Piggybank.ng, Nigerian investment startup closed $1.1 million in seed funding as it seeks to tap into Africa’s informal savings groups after announcing a new product, Smart Target, which offers a more secure and higher return option for ‘Esusu or Ajo’ group savings clubs common across West Africa.

The financing was led with a $1 million commitment from LeadPath Nigeria, with Village Capital and Ventures Platform contributing $50,000 each.

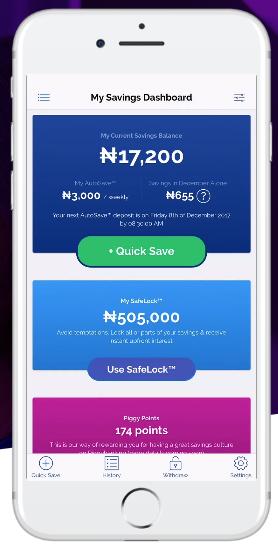

Founded in 2016, Piggybank.ng offers online savings plans, primarily to low and middle-income Nigerians, for deposits of small amounts on a daily, weekly, monthly, or annual basis. There are no upfront fees.

Savers earn interest rates of between 6 to 10 percent, depending on the type and duration of investment, Piggybank.ng’s

Users need an account with one of PiggyBank.ng’s bank partners to use the products. The startup generates returns for small-scale savers (primarily) through investment in Nigerian government securities, such as bonds and treasury bills.

PiggyBank.ng generates revenue through asset management and from the float its balances generate at partner banks.

The startup looks to grow clients across younger Nigerians and the country’s informal saving groups.

“The market that we are trying to serve is largely the millennial market, though we do not exclude anyone,” said Eweniyi, the company’s chief operating officer. The venture also looks to meet a demand in Nigeria for accessible investment options, citing a survey they conducted indicating that as a top priority for people with discretionary income.

“Piggybank offers savings, but our vision is not just savings, but to become a holistic platform — a financial warehouse — where other financial providers can plug in their services for PiggyBank users,” said Eweniyi. She cited banks, investment houses, insurance, and pension funds as possible partners.

The company currently has 53,000 registered users — 60 percent of whom are Nigerian Millennials — who have saved in excess of $5M since 2016, according to a release.

PiggyBank.ng will use its $1.1M in new seed funding for “license acquisition and product development.”

The startup has taken preliminary steps to launch in other African countries (Kenya in particular) but could not offer exact details.

Groups will be able to choose savings options and goals through PiggyBank.ng’s app and receive automated disbursement of returns across their individual bank accounts, according to COO Eweniyi.