| What shaped the past week?

Global: Global investor sentiment was buy-side driven this week, as Q2’22 earnings drove investor positioning across global markets. Starting in the Asian-Pacific region, the Australian ASX was the best performer in the region, rising 3.26% w/w to close at 7,114.50pts. Investor focus shifted to the latest economic data out of the region; of note, the Statistics Bureau of Japan stated that inflation in the country climbed to 2.6% y/y in July. Meanwhile, in mainland China investors digested major data reports and the People’s Bank of China’s (PBoC) latest decision on interest rates. The PBoC decided to cut interest rates, following the release of data reports which revealed industrial production and retail sales figures came in lower than expected for July. Moving to Europe, where inflation continues to soar, investors reacted favorably to news of an agreement reached between Germany and energy giants in the country, to keep gas terminals well supplied with gas starting from this winter until March 2024. The French CAC was the best performer, up 2.75% w/w, while the German Dax gained 2.17% w/w. Finally, across US markets growth stocks were again the best performers this week, as the NASDAQ was up 4.44% w/w; investors reacted to the latest earnings report from U.S. corporations. Additionally, investor focus in the region was on the latest statements from U.S. central bank officials and their outlook on the U.S. economy and interest rate movements. Expectations are that the U.S. Fed will hike rates further albeit in a less aggressive manner, following the latest inflation numbers.

Domestic Economy: Headline inflation rose to 19.64% y/y in July, marking the sixth consecutive month of growth and the highest print in 17 years. Energy pressures played a significant role in the increase, particularly since the 3-9% increase in PMS prices. Inflation was higher in both the food (22.02% y/y) and core (16.26% y/y) segments. Food inflation was primarily driven by pricey farm produce (+42.76% y/y) which was triggered by increased insecurity in food-producing communities. Energy-related pressures drove up core inflation. In the short term, sustained energy and currency shocks (given the naira’s increased volatility) could drive inflation higher.

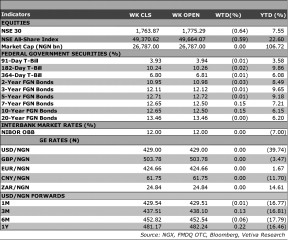

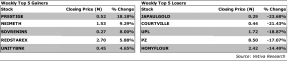

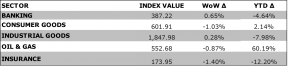

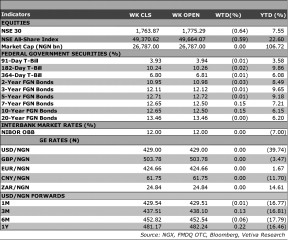

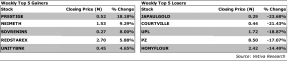

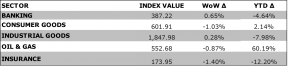

Equities: Nigerian equities extended their week of consecutive losses into a third one, as the benchmark NGX lost 0.59% w/w to close at 49,370.62pts. The somber performance of the market was driven by losses across the Oil and Gas and Consumer Goods sectors which sank 0.87% and 1.03% w/w respectively. Meanwhile, the Banking and Industrial Goods sectors recorded marginal gains, up 0.65% and 0.23% w/w. Starting in the Oil and Gas space, losses in select oil markets as well as SEPLAT (-0.74% w/w), weighed on the index performance; meanwhile, in the Consumer Goods space, losses in the sector were driven by selloffs witnessed in FLOURMILL (-10.48% w/w) amongst others dragged its performance. On the other hand, gains in ZENITHBANK (+3.29% w/w) propped up the performance of the Banking sectors, amidst selloffs in across other banking stocks. Finally, in the Industrial Goods space interest across small-mid cap players, helped offset losses recorded in WAPCO (-4.01% w/w).

Fixed Income: This week, the fixed-income market was largely bearish. In the bond segment, we saw mild sell-offs across the benchmark bonds as investors reacted to the bond auction rate hike and the uptick in inflation. Given this, the average yield on benchmark bonds increased by 13bps w/w. Similarly, the OMO markets saw some sell-side activity, causing yields to rise 6bps w/w. Meanwhile, mild buy-side activity in the NTB segment caused average yields to fall by 1 basis point.

Currency: The Naira depreciated 5bps w/w at the I&E FX Window to ₦429.05.

| What will shape markets in the coming week?

Equity market: This week’s bearish sentiment can be seen in the 59bps w/w dip in the ASI and with the current sentiment in the market, we expect neutral to negative sessions next week with pockets of positive close across sectors.

Fixed Income: The NTB market is expected to open on a quiet note next week, as investors remain on the side lines ahead of the NTB primary market auction on Wednesday. Similarly, given the current liquidity squeeze, the bonds market should continue to trade on a tepid note, with a strong bearish undertone.

SSA Currencies: From geopolitics to national politics

In H1’22, unfavorable dynamics in the global economy clouded our outlook for SSA Currencies, from the Ukraine-Russia war to the surge in inflation and the barrage of rate hikes. Almost midway through the second half of the year, we have observed an easing of the raging inflationary tides after the recent reopening of the Black Sea, a key trading route. Commodity prices have slowly retreated from their multi-year highs. Consequently, this has reduced inflation expectations and abated pressure on emerging market currencies (e.g., the South African Rand), especially after the favorable inflation print in the United States. Nonetheless, the currencies of other net-oil importers under our coverage have weakened to new all-time lows. With fiscal concerns triggering credit downgrades, further down the junk zone, the Ghanaian Cedi plummeted to new lows.

Nigeria: Oil sector woes prompt tight FX management

Nigeria’s OPEC compliance has deteriorated significantly, due to frequent production shut-ins. With force majeures springing up at major oil terminals in Nigeria, the expected weakening in oil exports could worsen Nigeria’s current account position. Although, provisional Q1’22 Balance of Payments data revealed that Nigeria had a positive goods account balance (i.e. tangible exports were greater than tangible imports), this could be due to the favorable terms of trade (high export prices relative to import prices) and constrained FX access for importers and manufacturers.

While the country had a positive current account balance in Q1’22 (2.36% of GDP), its capital and financial account balance was negative (-0.72% of GDP). With the apex bank opting to maintain external reserve stock as opposed to defending its currency and reducing the official-parallel rate gap, Nigeria’s external reserve stock remains strong with an import cover of 8.63 months, which is more than twice the global benchmark (3 months). Nevertheless, the Naira continues to slide to new lows in both the official and parallel markets.

Parallel Market: Volatility sends unofficial market rate to new lows

2022 is the first pre-election year (since 2010) where the country faces three simultaneous challenges – an oil production shock, negative real returns on Naira-denominated fixed income instruments, and an FX crisis. With the production shock reducing export proceeds and rising inflation eroding the appeal for Naira assets, inadequate supply of FX could lead to upward pressure on the Naira, especially in the parallel market.

Since the conduct of primary elections in Q2’22, the parallel market has depreciated further from the NAFEX rate. After testing new lows of ₦720/$ by the end of July, an unconventional approach was employed to stem the fall of the Naira, as security agencies pounced on BDCs. Despite the brief gains from this unconventional policy, the parallel market is prone to further demand pressure, if there are no adequate supply injections to subdue the demand pressure from emigrants and politicians, once electoral campaigns kick off in September.

With the exclusion of BDCs from official FX supply amid increased demand pressures, more volatility could erupt in the near term. Should volatility remain at current levels, the parallel market could average ₦720/$ by year end. On the flip side, should volatility spike to 2016 levels (30%), the Naira could average ₦754/$ by year end. We note that the apex bank could be forced to intervene in the parallel market (Goldilocks) by altering its stance on Bureau de change operators, especially if a substantial recovery in crude production/transmission materializes. This could lead to a sharp appreciation in the parallel market rate.

|

|