Nigeria’s economy to edge up at least 2.5% in 2018 – World Bank

January 10, 20181.9K views0 comments

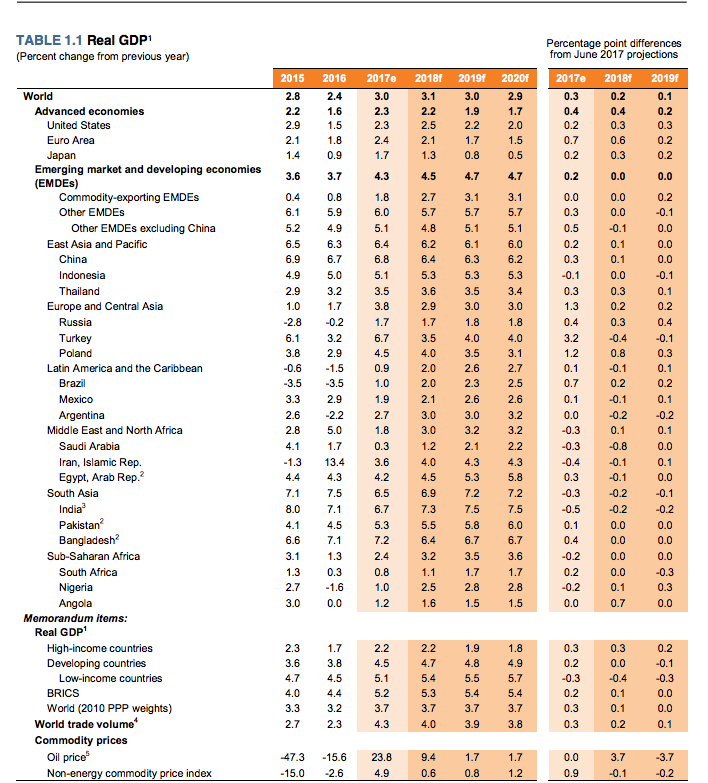

The World Bank in its latest report forecasts that economic growth in Nigeria would edge up to at least 2.5 percent in 2018.

This is contained in Bank’s January 2018 Global Economic Prospect report launched on Tuesday in Washington DC, United States.

Nigeria’s Gross Domestic Product (GDP) is expected to grow by 2.8 percent in 2019 and 2020, while the forecast shows that global economic growth will go up to 3.1 percent in the year 2018.

According to the bank, growth in Sub-Saharan Africa is projected to continue to rise to 3.2 percent in 2018 and to 3.5 percent in 2019, on the back of firming commodity prices and gradually strengthening domestic demand.

Read Also:

However, the report showed that growth would remain below pre-crisis averages, partly reflecting a struggle in larger economies to boost private investment.

“South Africa is forecast to tick up to 1.1 percent growth in 2018 from 0.8 percent in 2017.

“The recovery is expected to solidify, as improving business sentiment supports a modest rise in investment.

Global Muslim demographic seen driving Islamic economy size to $3trn in 2021

“However, policy uncertainty was likely to remain and could slow needed structural reforms.

“Nigeria is anticipated to accelerate to a 2.5 percent rate this year from one percent growth in the year just ended.

“An upward revision to Nigeria’s forecast is based on the expectation that oil production will continue to recover and that reforms will lift non-oil sector growth.

“Growth in Angola is expected to increase to 1.6 percent in 2018, as a successful political transition improves the possibility of reforms that ameliorate the business environment,” it stated.

Côte d’Ivoire is forecast to expand by 7.2 percent in 2018, Senegal by 6.9 percent; Ethiopia by 8.2 percent, Tanzania by 6.8 percent, and Kenya by 5.5 percent as inflation eases.

The World Bank said that the regional outlook for Sub-Saharan Africa was subject to external and domestic risks, adding that any unexpected activity in the US and Euro Zone could have a negative impact on the region.