BY Chisom Nwatu.

The Central Bank of Nigeria has increased the Monetary Policy Rate (MPR) by 100 basis points to 14 percent, a move it believes would promote stability in the midst of rising inflation.

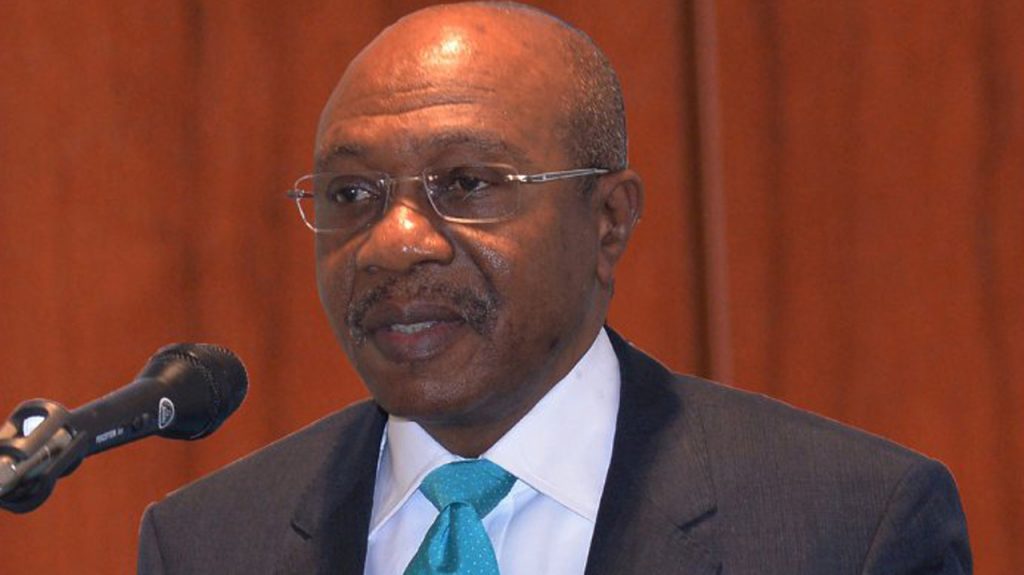

Godwin Emefiele, the CBN governor, announced the decision on Tuesday, 19 July, 2022 at the end of a two-day meeting of the apex bank’s Monetary Policy Committee (MPC) in Abuja.

Inflation has defied the bank’s monetary tightening objectives, rising for the seventh consecutive month to a five-year high of 18.6 percent in June.

The CBN had raised the benchmark interest rate to 13 percent in May 2022, up from 11.5 percent where it had been since September 2020, citing the need to curb rising inflation while still cautiously ensuring economic growth.

However, inflation rate climbed to 17.71 percent in May and has further accelerated to 18.6 percent in June.

Emefiele said on Tuesday that the MPC’s move underscores the conviction of members that not containing inflation would threaten growth and the purchasing power of the poor.

The CBN governor said the MPC members believe that inflation would moderate, and that they are cautious of emerging external shocks, adding that the broad outlook for both the global and domestic economy remains cloudy considering the economic headwinds.

He also noted that available data showed a likelihood of a growth decline due to supply blockages on account of the Russia-Ukraine war and high energy prices.

According to the CBN governor, members are cautious of broad money supply due to election spending in the country, insecurity and upsurge in price of energy.

There was a need for a balance in the pricing of petroleum products and curbing insecurity, he added.

However, the MPC expressed concern on Nigeria’s debt sustainability as borrowing is on the increase.