U.K. Prime Minister Theresa May will start Brexit talks with a slowing economy.

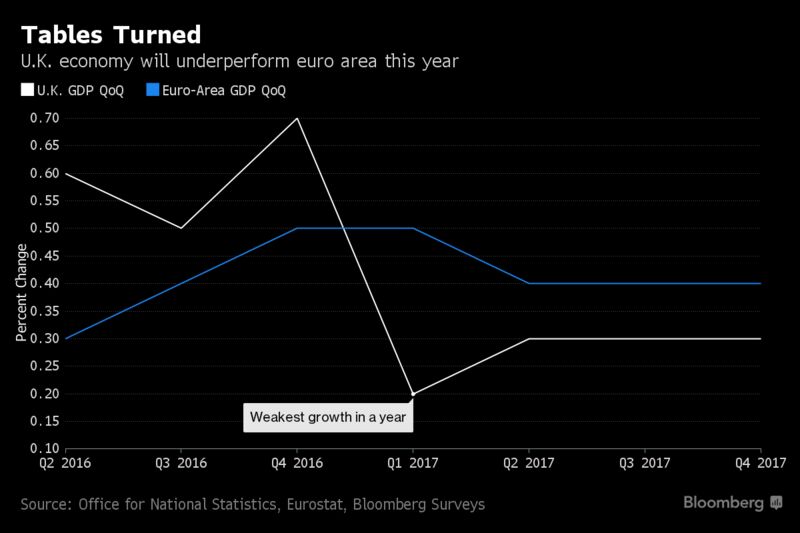

Growth was just 0.2 percent in the first quarter, the weakest in a year, and less than half the pace recorded in the euro area, the Office for National Statistics said Thursday. That sluggishness points to the risks to confidence and investment as May negotiates secession from the world’s biggest trading bloc.

It “underlines the importance of getting a deal and also a long transition period,” said James Knightley, an economist at ING Bank NV in London. “If the economy is weakening now, throw in hard Brexit — where the U.K. ceases to be able to trade as it was before — and that would put huge pressure on the economy and cause it to slow even more.”

The latest data confirm that the Brexit slowdown has finally arrived, as faster inflation hits households and wages fail to keep up. While the economy initially performed better than many expected after the referendum, it may now be heading into a phase of lower growth. “Subdued for the rest of the year” was the summary offered by Dan Hanson at Bloomberg Intelligence in response to the data.

The knock to May’s “strong and stable” economy — to use her election campaign slogan — may worry her and her Conservative Party as she campaigns for the June 8 vote and prepares for what will be intense divorce talks with the EU. While she retains a healthy lead in polls, the gap with Labour has narrowed in recent weeks after an unpopular manifesto pledge.

May did get some good news today, with data showing net migration fell to a three-year low in 2016. She is fighting the election on a renewed pledge to cut net migration to the “the tens of thousands,” despite her Conservative Party failing to come even close since the promise was first made in 2010.

Trade Drag

For the economy, there was an expectation that the pressure on consumers could be offset by a boost to exports from the weaker sterling. That didn’t prove to be the case at the start of the year, with net trade subtracting 1.4 percentage points from GDP. Nevertheless, some economists see growth picking up in the coming months.

“The poor trade performance appears to have been partly driven by erratic factors” and not a “deterioration in the underlying net trade position,” said Ruth Gregory, an economist at Capital Economics. “We have not altered our view that the economy will remain fundamentally resilient in the coming quarters.”

The BOE said earlier this month that the first-quarter number might be revised up, so the new data will keep it on a cautious policy footing. Governor Mark Carney and the majority of officials at the bank have indicated they’re in no rush to tighten, with just one pushing for a rate increase. That member, Kristin Forbes, leaves the central bank at the end her first term next month.

Sterling swaps data put the probability of a BOE increase by the end of the year at about 15 percent. That’s down from 26 percent before the May Inflation Report.

“For now, first quarter GDP is likely to deter any aspiring hawks from dissenting and taking Forbes’ place as chief hawk after her departure,” said Alan Clarke, an economist at Scotiabank in London.

Courtesy Bloomberg