Twitter now has a bigger market cap than Snapchat maker Snap after posting a thoroughly interesting earnings beat for its fourth quarter Friday morning.

Shares of the social media giant rocketed more than 25% this morning following the report, which showed the service is actually able to generate a profit on a GAAP basis. Twitter already wrapped up 2017 with a big run on Wall Street, but it looked like Snap would be heading into this year as the more-valuable of the semi-distressed pair of social media companies. Now, Twitter has a market cap of around $25 billion, while Snap has a market cap of $24 billion. That’s a pretty narrow gap, but still a semi-big deal.

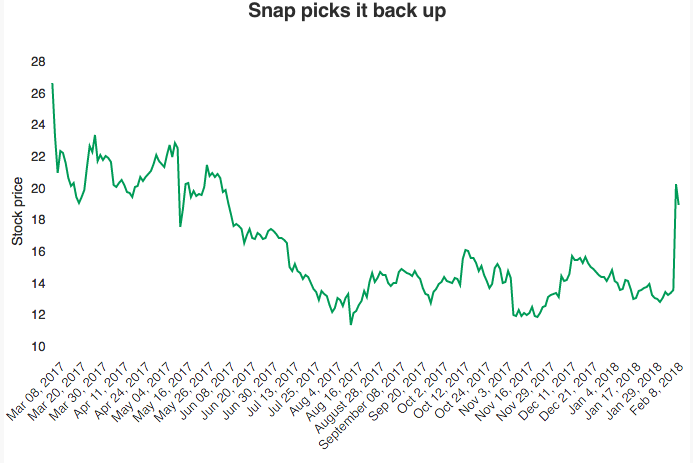

Snap also posted a very positive fourth quarter earlier this week, which promptly sent the stock soaring. That brings us back to the question: Are these tertiary (or quaternary) advertising options actually viable alongside Facebook and Google? That story hasn’t really played out yet, but it’s fun to actually see a storyline here where they can find ways to be competitive by offering some kind of differentiated product compared to Facebook and Google.

The two companies about matched each other at the end of 2017, as Snap was one of the more robustly weird and semi-disappointing IPOs of 2017 (and it also opened the so-called IPO window for a wave of newly public companies). Snap’s stock was down more than 7% this morning, giving Twitter an opportunity to slide past the company. Twitter’s stock, meanwhile, is up more than 20% (and it at one point was up more than 25%) as we head into the initial trading for the day.

As of this morning, these two companies are still jockeying for position as to which one is more valuable, though Twitter still has an edge. That’ll probably change tomorrow, and the next day, and the one after that (or even by this evening), but it’s still a notable point in the grand scheme of volatile social media stocks that are under scrutiny when it comes to their user growth and their potential as large advertising businesses.