Nigeria’s mutual funds assets soar to N318bn in H1 2017 as investors hedge against volatility

August 11, 20172.1K views0 comments

The current state of the Nigerian economy and fluctuations in the stock market and interest rates may have been responsible for growing interest in mutual funds among investors, according to financial analysts and fund operators.

Nigeria’s mutual funds’ assets as at the beginning of the second half of 2017 are estimated to have stood at N318 billion, up by 42 percent on a year-to-date basis from the 2016 year-end value of N223.6 billion.

Analytics on Nigerian mutual funds market also indicates that it attracted an estimated sum of N42 billion inflows in Q1, 2017 as against the N49 billion inflow recorded for the entire 2016.

“Investors are hedging against market volatility and are equally seeking professional management of their portfolio hence the increased interest in mutual funds,” an analyst told businessamlive, adding that improved mutual funds offerings and ease of buying and selling, as well as the diversity of the funds, are key impetus for the increased investments.

Read Also:

A mutual fund is an investment vehicle made up of a pool of funds collected from many investors for the purpose of investing in securities such as stocks, bonds, money market instruments and similar assets.

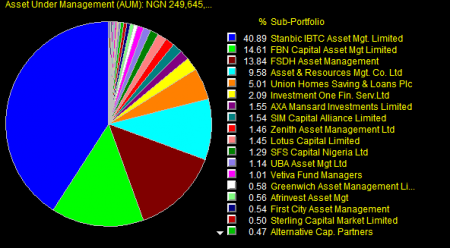

The number of mutual fund managers in Nigeria is growing, with the top mutual fund managers, going by their assets, according to Quantitative Financial Analytics, including Stanbic IBTC Asset Management Limited; FBN Capital Asset Management Limited; FSDH Asset Management; Asset & Resources Management Company Limited; and Union Homes Savings and Loans Plc.

“Active portfolio management by experienced professionals offer investors better prospects on their investments especially in periods of market volatility and economic downturns as is being experienced in Nigeria, making mutual funds an optimal choice, Emeka Okolo, senior fund manager and head, Coronation Asset Management, said at the launch the Coronation Mutual Funds recently.

The naira denominated and open-ended mutual funds by Coronation Assets Management Ltd indeed witnessed a high subscription rate by individuals, retail and institutional investors. The Mutual Funds – N1.5 billion Money Market Fund, including N400 million Fixed Income Fund and the N200 million Balanced Fund, were all offered at par of one naira each.

“No one can doubt the capacity and expertise of Coronation Asset Management to deliver competitive returns to investors in the Coronation Mutual Funds. The level of professionalism and quality of investments will be difficult to match by other mutual fund managers in Nigeria and the West African sub-region,” Okolo said on the Coronation Mutual Funds, reflecting the broad confident pitching in the sector that seems to attract investors.