks trading higher this week. The tech-heavy NASDAQ Composite was the top performer in the U.S., with the index up 6.14% at time of publishing. The S&P 500 and the Dow Jones Indices climbed higher as well, up 5.52% and 5.20% respectively.

Domestic Economy: The long-awaited rate hike took place this week. Following a 90bps surprise increase in inflation in April, Nigeria has finally joined the ranks of countries implementing tighter monetary policies. The Monetary Policy Committee voted to raise the MPR by 150bps to 13%. Though the rate hike cannot curtail cost-push inflation, the hawkish move could ease demand pressures from pre-election spending. In the near term, we anticipate that the MPC’s decision will result in higher fixed income yields and selloffs in the equity market. However, the Naira may not benefit from the rate hike due to crude theft.

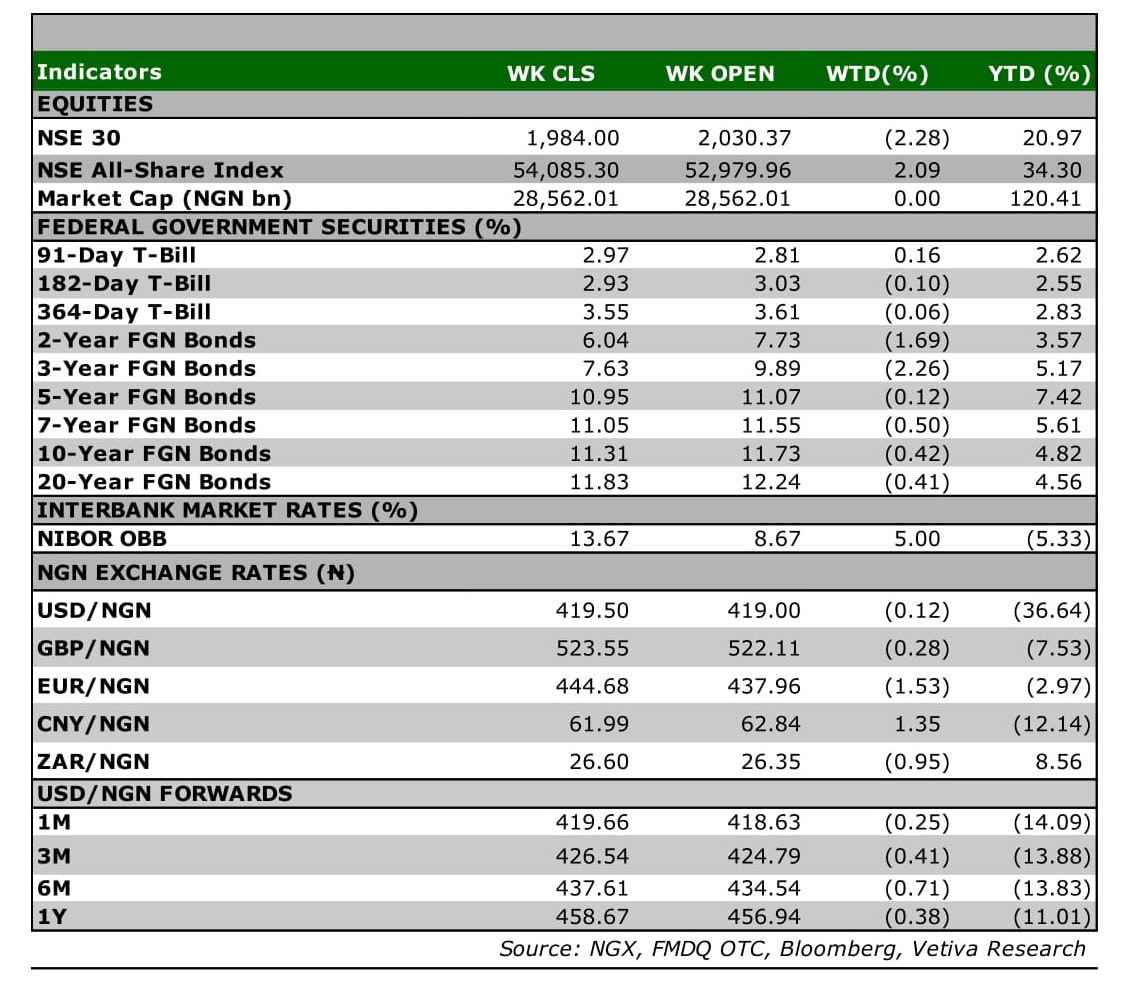

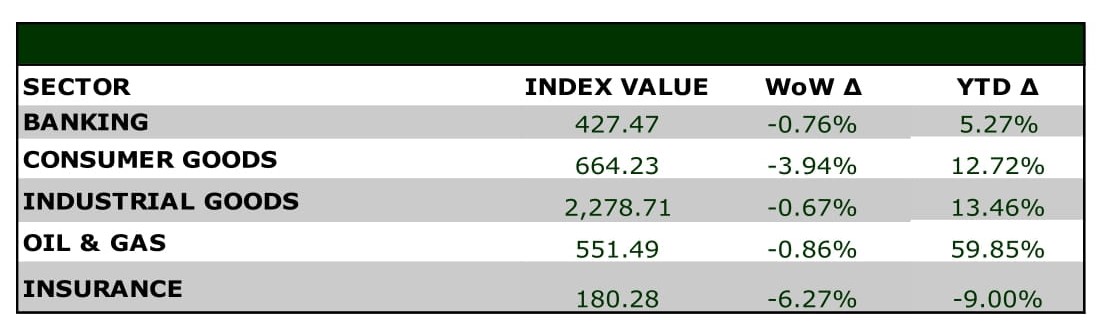

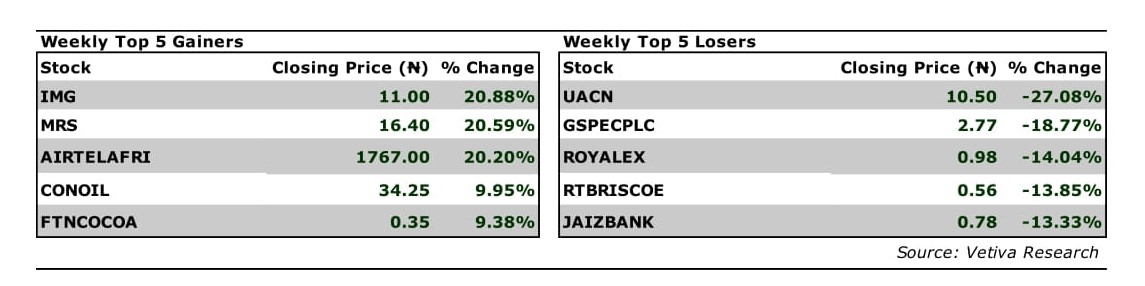

Equities: Despite broad-based losses across the key sectors on the equities space, the benchmark NGX rose 2.09% w/w driven by interest in the telecommunications space. AIRTELAFRICA saw its share price surge 20.20% w/w to trade at ₦1,767/share. The fungibility of the counter continues to drive the bullish bias in the stock. On the other hand, broad-based sell-side action across the market saw all key sectors close in the red, as investors reacted to the latest rate hike for the MPC. Starting in the FMCG space, the sector sank 3.94%, as profit-taking action in the brewers weighed on its performance; notably GUINNESS fell 11.12% w/w to ₦87.1/share, with NB also easing 10.00% w/w to ₦69.3/share. Moving to the Banking space, the sector closed in the red for a second consecutive week, as losses in FBNH (-4.17% w/w) and ZENITHBANK (-0.83% w/w) amongst others damped its performance. Likewise, in the Industrial Goods space, profit-taking action in DANGCEM (-1.00% w/w) and WAPCO (-2.26% w/w) saw the sector dip 0.67% w/w. Finally, the Oil and Gas space fell 0.86% as losses observed in the fuel marketing space hampered its performance.

Fixed Income: The fixed income market started the week on a positive note, however the decision by the MPC to hike interest rates by 150bps turned sentiment sour as a bearish bias permeated across the market in subsequent sessions. Yields on benchmark bonds rose 17bps w/w on average as investors aggressively sold-off papers at the long-end of the market. Of note, the yield on the 16.2499% FGN-APR-2037 paper soared 34bps w/w to settle at 12.86%, while the yield on the 14.80% FGN-APR-2049 spiked 34bps w/w to settle at 13.09%. Moving to the T-bills segment, the CBN carried out a PMA auction on Wednesday, where they offered ₦148 billion and sold ₦173 billion across the 91-Day, 182-Day, and 364-Day maturities at stop rates of 2.50%, 3.89% and 6.49% respectively. As a result, investors largely stayed on the side-lines in the space, with yields closing flat w/w. Finally, in the OMO space, yields rose 16bps w/w, driven by sell-side action at the long-end of the OMO curve.

Currency: The Naira depreciated by ₦0.50 w/w at the I&E FX Window to close at ₦419.50.

What will shape markets in the coming week?

Equity market: Despite the Monetary Policy rate hike on Tuesday, the week ended on a positive note amid price appreciation in selected large-cap names and recoveries in other stocks with beaten down prices. We anticipate a tepid start to the week as investors continue to bargain hunt across board.

Fixed Income: We expect the market to open the week on a muted note with a bearish tilt, as investors continue to react to the rate hike from the CBN. In the NTB space, we expect to see pockets of sell-side action, given where rates closed at the NTB auction on Wednesday.

Currency: We expect the naira to remain largely stable across the various windows of the currency space as the CBN maintains interventions in the FX market.

NIGERIA MONETARY POLICY COMMITTEE – At last, the hawks carry the day

At its third meeting of the year, the Monetary Policy Committee (MPC) raised the Monetary Policy Rate (MPR) by 150bps to 13.0%. While six members voted to raise interest rates by 150bps, four members preferred a 100bps hike, while one opted for a 50bps hike.

Nigeria joins other African economies like Egypt (+200bps YTD) and Ghana (+450bps YTD) in raising interest rates to curb inflation. On a comparative basis, however, Nigeria’s negative real rate of return is still above Egypt’s and South Africa’s levels. If there were no capital controls, the MPR needs to rise to 15.0% – 15.5% to match the current real rate of return in Egypt and South Africa respectively.

What will shape markets in the coming week?

Equity market: Despite the Monetary Policy rate hike on Tuesday, the week ended on a positive note amid price appreciation in selected large-cap names and recoveries in other stocks with beaten down prices. We anticipate a tepid start to the week as investors continue to bargain hunt across board.

Fixed Income: We expect the market to open the week on a muted note with a bearish tilt, as investors continue to react to the rate hike from the CBN. In the NTB space, we expect to see pockets of sell-side action, given where rates closed at the NTB auction on Wednesday.

Currency: We expect the naira to remain largely stable across the various windows of the currency space as the CBN maintains interventions in the FX market.

NIGERIA MONETARY POLICY COMMITTEE – At last, the hawks carry the day

At its third meeting of the year, the Monetary Policy Committee (MPC) raised the Monetary Policy Rate (MPR) by 150bps to 13.0%. While six members voted to raise interest rates by 150bps, four members preferred a 100bps hike, while one opted for a 50bps hike.

Nigeria joins other African economies like Egypt (+200bps YTD) and Ghana (+450bps YTD) in raising interest rates to curb inflation. On a comparative basis, however, Nigeria’s negative real rate of return is still above Egypt’s and South Africa’s levels. If there were no capital controls, the MPR needs to rise to 15.0% – 15.5% to match the current real rate of return in Egypt and South Africa respectively.

The backdrop remains the same The background underpinning this decision is similar with the last meeting – the ongoing war in Ukraine, backlash from sanctions on Russia, lockdowns in China, swift change in monetary policy stance, and risk aversion in the global financial markets.

The Ukraine-Russian war aggravated supply chain disruptions as major trade routes were closed amid sanctions on Russia. Should the war escalate, this could worsen already high food inflation, as food prices rise to levels not seen in 40 years. In our view, the resurgence of the pandemic in China could spill over to resource-dependent emerging economies in form of lower external demand and lean current account balances, while reducing demand for oil. The decline in Chinese demand is however inadequate to stop the oil bull, as oil prices sit comfortably at $114/barrel. China could decide to buy Russian crude at discounts, risking international sanctions, that could boomerang on emerging markets in form of higher imported inflation.

The surge in inflation has led many central banks to raise interest rates and curb external pressures on their economies. Notwithstanding, there have been net portfolio outflows from emerging markets since the US Fed began raising its policy rate in March this year. The strengthening of the dollar to multi-year highs has attracted portfolio interests and led to reduced demand for safe-haven assets such as gold, a trend that has occurred in previous hiking cycles. Thus, the stock markets’ rout is far from over. Nigeria appears to be exempted with a positive year-to-date return of 21.6% in naira terms. However, this is due to the existence of capital controls and FX backlogs, which have dented foreign appetite for Naira asset.

In our last MPC communication, we raised concerns that foreign portfolio investors will continue to be net-sellers of Naira assets if the MPC remains neutral. We also historically traced how the current global and domestic happenings align with previous hiking cycles. True to our prognosis, the CBN Governor acknowledged that tightening would help rein in inflation, narrow the negative real rate of return improve market sentiment, moderate exchange rate passthrough to inflation, reduce the speed of capital flow reversals, and sustain remittance inflows.

Taking into cognizance the electoral season, the apex bank opined that money demand pressure is on the rise and unlikely to abate until the 2023 general elections are over. Should inflation surprise negatively in the future, the apex bank also hinted at altering the Cash Reserve Ratio to curb money demand growth.

The policy dilemma facing the apex bank was how to best drive down inflation and support fragile recovery. The MPC felt though there were no significant signals to its hawkish posture, it believes a 150bps hike would suffice to tackle inflation from its end at the moment.

Whilst reasonable care has been taken in preparing this document to ensure the accuracy of facts stated herein and that the ratings, forecasts, estimates and opinions also contained herein are objective, reasonable and fair, no responsibility or liability is accepted either by Vetiva Capital Management Limited or any of its employees for any error of fact or opinion expressed herein.