OPEC’s job of rebalancing the oil market has just got a lot more difficult. Not only is there a lot more oil in storage than it previously thought, but the group will need to make deeper output cuts to drain the excess.

A month ago OPEC oil ministers had probably read the International Energy Agency’s monthly report with a sense of quiet confidence. It showed the world would need more oil than the group was producing for the rest of this year and next. And, as long as producers held their nerve — and their discipline — inventories would continue to fall. That is no longer the case.

So the latest report from the Paris-based IEA, published on Friday, is a nasty shock. It has just found another 230 million barrels of oil in storage that will need to be drained before balance is restored.

That is a lot of oil. To put it in perspective, it increases the build-up in inventories since the beginning of 2014 by almost 25 percent. An output cut of 1 million barrels a day would take another six months to drain it.

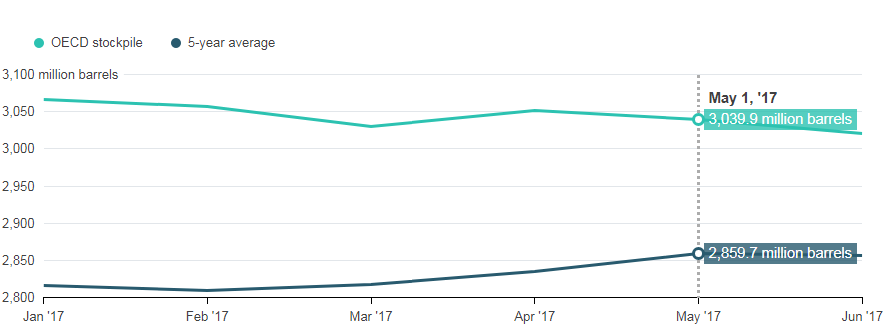

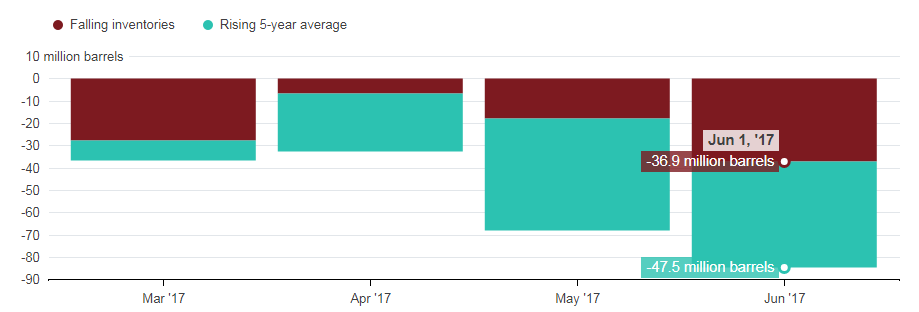

To be sure, commercial oil inventories in the OECD — the only ones we can see with any clarity — are getting closer to the five-year average level targeted by OPEC.

The overhang narrowed to 84 million barrels in June. But before you get too excited, well over half of the narrowing of the gap is because the five-year average increased. The actual draw in inventories has been a much more modest 37 million barrels.

How do you suddenly find 230 million barrels of oil? By realizing that the countries who were driving demand growth over the past couple of years weren’t driving it as fast as you thought.

The IEA also cut its assessment of 2016 demand in non-OECD countries by 420,000 barrels a day, with China accounting for more than a quarter of that. With no similar reduction in its assessment of supply, all of the oil that was not consumed, around 157 million barrels, must have gone into storage. The rest comes from the smaller revisions that the IEA made to its 2015 demand numbers.

The difference this makes to OPEC is hard to over-estimate. The biggest hit is coming right now.

The IEA’s revisions cut by 800,000 barrels a day the amount of oil the world may need from the group in the current quarter. That is almost as much as the combined production of OPEC’s three most recent joiners: Ecuador, Equatorial Guinea and Gabon. Inconveniently, this reduction coincides with a jump in the group’s production by 200,000 barrels a day in July, according to Bloomberg estimates.

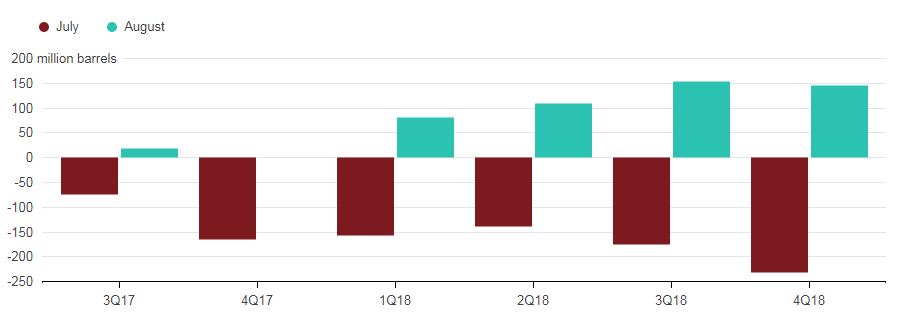

Based on the latest figures, the IEA now expects global stockpiles to rise this quarter — not fall. A forecast for a small draw in the final quarter would leave global inventories unchanged over the second half of 2017.

And next year suddenly looks a lot worse than it did a month ago, too. If OPEC’s current aggregate production level is carried forward for the whole of 2018, global oil inventories would rise by around 170 million barrels. That’s about six times as big as the inventory drawdown for 2017.

Saudi oil minister Khalid Al-Falih may already be preparing the ground for deeper cuts. That possibility was raised during a joint press conference in Jeddah with his Iraqi counterpart on Thursday, according to a report in Asharq al-Awsat. Don’t be surprised if you hear more along these lines in the run-up to OPEC’s next full ministerial meeting in November.

By Julian Lee, Courtesy Bloomberg

Oil windfall expectations from the Middle East crisis