What shaped the past week?

Global: This week saw a widespread profit-taking trend among global equities as investors responded to the latest economic data and company earnings releases. In the Asia-Pacific region, the Reserve Bank of Australia adjusted its monetary policy rate by 25 basis points to 3.35%, which was in line with market expectations. Meanwhile, Chinese tech giant Baidu announced its plan to develop its own artificial intelligence chatbot. In Japan, SoftBank Group reported a 6% y/y increase in net sales. The Japan Nikkei returned 0.59%, while the Shanghai Composite declined by 0.08%.

In Europe, investors reacted to the recent inflation from Germany and GDP data from the U.K. Inflation in Germany rose 8.7% y/y while the U.K. economy contracted by 0.5% in December, and growth remained flat in Q4 2022. Additionally, companies such as AstraZeneca, Siemens, and Credit Suisse Group AG published their earnings results, influencing investor sentiment. The German DAX and London FTSE returned -0.41% and -0.99% respectively.

Domestic Economy: Oil production firmed up (+5.7% m/m) in January by 80.7 thousand barrels per day (kb/d) to 1.49 million barrels/day (mb/d). This is an improvement from the flat performance in December (1.41 mb/d). The increase in production was driven by higher output in Agbami (+62 kb/d), Erha (+33 kb/d), Forcados (+13 kb/d), Bonga (+10 kb/d) and Escravos (+8 kb/d) terminals. These expansions offset the notable decline in the Bonny terminal (-30 kb/d). While we anticipate further improvement in oil production, we remain wary of politicial risks that could influence low oil production in Q1’23. Nevertheless, we believe this could trickle down into improved oil FX inflows, only when the fiscal authorities remove fuel subsidies.

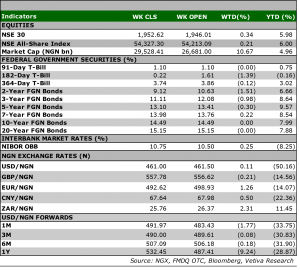

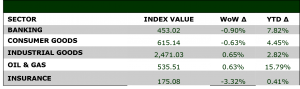

Equities: This week, the Nigerian equities market was mixed, with the bulls gaining a slight advantage by the week’s close. The NGXASI returned 0.21% w/w, driven by the performance of large-cap stocks. The performance of the sectors was mixed, with the Consumer Goods and Banking sectors recording negative returns and the Oil and Gas and Industrial Goods sectors recording positive returns. In the Industrial Goods sector, renewed interest in DANGCEM saw the sector return 0.65% w/w. On the other hand, profit-taking in the banking sector caused a 0.90% w/w decline. Meanwhile, increased interest in the oil marketing space boosted the 0.63% w/w performance of the Oil and Gas sector. Finally, selling pressure in companies such as NB led to a -0.63% w/w return for the Consumer Goods sector.

Currency: The Naira appreciated N0.50 w/w at the I&E FX Window to ₦461.10.

What will shape markets in the coming week?

Equity market: The market is expected to have a mixed performance this week with profit-taking and large-cap stocks dictating market trends.

Q1’23 FX Outlook – Hanging between a black swan and a pivot Angola outshined peers in 2022

African currencies were battered by the Russia-Ukraine war and rising global interest rates in 2022. For the second year running, the Angolan Kwanza outshined our coverage currencies. This can be linked to its oil-producing status. The reopening in China could provide further legroom for outperformance in 2023 as buoyant demand and elevated oil prices support the Angolan currency.

While we still see room for broad-based depreciation, we note that a Fed pivot could bode well for these currencies, as hot money finds its way into emerging economies. While African central banks have raised interest rates to improve the carry trades, foreign investors could continue to watch from the side lines, awaiting a Fed pivot. Should no black swan event erupt during the course of the year, a deceleration in US’ inflation could pave way for gains in EM currencies (as the South African Rand).

SSA Currencies could weaken despite favourable global backdrop

With the Black sea deal reducing the impact of the war on food supply chains and the fall in inflation slowing the pace of rate hikes, the outlook for 2023 is dependent on global macro factors. The trajectory of inflation in the United States will be a major driver of currency performance across emerging markets. While the US Fed voted to raise interest rates by 25bps at its first FOMC meeting of the year, we note that there is an increasing possibility of a Fed pivot should inflation fall closer to its target range. Nevertheless, we see increasing inflationary risks from the escalation of the Russia-Ukraine war.

In the meantime, however, elevated sovereign yields on account of sustained hawkish monetary policy could keep countries out of the international debt market. Most African central banks under our coverage raised their benchmark interest rates in January – Nigeria (+100bps), Ghana (+100bps) and South Africa (+25bps). Kenya kept rates unchanged amid sustained decline in inflation and narrow negative real rate of return. Angola (-150bps) went against the tide to reduce interest rates amid rapid disinflation. From an interest rate parity perspective, we find most of our coverage currencies slightly overvalued, except the Ghanaian Cedi. However, nondeliverable forward contracts suggest all currencies are prone to depreciate in 2023.

Although expected to weaken, the South African Rand and the Angolan Kwanza are expected to outperform their historical returns in 2023. This could be linked to positive passthrough of a Fed Pivot (South Africa) and elevated oil prices (Angola). We believe the markets are pricing in a de-escalation of the Ukraine-Russia war in 2023, as lower oil prices and global monetary easing would bode well for South Africa, a key emerging market economy. On the contrary, lower oil prices could cause the Angolan Kwanza to depreciate. However, the market anticipates that this depreciation could be milder than its historical slides.

At the other side of the spectrum, the Kenyan Shilling, the Nigerian Naira and the Ghanaian Cedi are expected to underperform their historical returns (i.e. depreciate at a faster pace). We attribute the bearish outlook over the Nigerian Naira and Kenyan shilling to their political, fiscal, and external vulnerabilities. Nigeria’s decisive elections raises concerns over social stability, given the emergence of a third force and the unpopular plan to expunge regressive fuel subsidies. Kenya, on the other hand, is battling with dwindling external reserves as reserve stock fell to a 7-year low recently, despite the inflow of $447 million from the IMF. This caused import cover to fall short of its 4.5 months target. Amid negotiations with multilateral institutions, investors expect the Ghanaian Cedi to slide by 28% over the next one year. This outlook can be traced to increased uncertainty over its debt restructuring process.