Hedge-fund pessimism about crude prices is spilling into gasoline markets, even at the time of year when demand is highest.

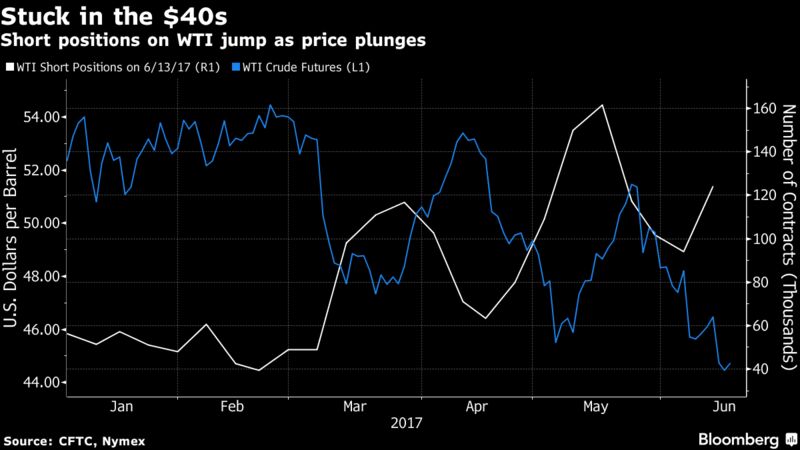

With the U.S. awash in gasoline, money managers for the first time on record were bearish on the fuel in the month of June, when the driving season is heading for its peak. At the same time, bets on falling West Texas Intermediate crude prices surged by almost a third in the week through June 13, U.S. Commodity Futures Trading Commission data show. That increase in short positions on oil was the biggest in five weeks, according to Bloomberg.

Oil plunged below $46 a barrel earlier this month when Energy Information Administration data showed total U.S. stockpiles of crude and product jumped by the most since 2008. Last week, futures breached $45 as the EIA said gasoline supplies surged to the highest level since mid-March. On Monday, WTI futures on the New York Mercantile Exchange fell to $44.59 a barrel as of 10 a.m. London time.

Adding to the stress, OPEC said its production climbed the most in six months in May as Libya and Nigeria revived output. The International Energy Agency warned that if both countries continue to increase output, those extra barrels will delay OPEC’s goal to re-balance the market.

“The price of oil has flipped into a range that is starting to cause a little bit more caution for the industry,” said Mark Watkins, the Park City, Utah-based regional investment manager at U.S. Bank Wealth Management, which oversees $142 billion in assets. “We’re awash in oil and the biggest issue you have is global demand as a whole that’s just slowly improving, but not at the pace needed to get the re-balancing.”

Hedge funds reduced their WTI net-long position, or the difference between bets on a price increase and wagers on a drop, by 25,842 to 195,298 futures and options, the CFTC data show. Shorts jumped by 32 percent, the most since May 9, while longs rose by 1.4 percent.

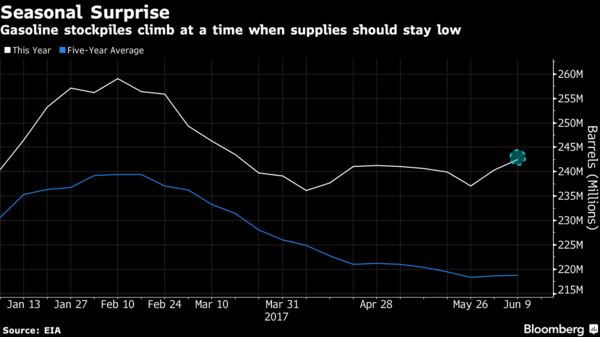

Bets on the benchmark U.S. gasoline contract flipped to a net-short position, the first time that’s happened in June in records dating back to 2006. The net-bearish position on diesel increased to the most pessimistic in more than 15 months.

U.S. gasoline inventories rose 2.1 million barrels in the week ended June 9, at a time when supplies should be declining seasonally, EIA data showed. Demand for motor fuel fell to the lowest level since April.

Prices will probably test $40 a barrel if we see a weak gasoline demand number and crude draws don’t exceed 5 million barrels in the next release of U.S. inventory data on June 21, Brent Belote, founder of Cayler Capital LLC, said by telephone.

The data have been “more bearish-leaning,” Michael Loewen, a commodities strategist at Scotiabank in Toronto, said by telephone. “The sentiment that I have been hearing from clients is that their concern is demand’s not there and there’s too much supply growth in the U.S.”

Courtesy Bloomberg