| What shaped the past week?

Global: This week was a positive one for global markets, with all major indices closing in the green. The focus of investors was on the latest earnings releases of listed companies and economic indicators from advanced economies. In the United States, Q4’22 GDP growth came in at 2.9% y/y, and notable firms such as Tesla and Chevron reported strong earnings, driving trading activity. As of writing, the DJIA, S&P 500, and NASDAQ are up 1.64%, 1.99%, and 3.72% w/w respectively.

In Europe, market performance was mixed, with attention on the business climate and incoming company earnings. The German Business Climate Index came in slightly below expectations at 90.2 in January (Consensus: 90.0), while the U.K. saw a 14.7% y/y rise in producer prices in December. The German Dax rose 0.22%, while the FTSE-100 lost 0.31% w/w.

In the Asia-Pacific region, inflation data from Australia revealed a 7.8% YoY increase, its highest reading since March 1990. The Bank of Japan reiterated its stance on maintaining loose monetary policy to bring inflation to the target 2% range “in a sustainable manner.” Meanwhile, South Korea’s central bank reported that the country’s economy dipped in Q4’22 for the first time in two and a half years. The Nikkei-225 rose 3.72% w/w, while the Shanghai Composite traded flat w/w.

Domestic Economy: To begin the year, the Monetary Policy Committee (MPC) decided to raise its benchmark rate by 100 basis points to 17.50%. The Committee cited increased global and domestic inflation risks as reasons for its decision. The MPC also hopes that tightening will help to narrow the negative real rate of return. Loosening was not an option because it could worsen inflation; neither was holding considered as that could signal a lack of confidence in its current policy stance to curb inflation. We believe that the next MPC decision could be guided by the direction of inflation. As upside risks to inflation abound, the MPC could raise rates by 50-100bps in its next meeting.

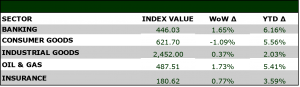

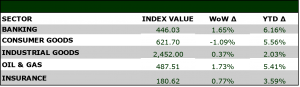

Equities: The local equity market experienced mixed results, as three sectors closed in positive territory while the consumer goods sector ended lower. The NGXASI returned 0.12% on a weekly basis as investors processed the latest earnings results from listed companies. The banking sector saw a rebound, rising 1.65% driven by strong performances from FIDELITYBK (+8.00% w/w), STANBIC (+4.69% w/w), and FCMB (+3.49% w/w). Additionally, the oil and gas sector experienced gains due to returns of 5.51% w/w from TOTAL and 15.27% w/w from GEREGU. The industrial goods sector also saw an increase of 1.73% w/w, attributed to interest in mid-cap names. On the other hand, profit-taking activity in counters such as NB (-9.69%) contributed to the consumer goods sector’s decline of -1.09% w/w.

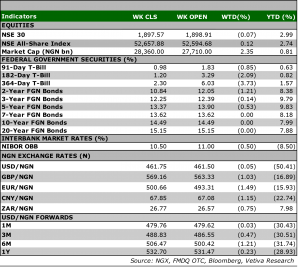

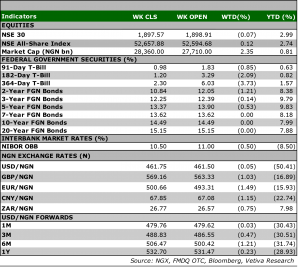

Fixed Income: he fixed income market displayed a bullish trend driven by ample system liquidity and lower NTB auction stop rates. In the bonds space, trading activity was buoyed by the disbursement of FAAC inflows and coupon repayments, resulting in an average decline of 30bps in yields on benchmark bonds. Of particular significance, the yield on the 14.20% FGN-MAR-2024 bond dropped by 220bps to settle at 7.80%. Additionally, sentiment in the NTB market was also bullish, as investors responded positively to the latest NTB auction, where the DMO sold ₦220 billion across the 91DTM, 182DTM, and 364DTM at more attractive stop rates. As a result, yields in the NTB space decreased by an average of 197bps w/w. Lastly, yields in the OMO segment of the market remained flat w/w.

Currency: The Naira depreciated ₦0.25 w/w at the I&E FX Window to ₦461.75.

| What will shape markets in the coming week?

Equity market: For next week, we expect to see further volatility in the market as investors continue to react to the recent rate hike and earnings results. However, market sentiment appears to have improved overall, which suggests that the market may close out the week on a positive note.

Fixed Income: Looking ahead, we anticipate another bullish session to start the week, as investors continue to react to the latest auction results, with system liquidity likely to drive activity in the market.

UNILEVER NIGERIA PLC – Earnings surprise on gross margin volatility

In its unaudited FY’22 financial statements, Unilever Nigeria PLC reversed the weak earnings reported in the 9M period (a loss of ₦0.3 billion). Bottom-line improved 4x to ₦5.9 billion in FY’22, bucking our expectation of suppressed profitability.

Although Q4 topline printed at ₦23.9 billion, in line with our projection of ₦23.4 billion, the company contradicted our Q4 profit estimate, reporting PAT of ₦6.4 billion (Vetiva: ₦0.7 billion), the highest quarterly profit announced. However, the headline factor responsible for this performance is Unilever’s quite unpredictable gross margin, which has swung between 14% and 60% in the last four quarters.

Admittedly, we believe that gross margin has largely responded to the cost of raw inputs. However, the trend seen in the company’s margin performance is not similar to the trend in the commodities market or other FMCG players.

Bottom-line was also substantially boosted by finance income

Consequently, even after accounting for the 39% rise in operating expenses, the company’s operating margin shot up by a forceful 23ppts y/y, with operating profit reporting at ₦8.0 billion (a 3x jump y/y). Furthermore, supported by a stronger y/y cash balance and no debt obligations, the company’s Q4 earnings was supported by a ₦1.4 billion net finance income. This propped PAT by 4.1x y/y to ₦6.3 billion.

Q4 buoys FY’22 financials overall

Consolidating the 9M Revenue and costs performances, ultimately, the Q4 results smoothed the company’s FY margins overall; gross margin landed at 35% (from a 9M gross margin of 27%), operating and profit margins also improved 9ppts and 8ppts to 10% and 7% respectively over the same period. This brought Unilever’s normalized FY earnings to ₦6.0 billion, with EPS printing at ₦1.04 billion (+3.6x y/y).

Asset efficiency supports profitability although uncertain margin expectation muddies outlook

This performance places Unilever’s RoE at 8.9%, an improvement from 1.1% in 2021 and -5.8% in 2020. Given sustained low levels of leverage, profitability has been propped by the boost to net profit margin as well as an improvement in fixed asset turnover to 4.1x (from 2.8x in 2021).

|

While a reasonable pattern can be drawn from the company’s Revenue performance in the last year, the same cannot be said for its input cost line or gross margin performance. That said, in terms of Revenue, with the expectation of declining consumer spending power over the year, volumes are estimated to decline slowly over the year. Nonetheless, sturdier prices should prop Revenue at ₦98.5 billion (+11%) during the period. For margins, given Unilever’s 63% exposure to the international commodities market (from FY’21 audited reports), we are cautiously optimistic that the company’s margins would remain afloat at 29% (not as lofty as the 60% reported in Q4’22) and under the FY’22 average of 35%. Based on these estimates, overall, we project a full year PAT of ₦1.0 billion and revise our full year target price to ₦16.51. Given that the stock currently trades at a 26% discount to this target price, we rate the stock a BUY. |